- Fiscal.ai

- Posts

- 🗞 The Most Profitable Business Models In the World

🗞 The Most Profitable Business Models In the World

Here are 10 of the most profitable businesses around the globe.

Happy Monday!

Today we’re talking about 10 of the most profitable business models in the world. 💰️

Let’s dive in!

Featured Story

10 of the Most Profitable Business Models in the World

When a business or business segment generates large profit margins, they tend to attract competition. In turn, that increased competition then typically leads to lower profit margins across the industry.

That’s why the average profit margin of the S&P 500 — which already includes many of the most successful businesses in the world — stands at just 12%.

So if a business (or business segment) is able to maintain 50%+ profit margins for a sustained period of time, that tells you that there’s something truly special about it.

Here are 10 of the most profitable businesses/business segments in the world:

The FICO score is deeply embedded in the US financial system and is widely accepted as the de-facto determination of an individual’s credit worthiness.

As the de-facto credit scoring system for more than 3 decades, FICO has more experience than competitors in scoring borrowers. This experience helps improve their assessment process which further reinforces FICO’s competitive advantage as one of the most reliable credit scoring systems.

Thanks to its solidified position as the leading credit score and its minimal costs to serve new customers, FICO’s “Scores” segment boasts a whopping 88% operating margin.

10-yr Total Return: +1,754%

Texas Pacific Land Corp (TPL) is a major landowner in West Texas and generates revenue primarily from managing oil & gas royalty interests and leasing land.

Since no other company has the rights to the same land, and West Texas sits on the Permian Basin which is the largest oil producing region in America, TPL has been able to generate more than 70% operating margins for more than 20 straight years.

10yr Total Return: +2,268%

As a leading global securities brokerage platform since the 1980’s, Interactive Brokers (IBKR) has spent several decades setting up its digital execution infrastructure with direct connections in countries all over the globe.

Now, with some of the widest securities coverage of any brokerage in the world, IBKR is able to onboard new customers and facilitate more trades at virtually no additional cost. This is why IBKR is able to generate a whopping 75% operating margin.

10yr Total Return: +608%

Kweichow Moutai’s namesake liquor brand Moutai is one of the most recognized premium brands of baiju (distilled liquor) in China.

As a cultural staple with more than 200 years of heritage, Moutai is able to charge much higher prices than other liquor brands while still growing its overall volume. This has led to an average 66% operating margin over the last 10 years.

10yr Total Return: +856%

VeriSign is the exclusive registry operator for all .com and .net domain names. That means that every time someone registers or renews their domain, VeriSign collects a fee. And since long-established domains rarely change, this leads to predictable, recurring revenue for VeriSign.

The bulk of VeriSign’s costs are related to maintaining their infrastructure (servers, security, etc.) so the incremental cost of adding a new domain is next to nothing.

10yr Total Return: +316%

Payments Networks - Visa & Mastercard

As the leading payment networks, Visa & Mastercard are now the de-facto communication infrastructure for banks globally.

Banks can now easily offer credit and debit cards to their customers by simply plugging into either Visa or Mastercard’s networks. For Visa and Mastercard, this onboarding of new cardholders requires minimal costs, which is why they’ve both been able to grow their operating margins as they’ve scaled.

10yr Total Return: Visa +426%, Mastercard +589%

Supply of Nvidia’s leading edge GPUs hasn’t quite been able to meet the soaring demand that the company has seen in recent years. This has led to price increases and rapid profit margin expansion. Last year, Nvidia generated 62% operating margins, which is nearly 4x higher than the company’s 16% operating margins from 2023.

While supply on Nvidia’s existing models will likely increase over time, its leading edge/next-gen models should continue to sell at a premium price point. If investment in AI continues to grow, and Nvidia maintains its leadership position, that would likely allow Nvidia to continue generating 50%+ operating margins.

10yr Total Return: +31,604%

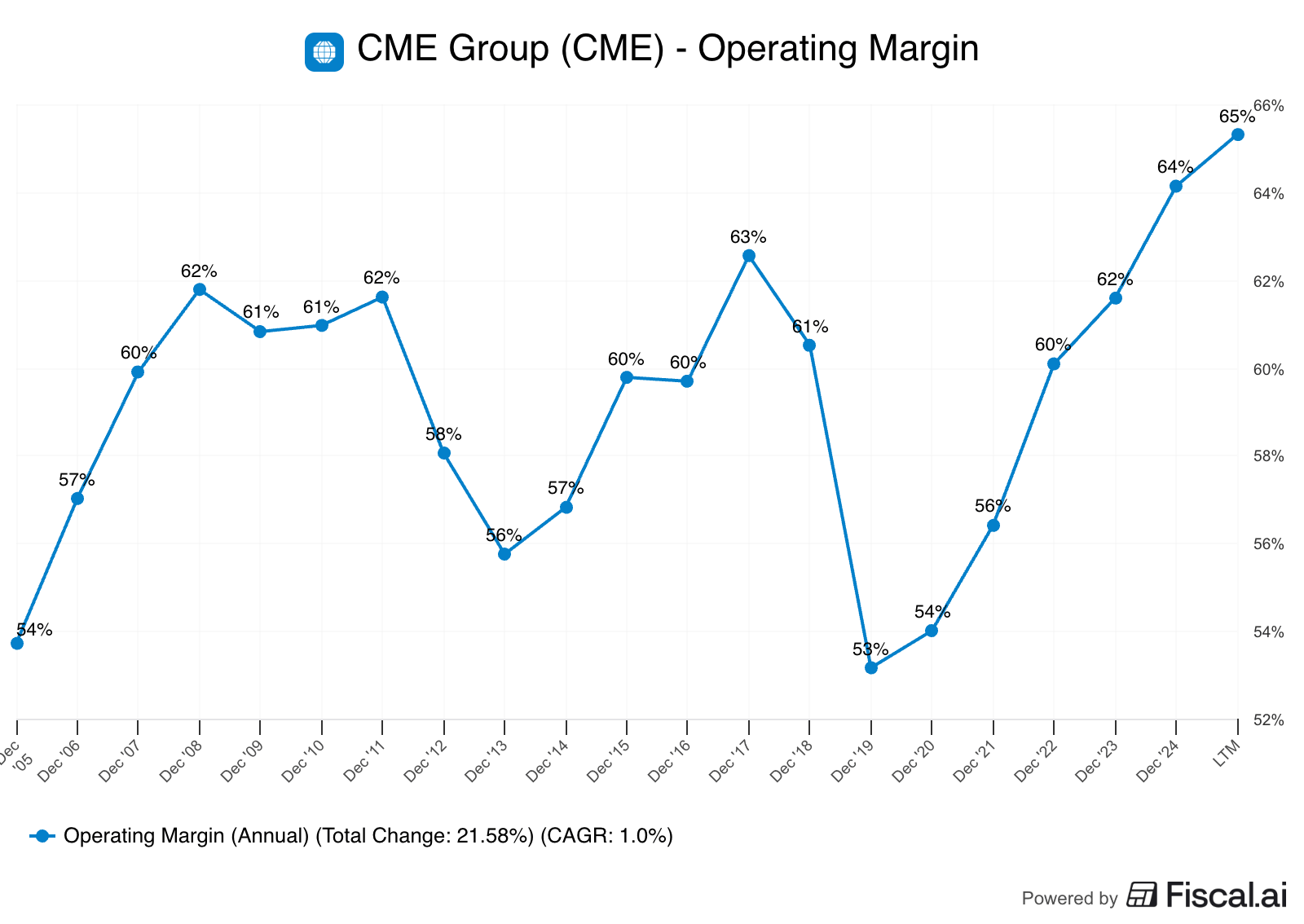

CME Group runs the largest derivatives exchange in the world.

Like other exchange operators around the globe, CME Group has a massive network effect. Since traders and institutions want to be where the most liquidity is, they come to CME. This means CME has to pay very little to acquire customers since they come naturally.

The bulk of CME’s costs are fixed costs related to building its exchange infrastructure and risk management framework. This allows CME to generate more than 60% operating margins at scale.

10yr Total Return: +314%

Building and maintaining an index isn’t very costly. However, scaling one and gaining notoriety among funds and asset managers can be difficult.

That’s why established index operators like MSCI or S&P Global are able to earn such wide profit margins. MSCI owns the rights to many of the world’s most widely used equity indexes and ETF issuers often choose MSCI’s indices thanks to their notoriety and credibility.

10yr Total Return: +967%

Underneath Amazon’s massive corporate umbrella, there’s one often under-discussed segment that likely drives a ton of profits for the e-commerce giant. That’s the advertising division.

Amazon generates more than $60 billion in advertising revenue with the bulk of that coming from promoted placements on Amazon’s marketplace. Serving promoted placements on top of its existing marketplace requires very little costs for Amazon.

Although management doesn’t disclose the exact profit margins from this segment, the growth of advertising is likely one of the primary reasons that Amazon’s North American retail segment is currently generating its largest profit margins ever.

10yr Total Return: +789%