- Fiscal.ai

- Posts

- 🗞 Is AWS Falling Behind?

🗞 Is AWS Falling Behind?

While Azure booms, Amazon drops 8%. The race to hyperscale heats up.

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

☁️ Is AWS Falling Behind?

📊 5 Best Charts from Earnings Season Week 2

Let’s dive in!

Featured Story

Is AWS Falling Behind?

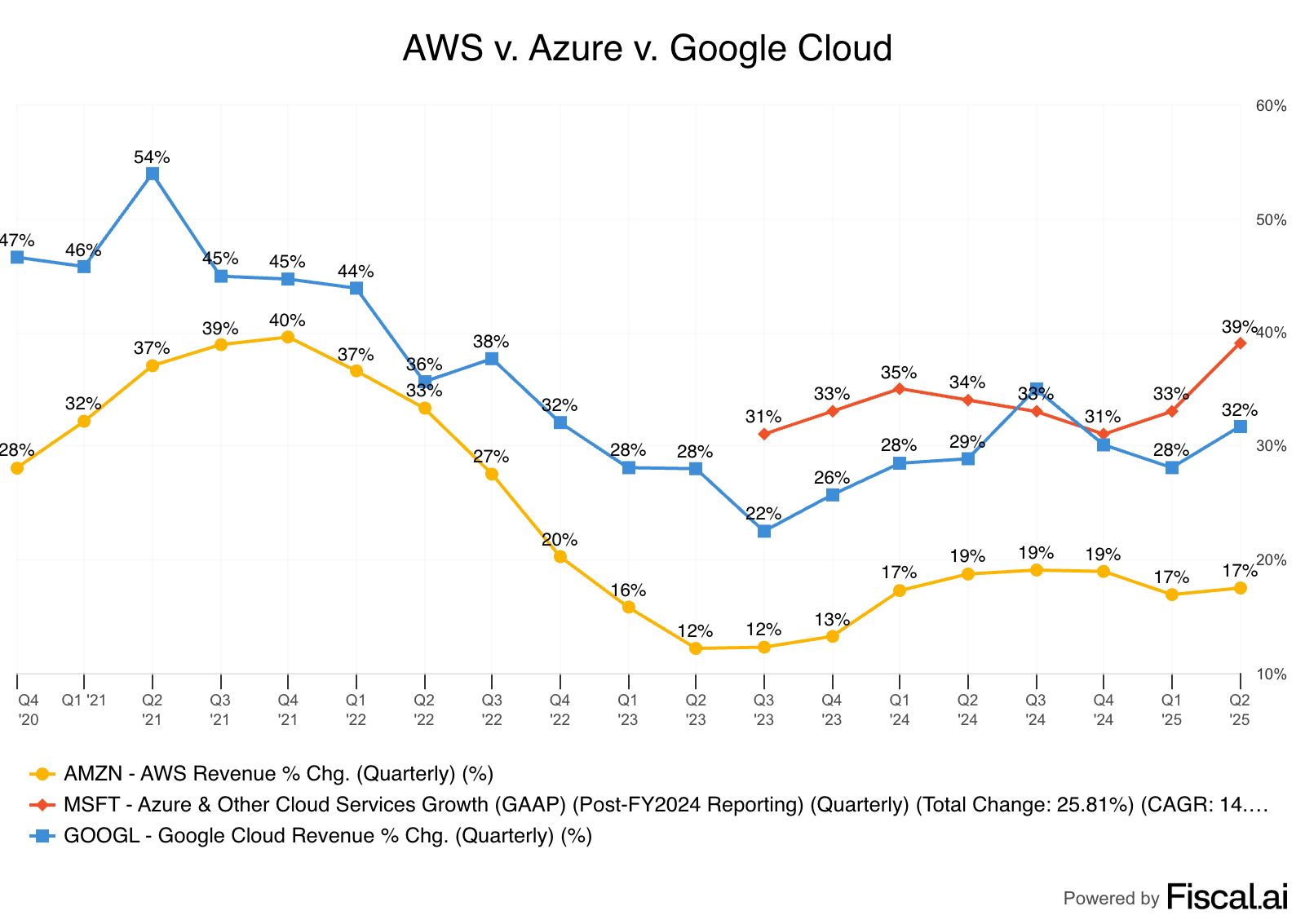

The world’s largest cloud providers (Amazon Web Services, Microsoft Azure, and Google Cloud Platform) have now all reported their 2nd quarter earnings.

All three of these “Hyperscalers” saw accelerations in their revenue growth compared to last quarter.

Looking at AWS specifically, the quarter looked quite good, in isolation.

The leading cloud provider accelerated revenue growth, surpassed analyst and management expectations, and now generates more than $30 billion in revenue each quarter.

But despite the strong report, investors remained focused on one question. Why isn’t AWS growing as fast as its peers?

In fact, on Amazon’s conference call, one analyst came right out and asked this exact question.

“We're seeing significantly faster cloud growth among the #2 and #3 players in the space. I totally appreciate that AWS is coming off of a bigger base. But beyond that, do you think the output gap is due more to customer demand or infrastructure supply for both?”

CEO Andy Jassy’s response did little to quell investor concerns:

That response led to a nearly $200 billion loss in market cap.

To paraphrase, Jassy is essentially saying “we’re bigger, so our percentage growth should be slower”, which is fair to some extent.

However, if we look at the growth not just on a percentage basis, but on a nominal basis, the results are a little more mixed.

Google Cloud added $1.4 billion in revenue this quarter.

AWS added $1.6 billion in revenue this quarter.

And Azure, well Azure grew by quite a bit more…

Now one important caveat is that “Microsoft Cloud Revenue” includes a lot more than just Azure. Microsoft CEO Satya Nadella said on the conference call this quarter that Azure surpassed $75 billion in revenue, so we can back into some math.

At $75 billion in revenue, Azure accounts for ~44% of “Microsoft Cloud Revenue”. Assuming that contribution stayed consistent, Azure added roughly $2 billion in revenue this quarter.

In other words, not only is Azure growing the fastest on a percentage basis, but it appears they’re growing the quickest in total dollar volume as well.

So is AWS falling behind?

Hard to say. Investors certainly think so.

Shares of Amazon dropped 8.3% on Friday as analysts appear worried that in the age of AI more workloads are flowing to Azure and GCP instead of AWS.

But it’s just one quarter. AWS is still the largest cloud provider by a wide margin with virtually unlimited resources to continue competing for this market.

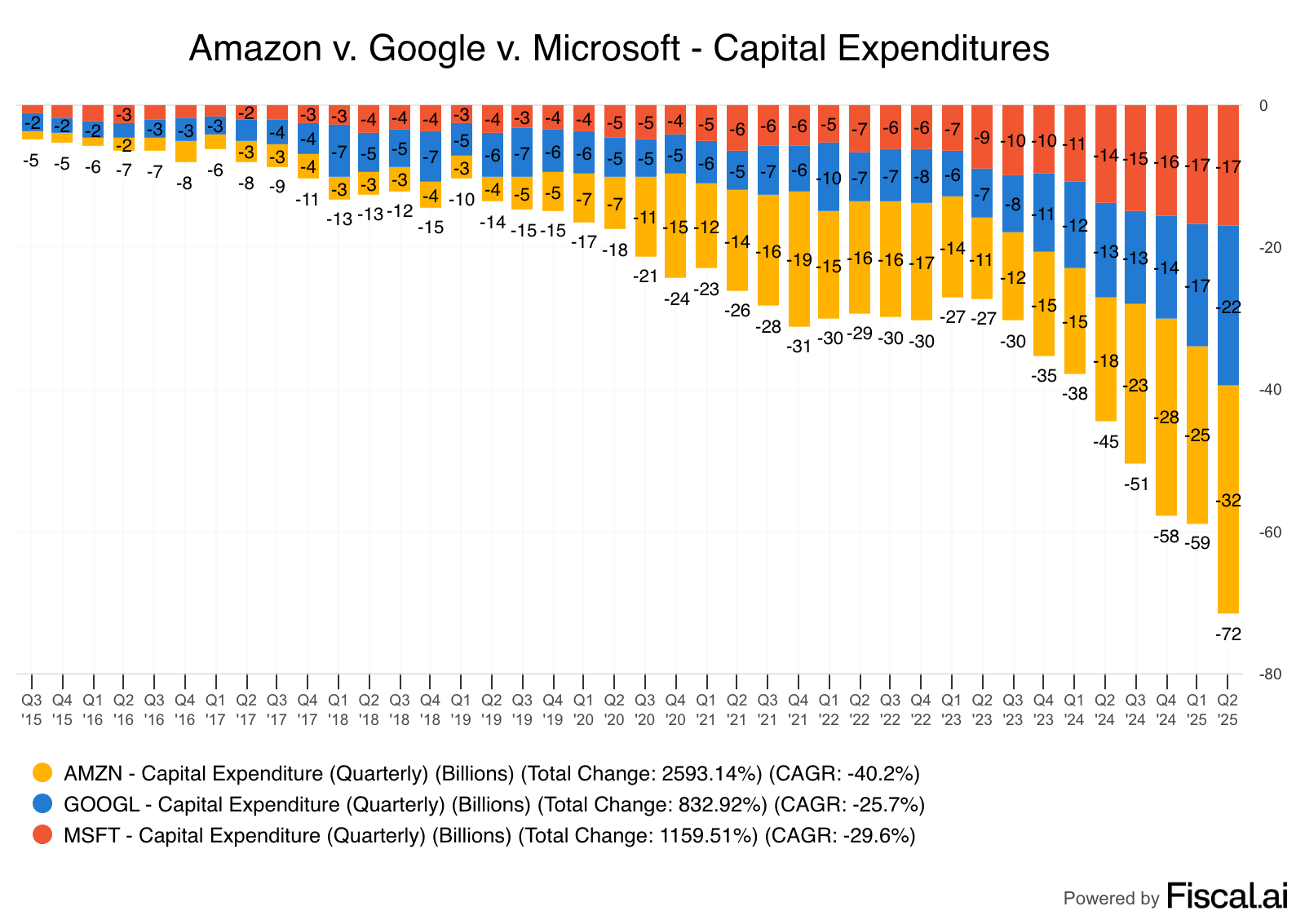

What is certainly clear however, is that all three of these cloud providers believes this is a market worth investing in.

Product Update: Fiscal v5

Introducing Fiscal Enterprise

On Thursday, the Fiscal.ai team launched our biggest update ever.

We released our Enterprise tier, but perhaps more importantly introduced our very own data feed.

While that might not seem like a huge deal to all our users, it’s analogous to swapping out an airplane engine mid-flight. With the platform now powered by the Fiscal.ai Data Feed, users get:

🔢 More Data (20 years & 40 quarters)

⚡️ Faster Data (All financials are updated within minutes of earnings for US companies)

🔽 Data Downloading

🔎 Click-Through Auditability (see the source of any datapoint with a single click)

📜 As-Reported & Standardized Financial Reporting

Featured Story

5 Best Charts from Earnings Season Week 2

Microsoft Azure - Quarterly Cloud Revenue Added

Carvana - Retail Vehicle Unit Sales

*Carvana is now a 100-bagger off of its 2022 lows.

Novo Nordisk - Cheapest Valuation in a Decade

SoFi Technology - Quarterly New Members Added

Amazon - The 3rd Largest Advertising Business in the World