- Fiscal.ai

- Posts

- 🗞 The 10 Best Roll-Ups of All Time

🗞 The 10 Best Roll-Ups of All Time

These are the 10 best performing serial acquirers ever. Plus, a glimpse at Meta's insane CapEx plans.

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

📈 10 Best Roll-Ups of All Time

📊 Meta’s CapEx Plans

Let’s dive in!

Featured Story

10 Best Roll-Ups of All Time

A company that regularly acquires smaller businesses or businesses operating within the same industry can be characterized as a “Roll-Up”.

Typically these roll-ups are able to improve subsidiary-level profits creating economies of scale. These can come in many forms, but often include:

Shared technology systems/infrastructure

Outsourcing back-office functions (HR, Accounting, etc.)

Increased purchasing/bargaining power

And much more.

While not all roll-up strategies work, the few companies that do it really well can supercharge growth and generate exceptional returns investors.

Here are the 10 best-performing roll-ups of all time:

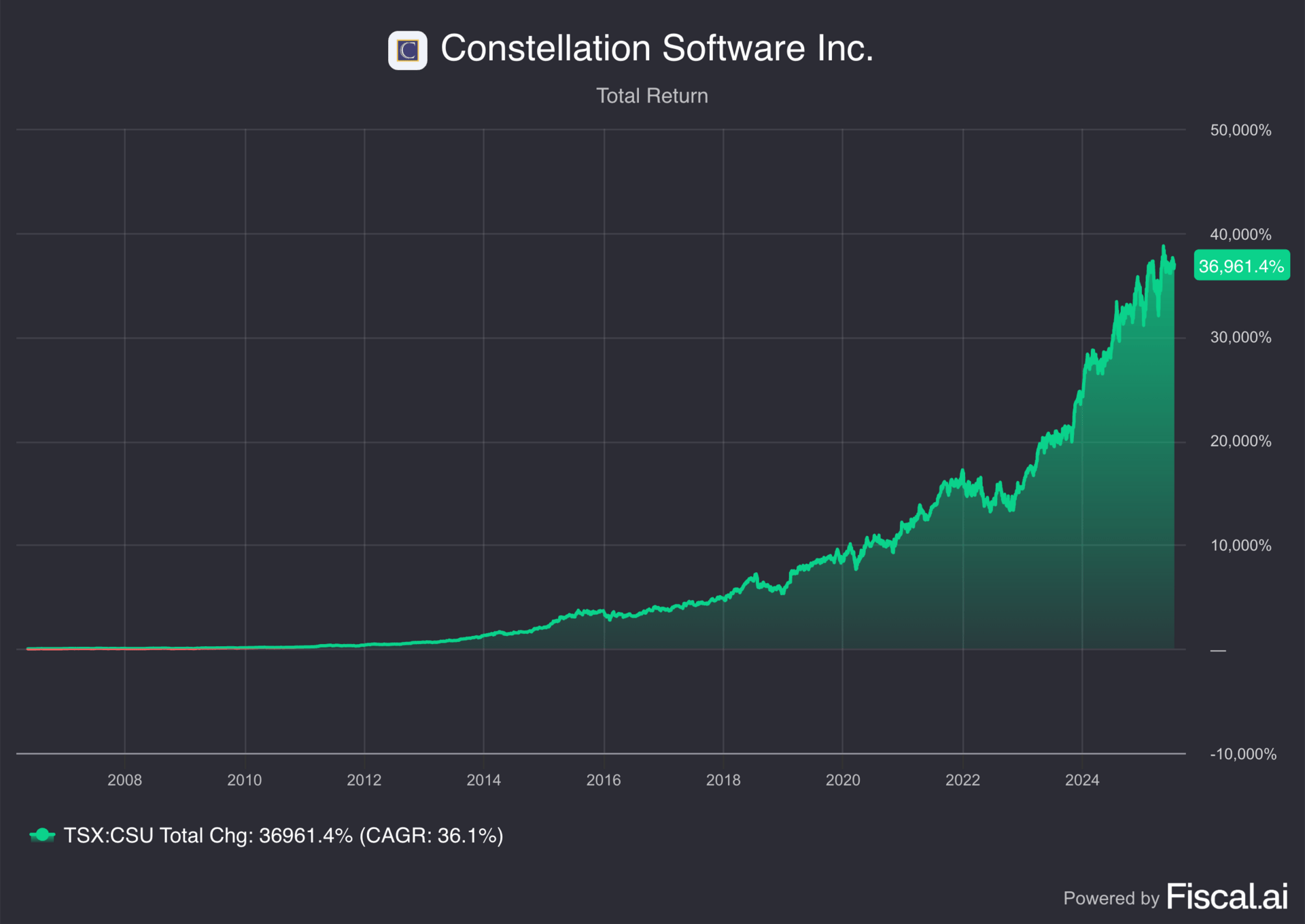

Constellation Software is a serial acquirer of vertical market software companies. Founded by former Venture Capitalist Mark Leonard in 1995, Constellation is able to share its operational excellence and best practices with the companies it acquires.

Total Return: +36,961%

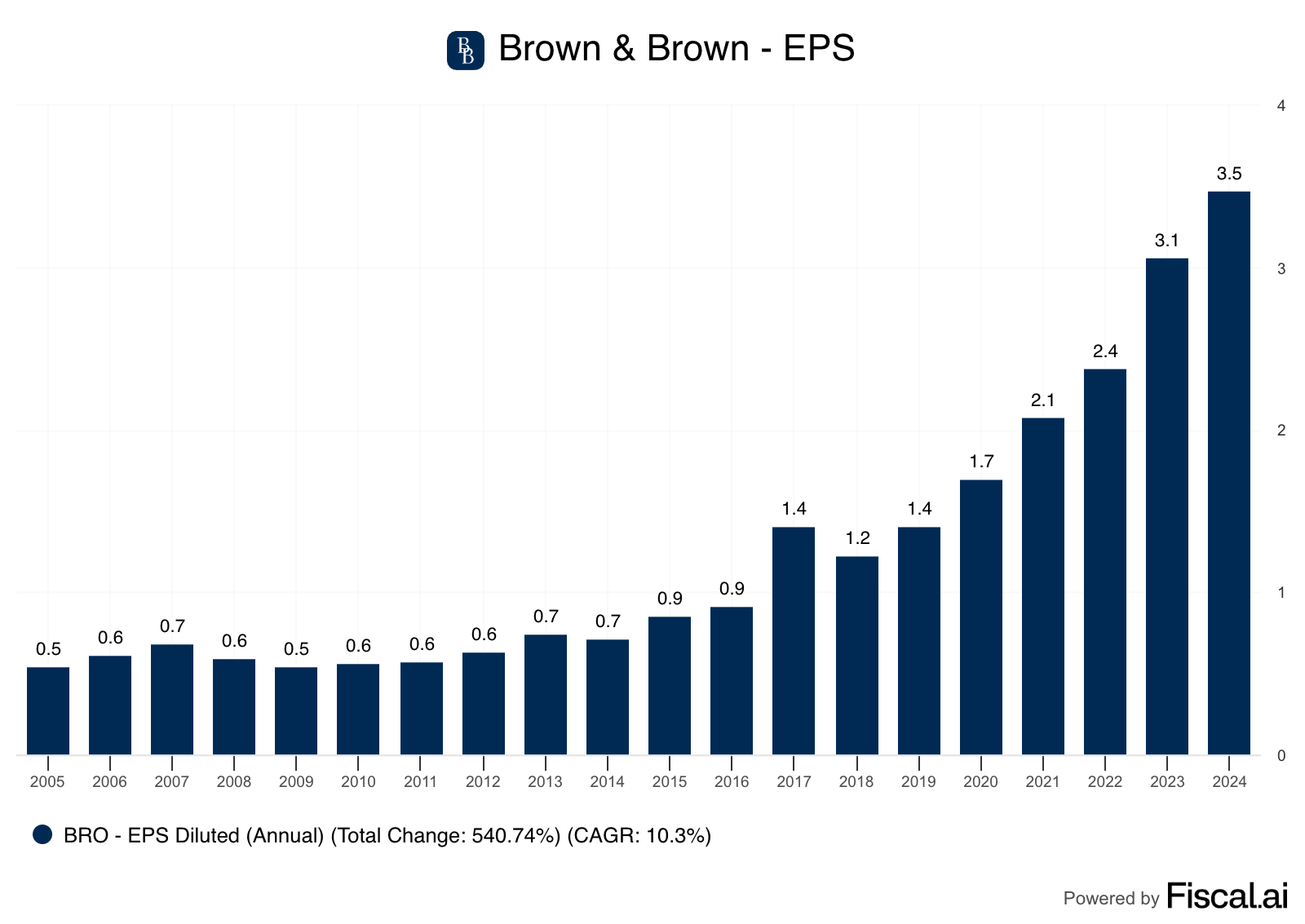

Brown & Brown is a serial acquirer of small, independent insurance agencies and brokerages in the United States. Their centralized support and existing carrier relationships help smaller agencies expand their business once under the Brown & Brown umbrella.

Total Return: +41,900%

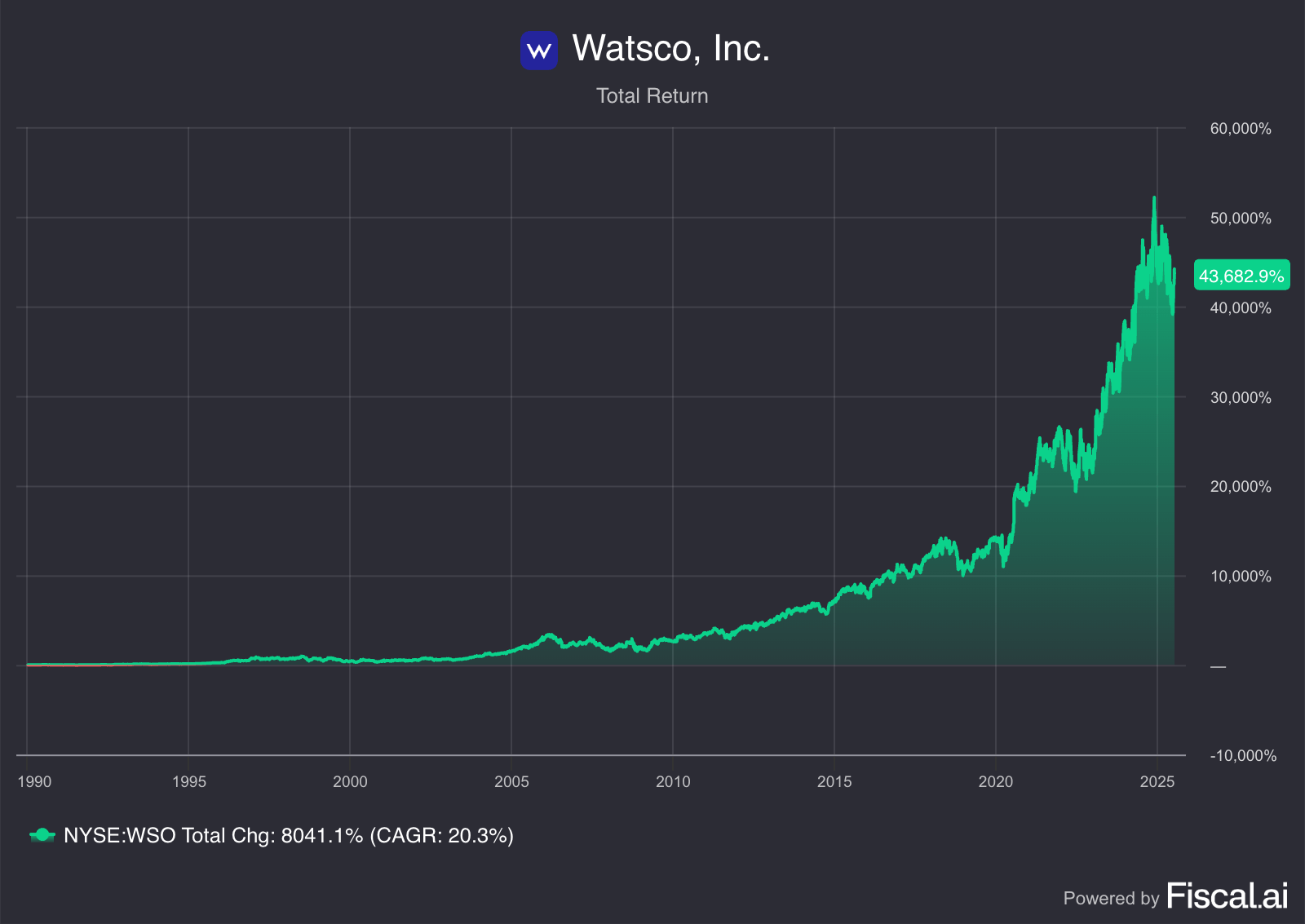

Watsco is one of the largest suppliers of HVAC systems and parts. They've primarily grown by acquiring hundreds of smaller, family-owned HVAC distributors. Between its nearly 700 locations and more than 375,00 contractors/technicians, Watsco is able to service more areas than its competitors.

Total Return: +43,683%

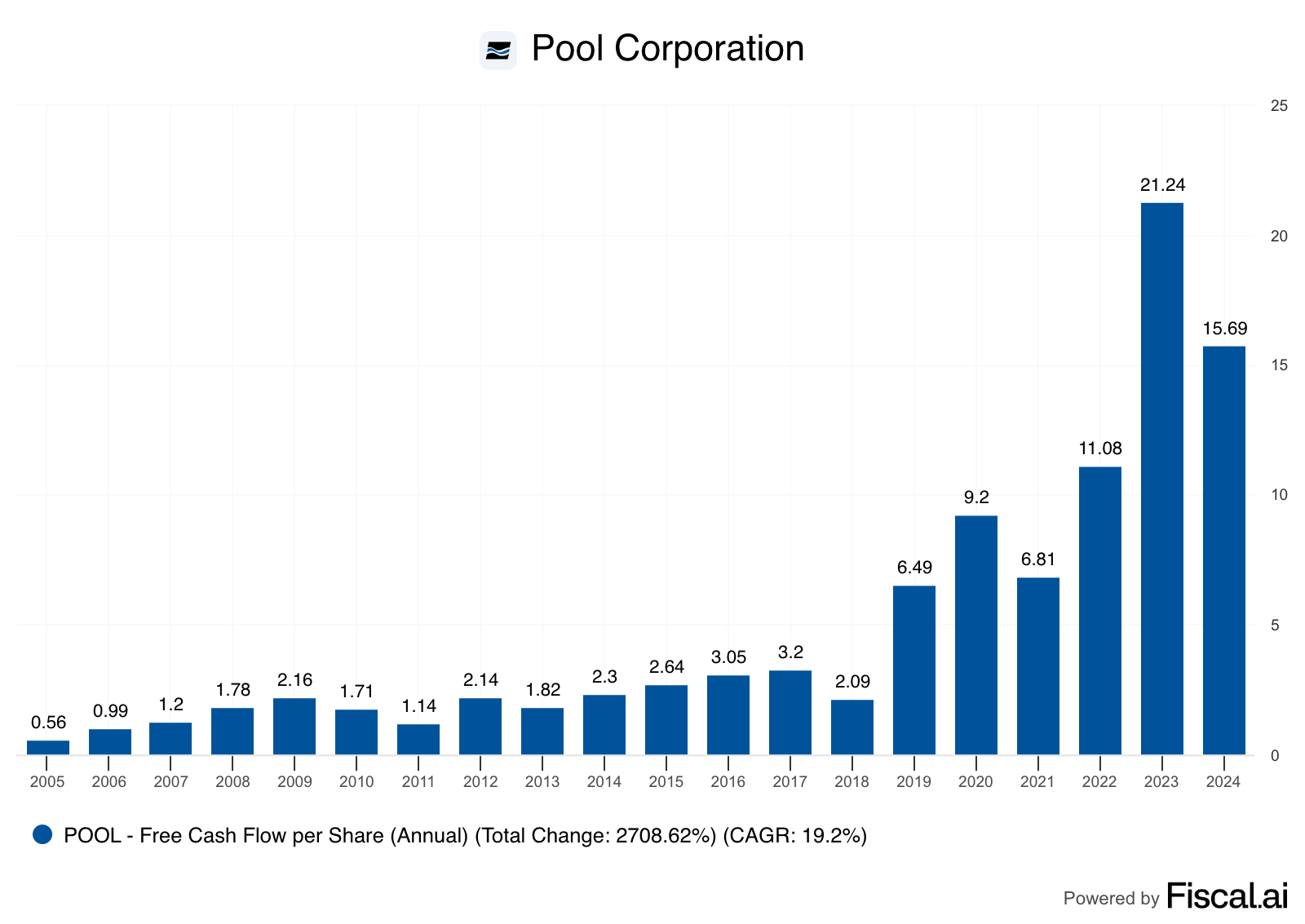

Pool Corp is the world's largest wholesale distributor of swimming pool supplies and equipment, and primarily adds new locations through acquisitions. As the leader in the industry, Pool Corp has significant negotiating leverage with suppliers which allows them to acquire inventory at a lower cost.

Total Return: +44,398%

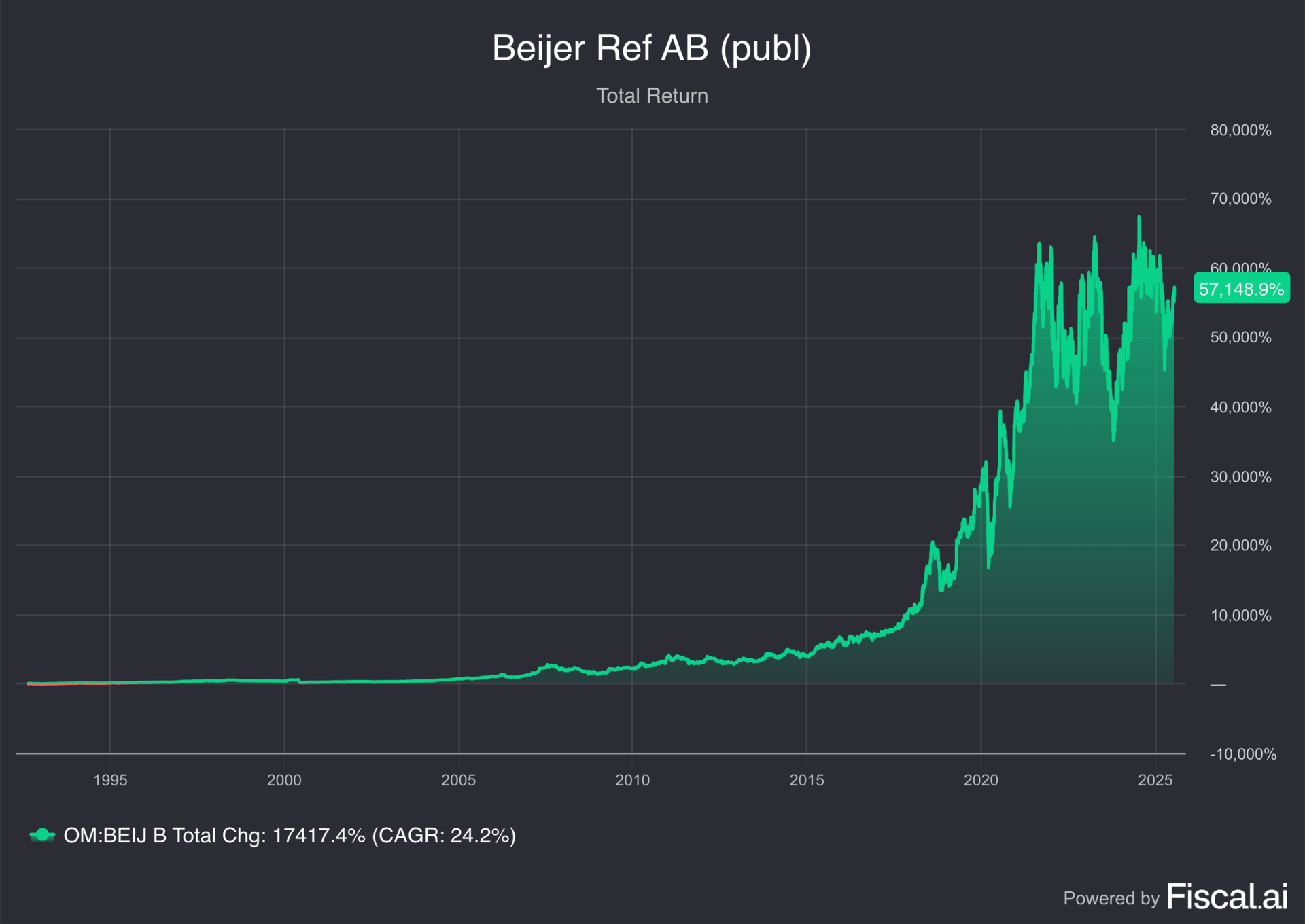

Beijer is a global distributor of Heating, Ventilation, and Air Conditioning products. They've added 35 bolt-on acquisitions just since 2021. Once a part of the Beijer Ref ecosystem, acquired companies can get better purchasing power and supplier terms.

Total Return: +55,295%

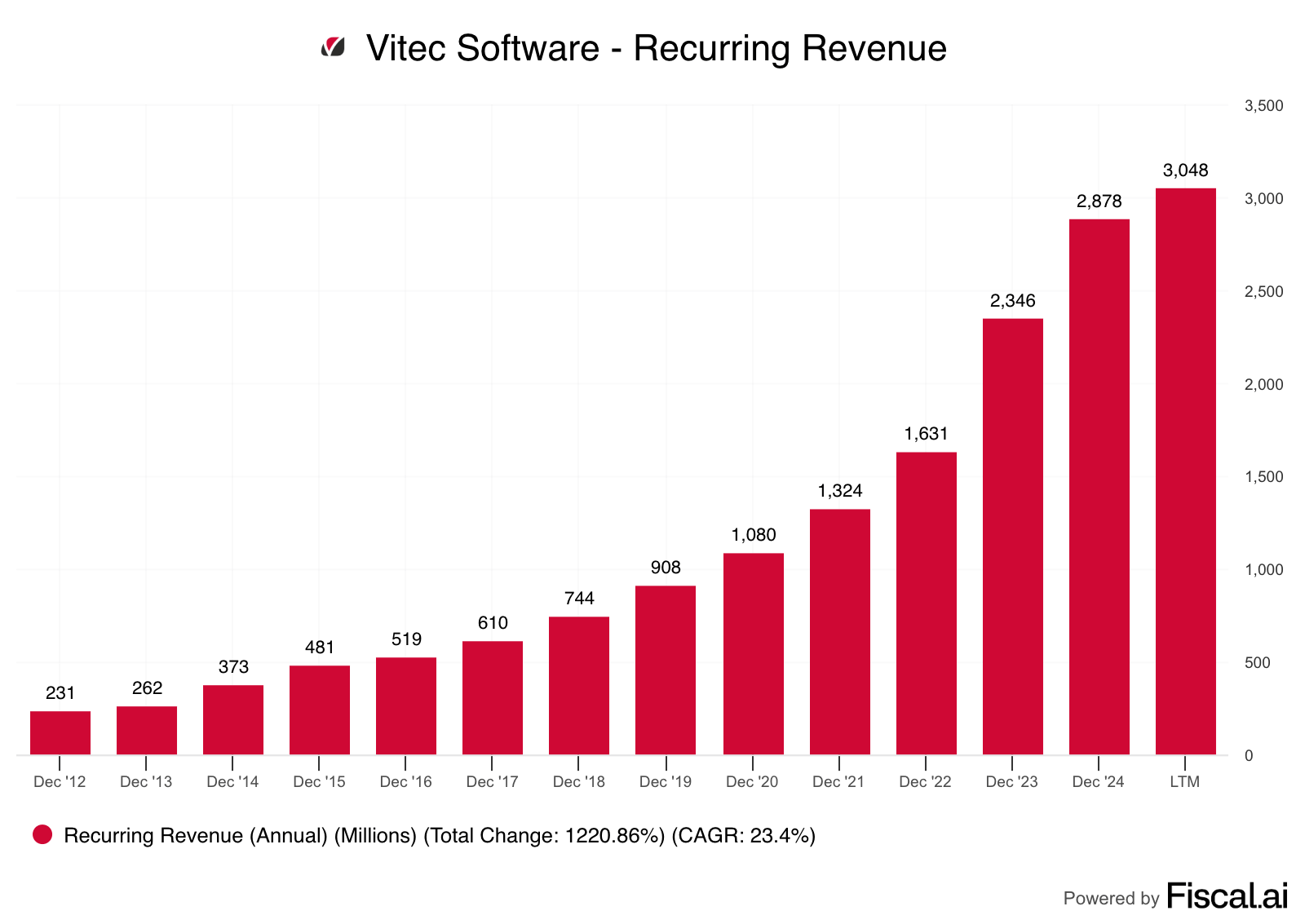

Vitec is a serial acquirer of vertical market software (VMS) companies. Its software caters to specific niches like pharmacies, banks, car workshops, real estate, & education. Vitec often helps legacy software licensing companies transition to a software-as-a-service model.

Total Return: +59,680%

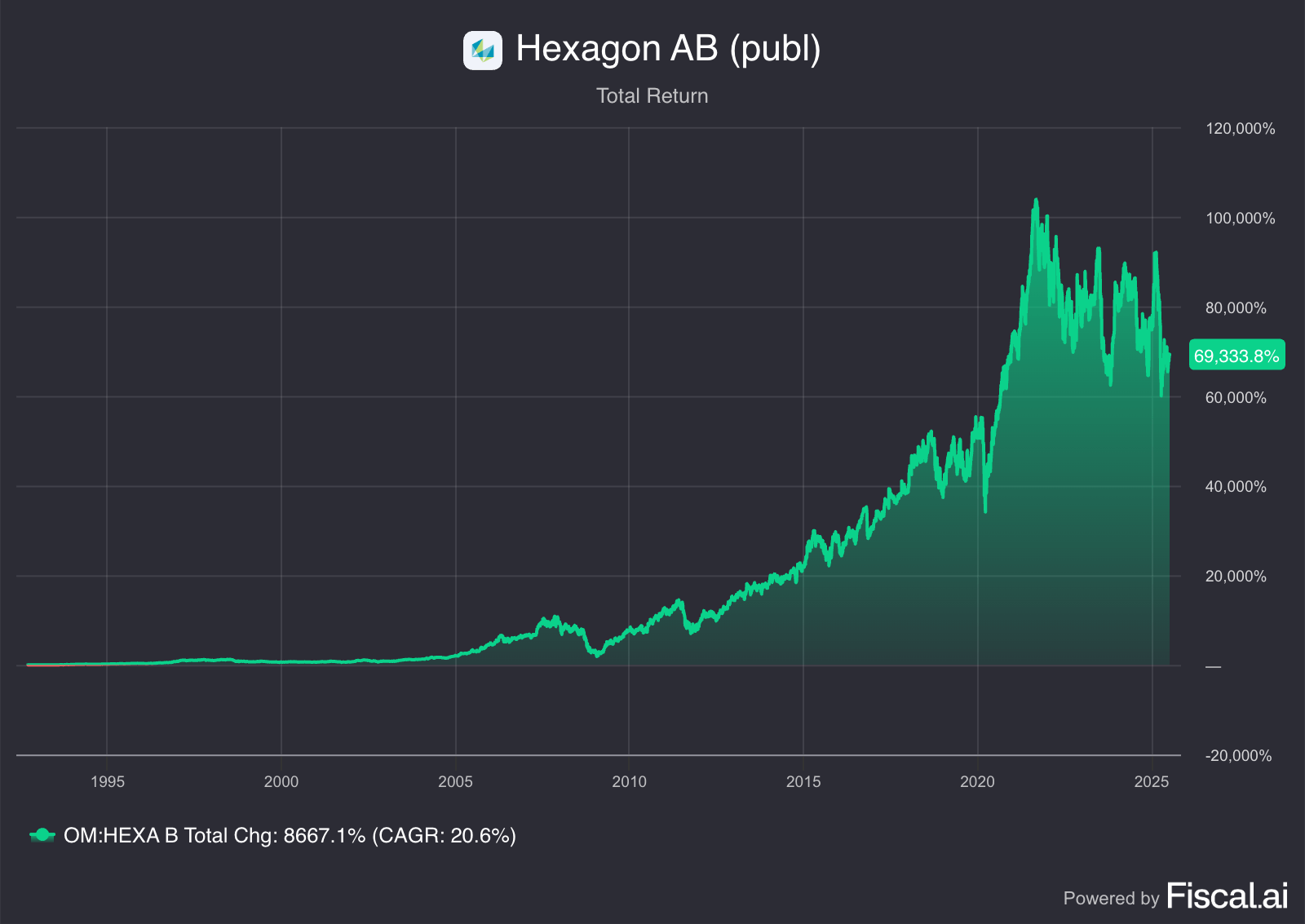

Hexagon AB is a global industrial-software and sensor provider. They've completed an estimated 170 acquisitions since 2000. With the breadth of its hardware and software suite, customers typically stay locked into the Hexagon product ecosystem.

Total Return: +69,334%

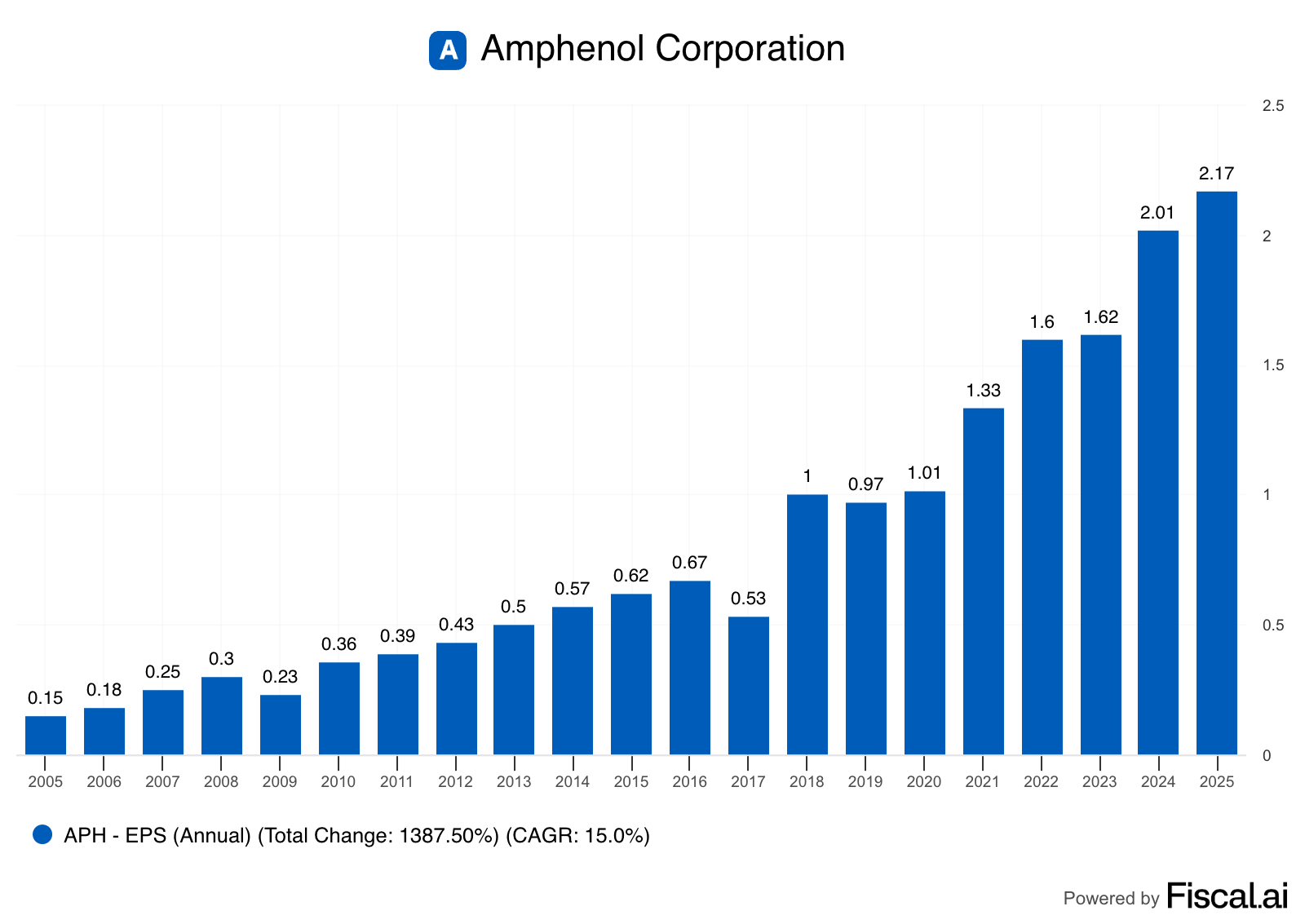

Amphenol is a leading provider of interconnect and sensor solutions to a wide range of end markets. They've done 20+ major deals and hundreds of tuck-in acquisitions.

Thanks to their global procurement network, Amphenol is able to lower the input costs for companies once they acquire them.

Total Return: +77,858%

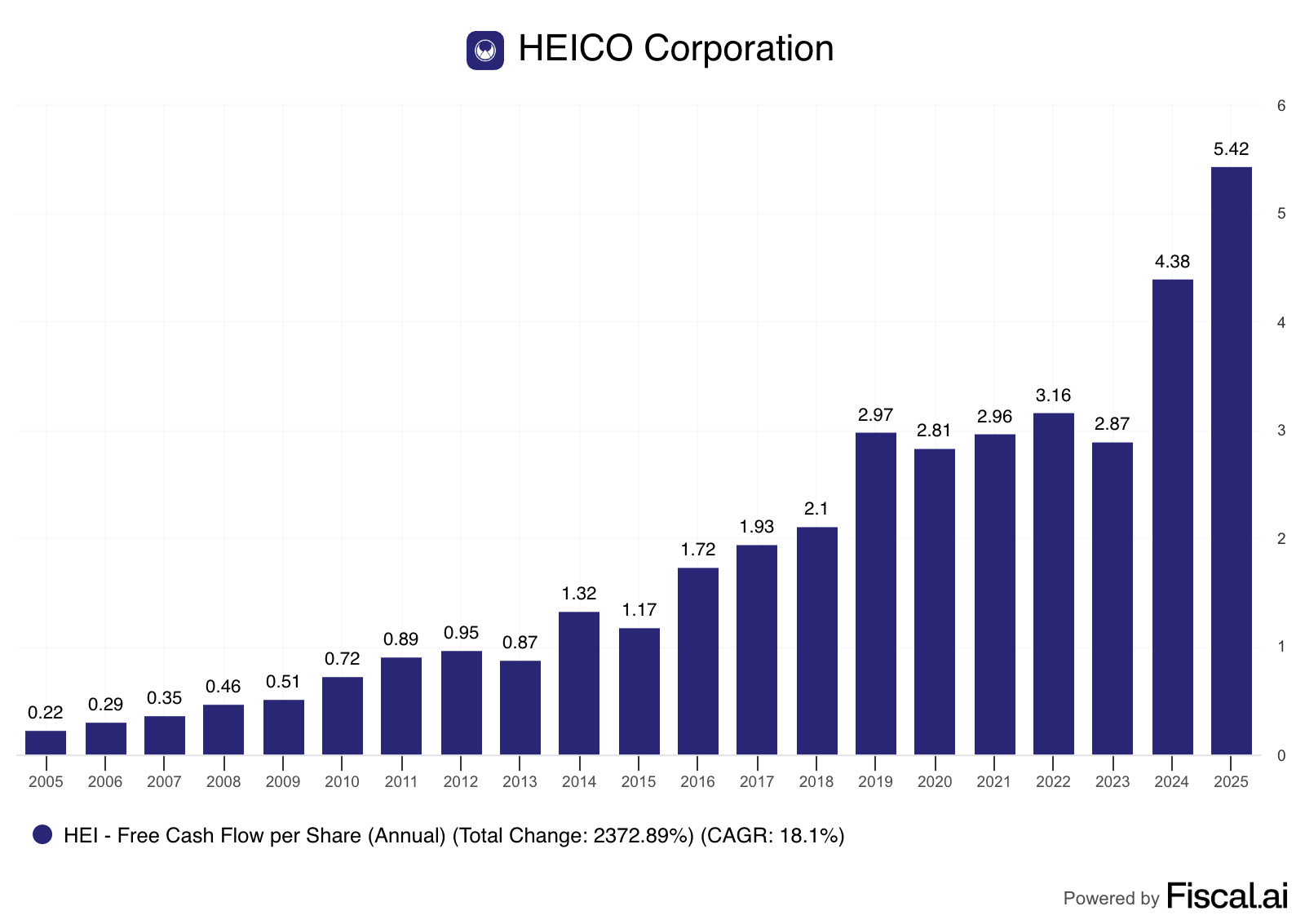

HEICO is a leading aerospace aftermarkets parts supplier with a long history of acquisitions. By expanding supply through acquisitions, HEICO has gained significant bargaining power with customers over the years.

Total Return: +123,498%

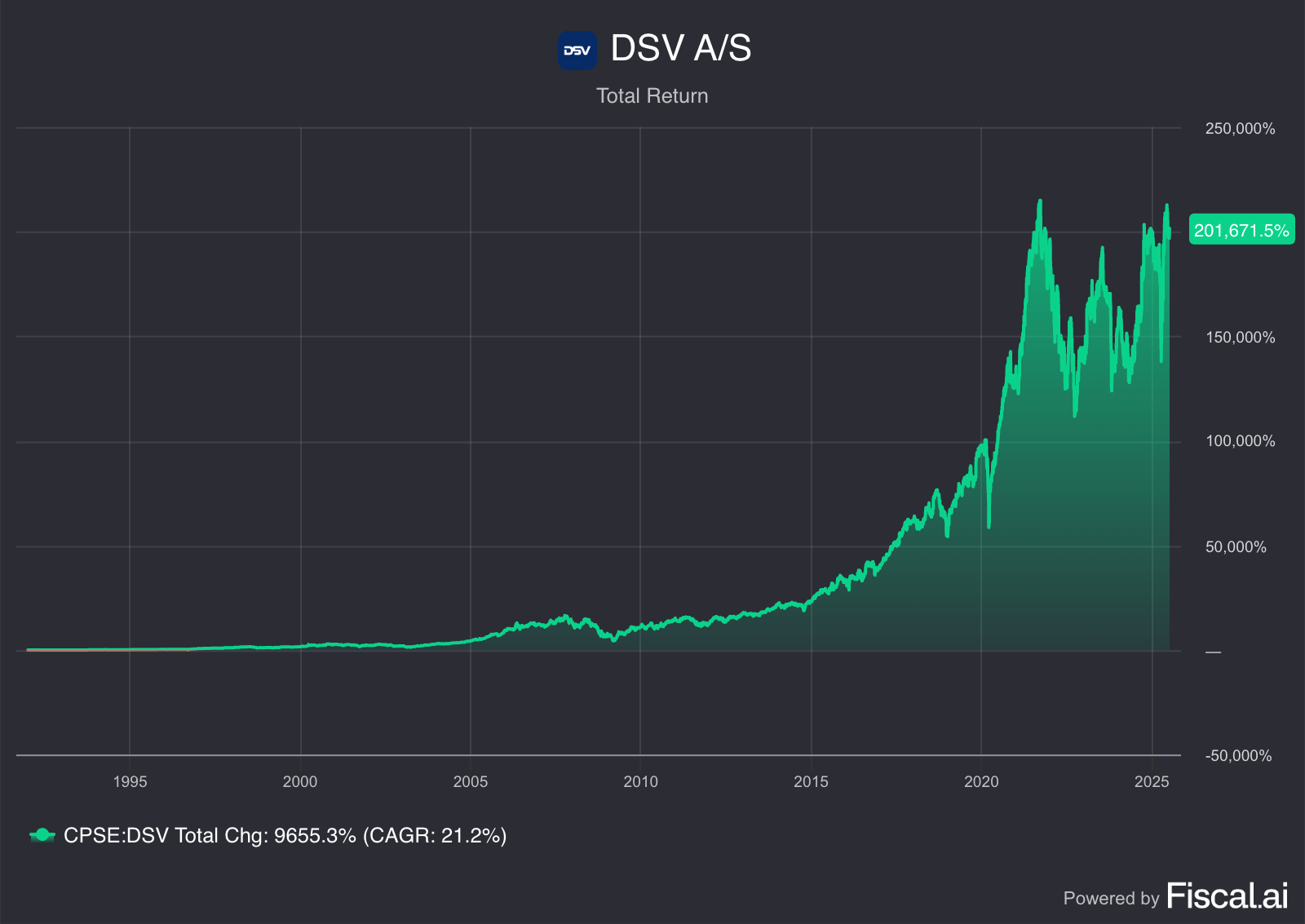

Through a series of strategic acquisitions, DSV has grown from a local Danish trucking company into one of the world's largest logistics firms.

Total Return: +201,671%

Meme of the Week

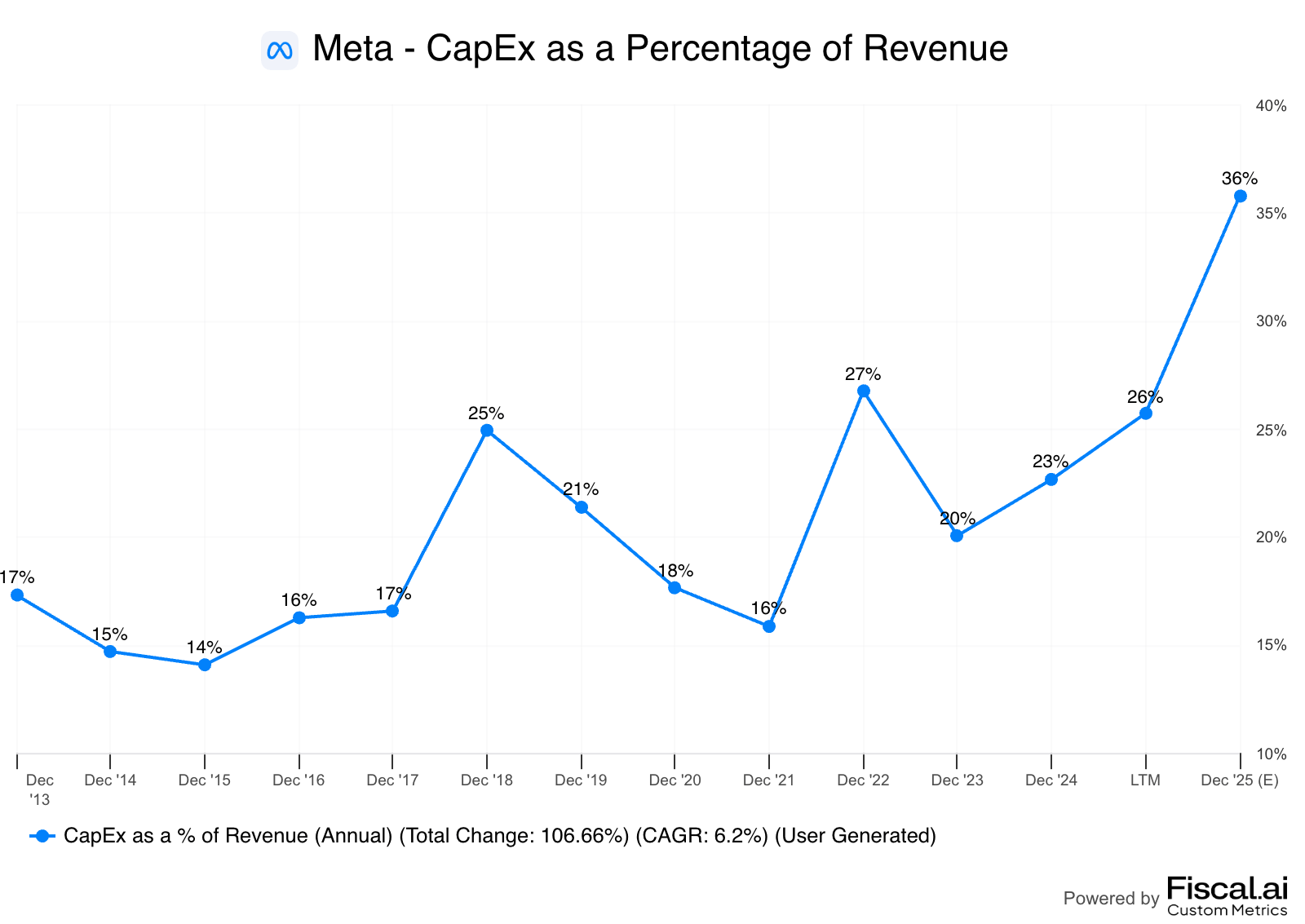

On Monday of this week, Meta CEO Mark Zuckerberg announced that the tech giant is planning to build “several multi-GW clusters” over the coming years.

It’s no secret that Zuckerberg wants to be a leader in AI, as over the last couple of weeks it has been reported that he is poaching talent with huge multi-million dollar pay packages, but this week’s announcement went a step further.

In a post on Threads, Zuckerberg made his capital allocation ambitions clear by stating “We're also going to invest hundreds of billions of dollars into compute to build superintelligence. We have the capital from our business to do this.”

The capital intensity of this business has changed drastically compared to just a decade ago. This year, analysts expect Meta to spend a whopping $67 billion on capital expenditures, accounting for 36% of the company’s estimated revenue.

While the return on this spending remains an unanswered question, one thing is clear. This should music to your ears if you’re an Nvidia shareholder. These data centers will undoubtedly need leading edge chips, and as of now Nvidia remains the leading supplier.