- Fiscal.ai

- Posts

- 🗞 This Is the Cheapest Big Tech Stock By Far, According to Analysts.

🗞 This Is the Cheapest Big Tech Stock By Far, According to Analysts.

Based on current analyst estimates, this is the cheapest big tech stock.

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

📉 The Cheapest Big Tech Stock

📊 5 Best Charts This Week

Let’s dive in!

Featured Story

The Cheapest Big Tech Stock

Big Tech dominates the US stock market.

Not just by their headlines and notoriety, but by their numbers.

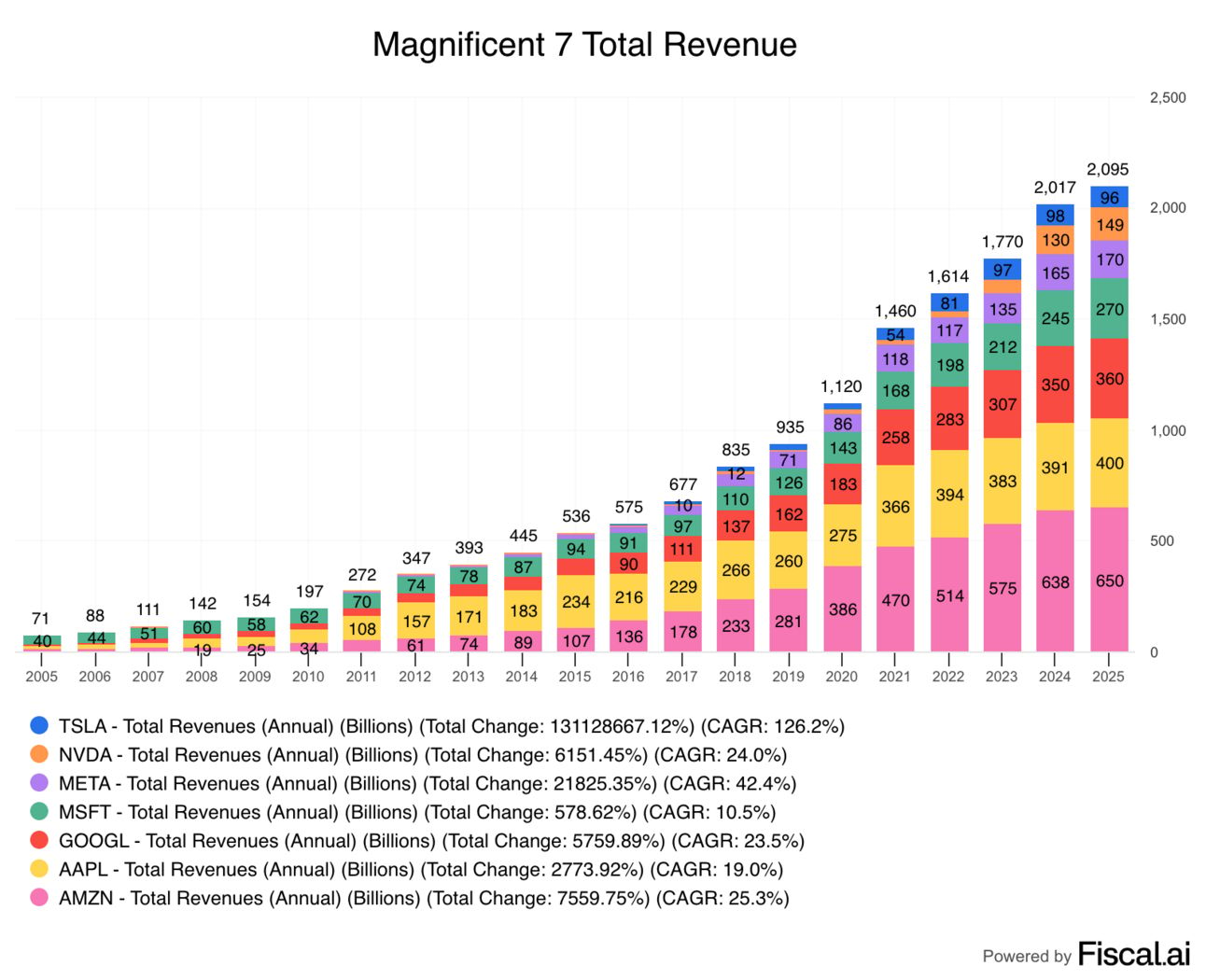

Combined, the “Magnificent 7” (Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta, and Tesla) have a market cap of $18.2 trillion and account for 34.4% of the S&P 500 Index.

But which of these stocks is the cheapest today?

Measuring that on a trailing basis is simple.

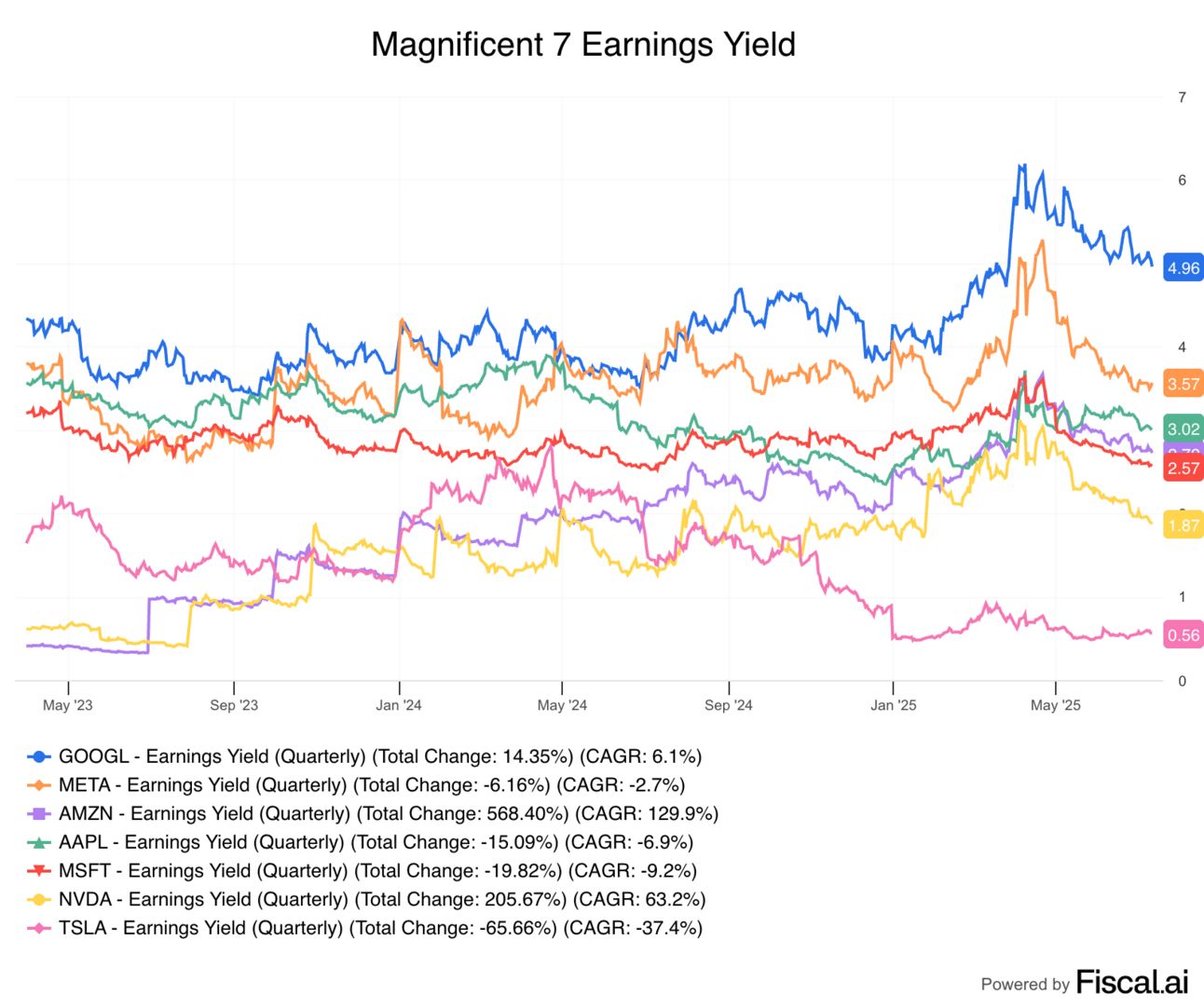

Alphabet has the highest earnings yield. In other words, of all the Magnificent 7 companies, the search giant currently generates the highest percentage of its market cap in earnings each year.

But as investors, we shouldn’t care about what a company has earned in the past. We should care about what they will earn in the future.

While investors can come to their own assumptions about what each of these businesses might earn a few years from now, let’s take a look at what Wall Street thinks.

According to Fiscal.ai, here are the consensus 3-year forward estimates for Operating Income of each company.

Current Enterprise Value | FY’24 Operating Income | FY’27(E) Operating Income | Current EV/2027 EBIT | |

Nvidia | $3.96T | $82B | $191B | 20.7x |

Microsoft | $3.75T | $109B | $164B | 22.9x |

Apple | $3.14T | $123B | $145B | 21.7x |

Amazon | $2.42T | $72B | $116B | 20.9x |

Alphabet | $2.09T | $114B | $159B | 13.1x |

Meta | $1.81T | $68B | $95B | 19.1x |

Tesla | $975B | $7.7B | $15B | 64.1x |

Looking at the last column, it appears Alphabet isn’t just the cheapest stock on a trailing basis, but on forward estimates as well.

Why?

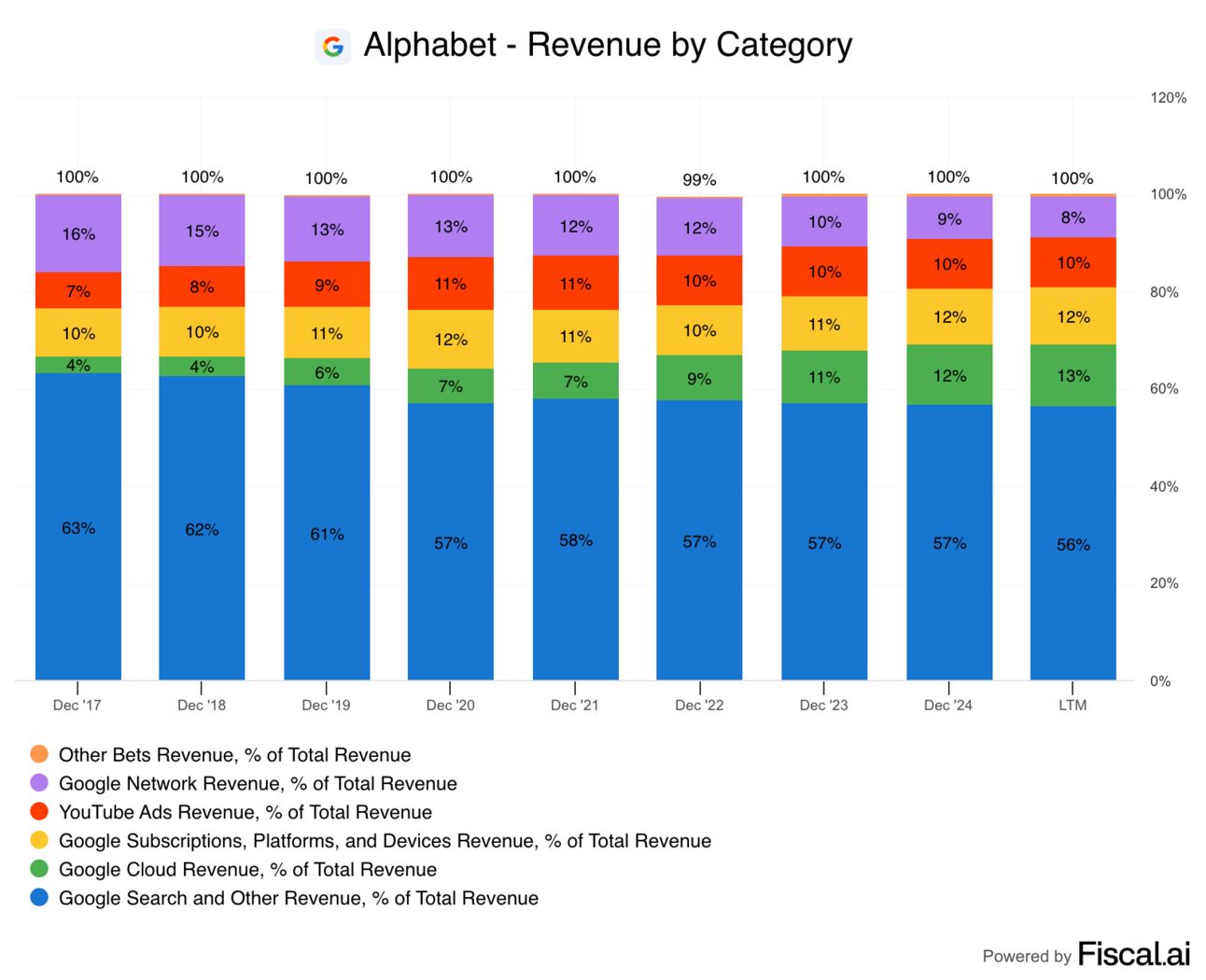

It’s no secret that Google’s Search business has been called into question due to the rapid adoption of conversational AI. While Google has diversified over the years, Search still accounts for more than 50% of the company’s overall revenue.

In a world where LLM’s steal significant share from traditional web search, and Alphabet isn’t providing one of those leading LLM’s, it’s fair to assume that those analyst estimates could prove incorrect.

Featured Story

5 Best Charts This Week

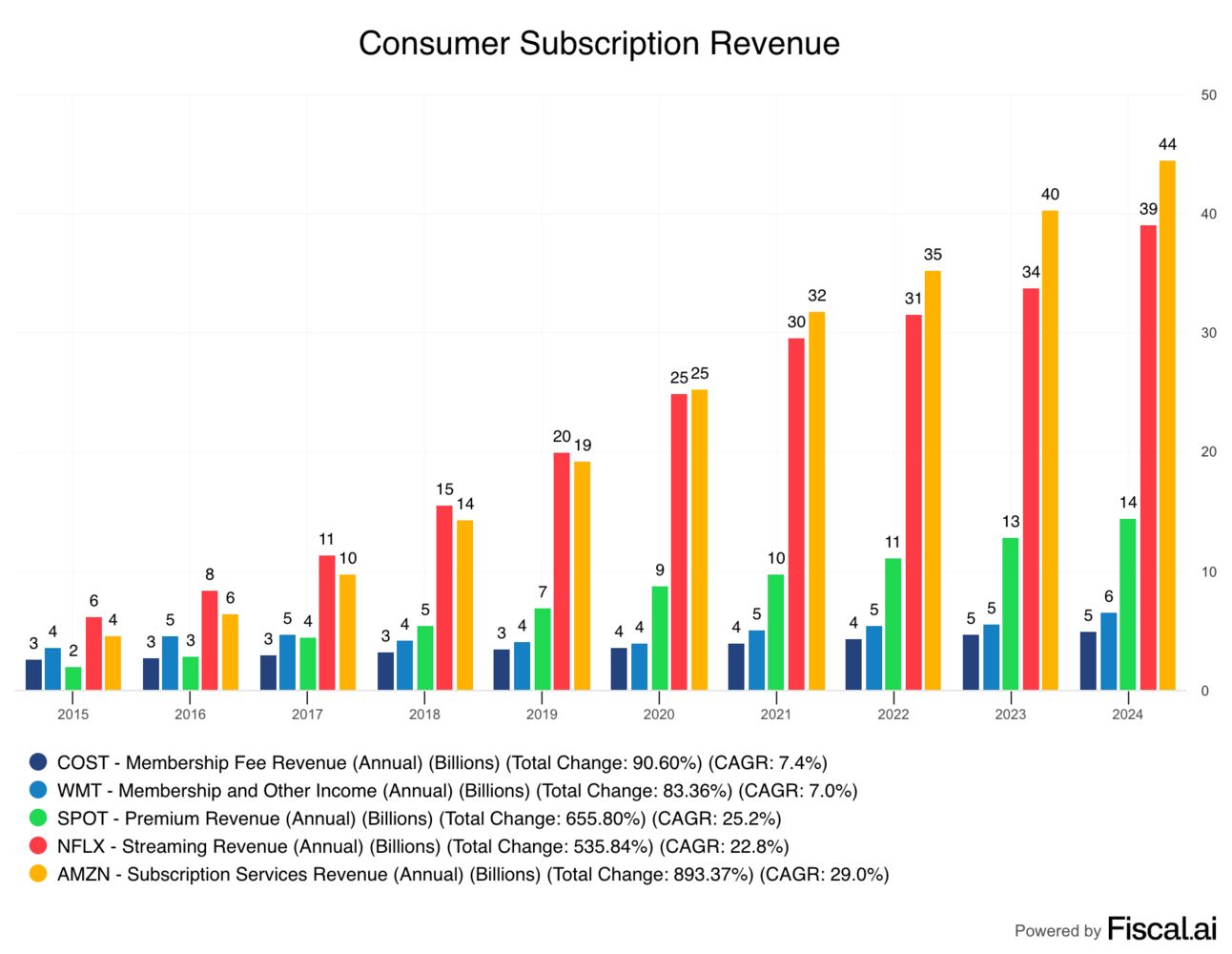

Amazon’s Subscription Dominance

While Amazon is most known for its e-commerce and cloud businesses, it has also built out the world’s most successful consumer subscription business. Even bigger than the likes of Netflix, Spotify, and others.

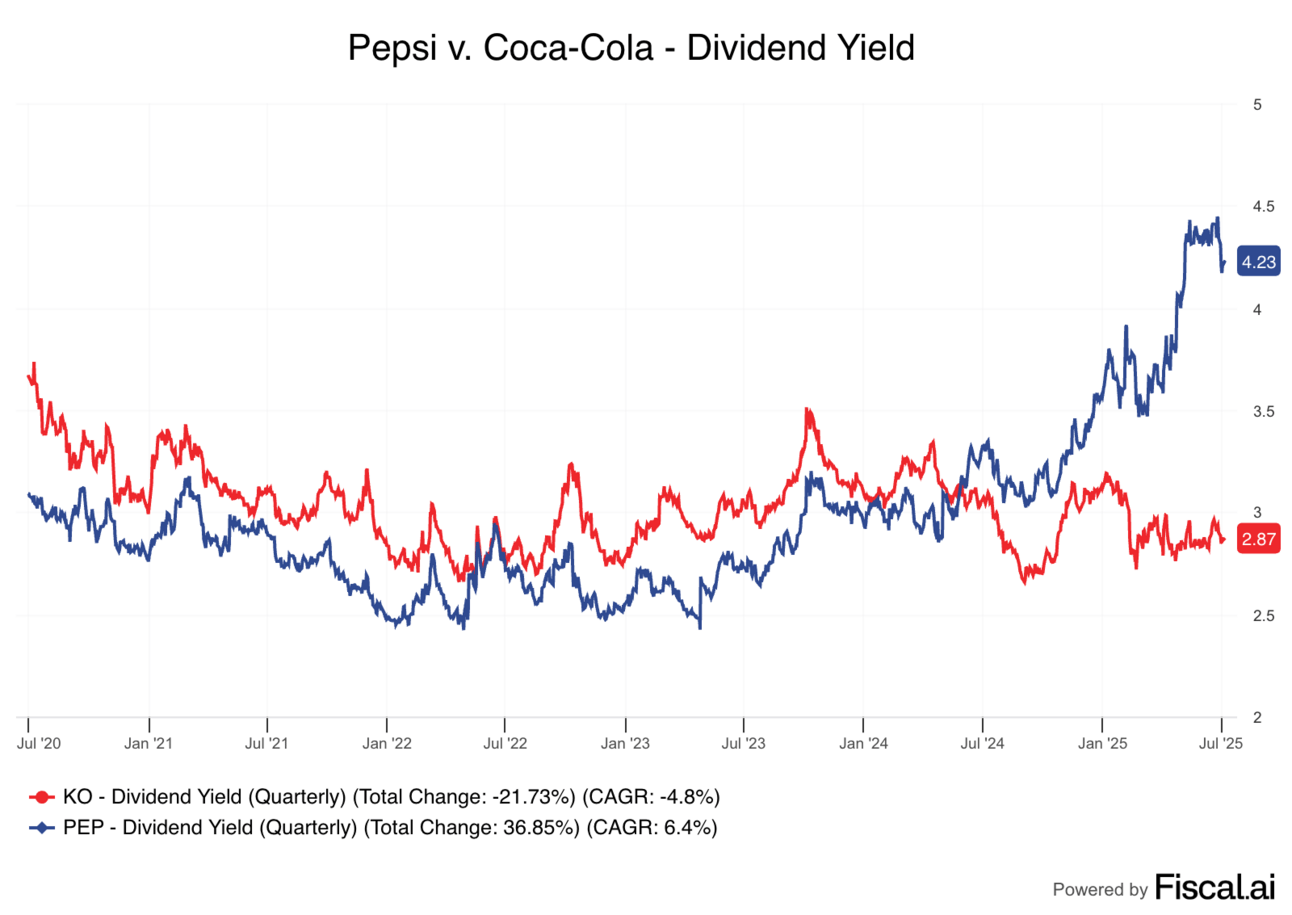

Pepsi v. Coke

The spread in valuations between long-time rivals Coca-Cola and Pepsi is the widest it has been in more than a decade. Shares of Pepsi offer a 4.2% dividend yield today, compared to just 2.9% for Coca-Cola.

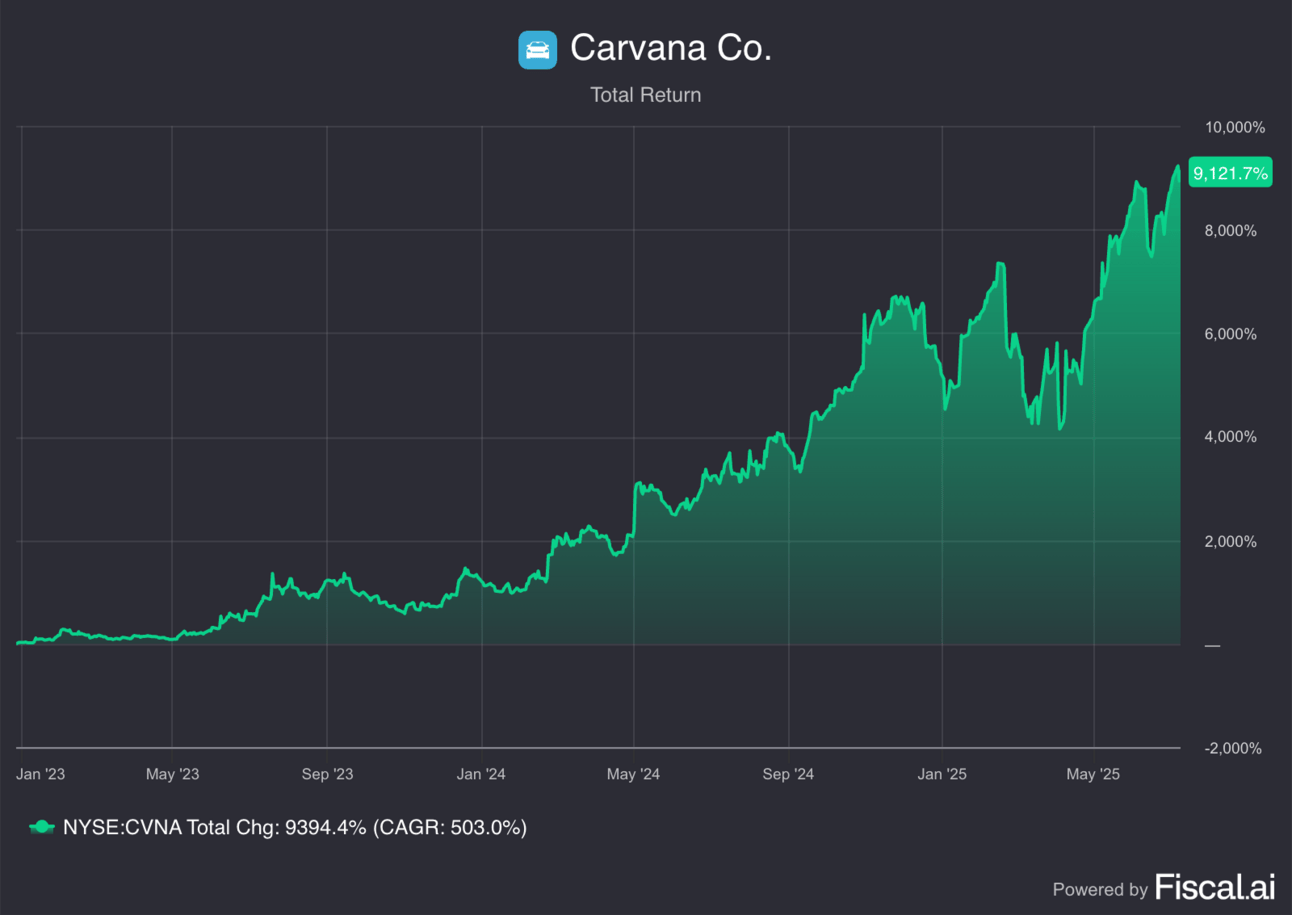

Carvana’s Wild Ride

Roughly 3 years ago, it appeared bankruptcy was imminent for the leading online automotive marketplace Carvana. But for shareholders that held, it’s been an incredible ride since. Shares of Carvana are now up 92x from their late 2022 lows.

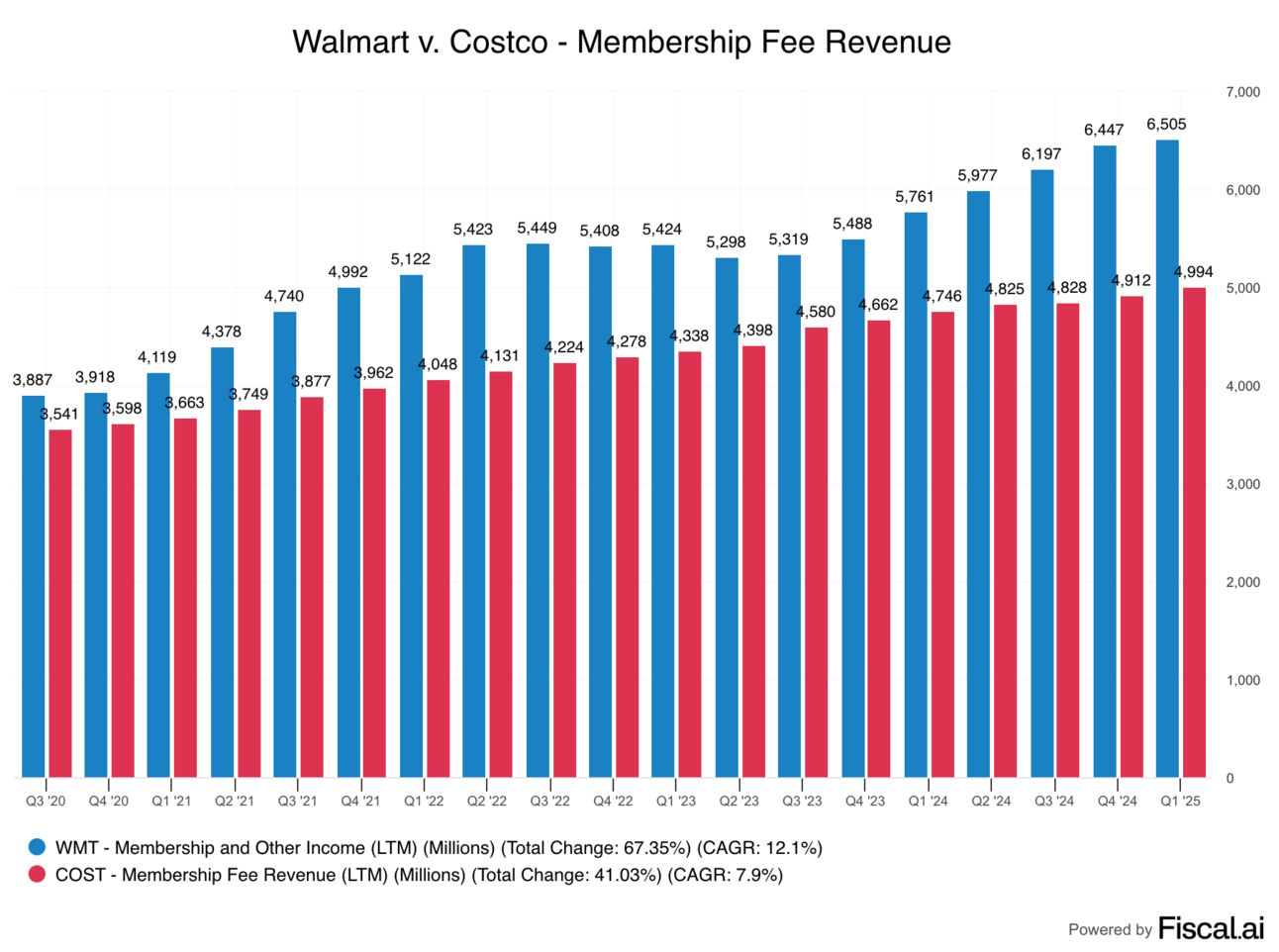

Walmart v. Costco

Did you know Walmart generates more revenue from memberships than Costco? Both retail giants generate billions of dollars in annual high margin Membership Revenue.

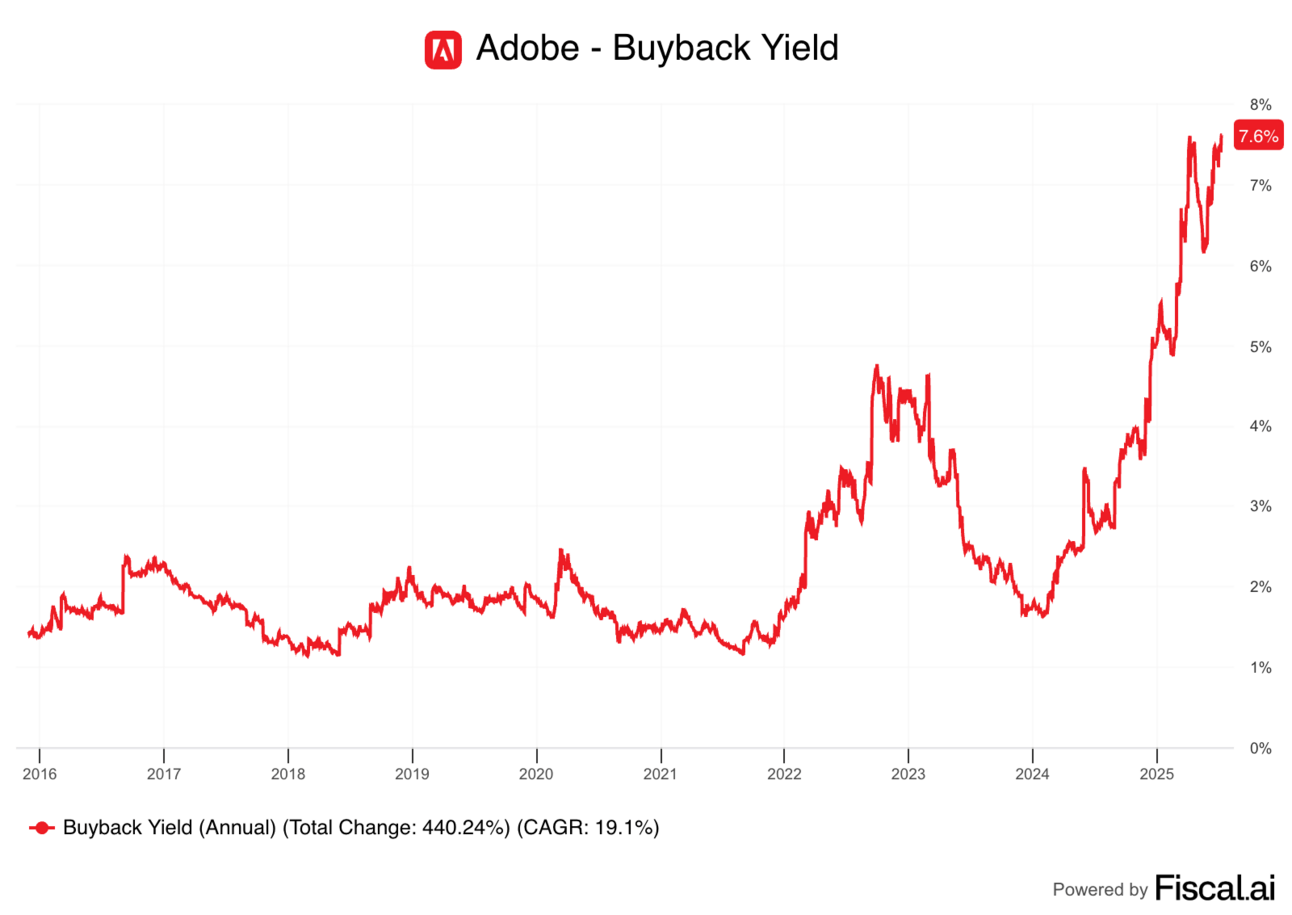

Adobe’s Growing Buyback

Investors have soured on software giant Adobe as of late. In response, Adobe’s management team has been ramping up their share repurchases. Between its heightened buyback and depressed valuation, Adobe is on pace to repurchase 7.6% of its total shares this year.