- Fiscal.ai

- Posts

- 🗞 The $12B Company Reshaping Global Payments

🗞 The $12B Company Reshaping Global Payments

How this emerging fintech built the leading international payments network

Happy Sunday! 👋

Today we’re taking a look at the $12 billion company that’s reshaping the global payments landscape.

Let’s dive in!

Featured Story

The $12B Company Reshaping Global Payments

“Our infrastructure is the reason why payments on Wise are so much faster and served at lower prices than any competitor can really match sustainably. This strategy of continuously lowering our fees makes it harder for anyone to compete, and it will underwrite the long-term success and growth of Wise.”

Over the years, every country has developed their own codes and messaging formats for their respective banking systems. These independent systems make it difficult for banks from different countries to conduct business with one another. That’s why SWIFT was formed.

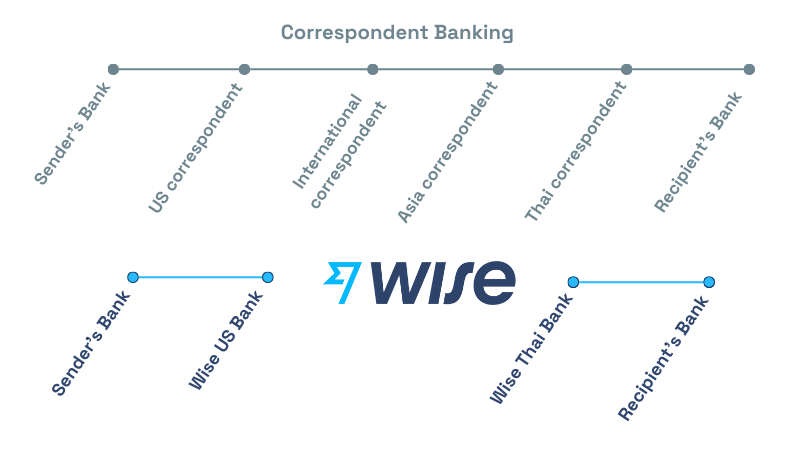

SWIFT (short for Society for Worldwide Interbank Financial Telecommunication) built a standardized way for banks to talk to each other through a shared set of message formats. Keep in mind, this is a messaging system not a payment system. A swift message just instructs the banks to increase or decrease their balances. That’s where intermediary or “correspondent” banks come in.

Most banks do not hold accounts with every other bank on Earth. Instead, they maintain balances with a smaller number of large institutions known as correspondent banks. These correspondent banks are used to route and settle global payments.

The correspondent banks then use each country’s domestic rails – like ACH in the US – to move the money to the final bank account. Every stakeholder in that system takes their cut, which is why cross-border payments are so costly.

Insert Wise

Wise, formerly known as TransferWise, built a system that circumvents the entire correspondent banking system.

What started as a convenient workaround by Kristo Käärmann and Taavet Hinrikus would go on to become the foundation for the world’s fastest and lowest cost cross-border payments network.

The genesis for the idea came in 2011. Taavet was living in London (as Skype’s first employee) and getting paid in Euros. Virtually all his bills were in British Pounds, so after he was paid, he’d have to exchange every paycheck.

Kristo – a friend of Taavet’s – was also working in London as a consultant for Deloitte. Like most citizens in the UK, Kristo was paid in British Pounds. However, he had a house in Estonia and was paying the mortgage in euros.

Long story short, Taavet needed British Pounds and Kristo needed Euros, and they were tired of paying 5% markups. So the two developed a simple peer-to-peer solution. Every month, Taavet deposited his Euros directly into Kristo's Estonian bank account, while Kristo topped up Taavet's UK account with his British Pounds. Both received the currency they needed, and the money never truly crossed borders.

Today, Wise essentially runs on the same system, only on a much larger scale. Instead of relying on correspondent banks to send money, Wise holds accounts on both sides of the transaction and simply increases/decreases balances when transfers are placed.

This model is what enables Wise to continue pursuing their mission of reducing cross-border fees to zero.

The Rise to Remittance Dominance

The early adopters of Wise were individuals much like Kristo and Taavet. People that simply wanted to find the lowest cost way to send money to other countries.

As Wise established itself as the low-cost provider, customers became evangelists for the platform:

“Word of mouth remains the main customer acquisition channel, with over 70% of customers' growth coming from this channel. This is the evidence that our product convinced and continued to have a great impact on people's lives, and that continued to build our evangelical customer base.”

While Wise caught fire with individuals early on, it didn’t take long before businesses started gravitating towards the low-cost solution as well. To help lean into that customer cohort, Wise began building out more business-focused solutions and features like invoicing tools, spending controls, and 3rd party integrations (Quickbooks, Xero, etc.).

Today, Wise has 542,000 businesses all around the world using the platform, which is up from 120,000 in 2019. Even though that’s only a small fraction of Wise’s individual customer base, it’s a much higher value audience. Wise reports that business customers send ~7x more than individual customers, on average.

This dynamic has created a healthy balance in overall volume growth between both individual and business customers.

Today, Wise processes more than $200 billion in annual volume. For context, there’s ~$1 trillion sent in global remittance volume every year.

That’s all for this week.

If you have any questions on Fiscal.ai or feedback for the newsletter, feel free to reply to this email!