- Fiscal.ai

- Posts

- 🗞 Should Adobe Investors Be Worried About Figma?

🗞 Should Adobe Investors Be Worried About Figma?

Figma files for IPO + 5 Best charts from this week

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

🎨 Figma Files for IPO: Should Adobe be Worried?

📊 5 Best Charts From this Week

Let’s dive in!

Featured Story

Figma Files for IPO

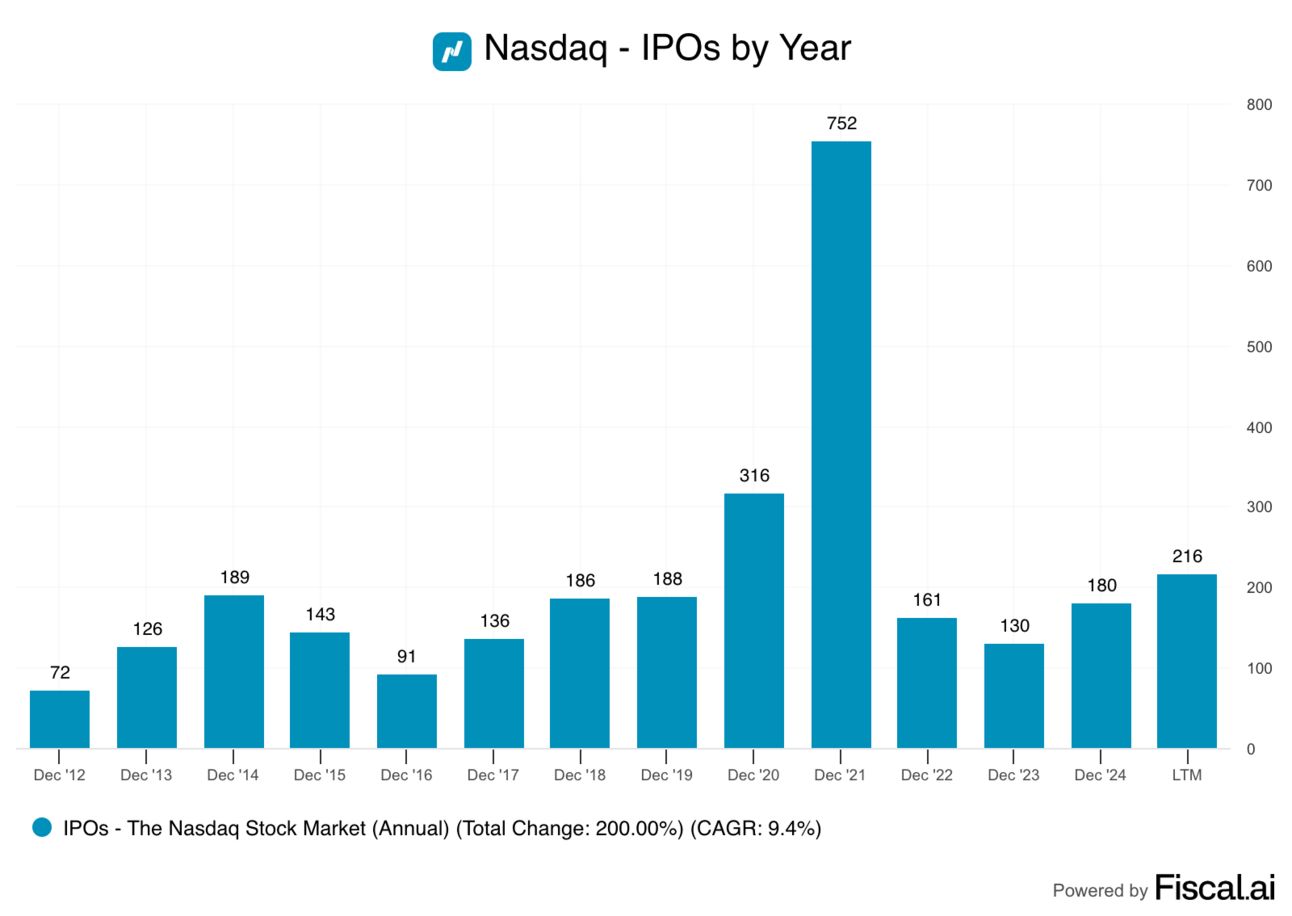

Since 2021, investors haven’t had too many IPOs to talk about.

But with the major indices now hitting all-time highs again, it appears the IPO market is beginning to open back up.

In the last 4 months alone, we’ve seen successful IPOs from well-known private companies like CoreWeave, Chime, eToro, and Circle.

And this week, we got news of another highly anticipated IPO. On Tuesday, the design and prototyping software company Figma filed its S-1, signaling its intention to go public.

For those that might remember, in 2022, software giant Adobe made a $20 billion bid to acquire Figma, but ultimately terminated the deal in 2023 after facing regulatory scrutiny.

Figma’s Business Model

Figma was founded in 2012 by Dylan Field and Evan Wallace, who met as computer science classmates at Brown University. Their overarching vision was to “eliminate the gap between imagination and reality”.

At the time, the digital design process was siloed. Designers would work by themselves across multiple tools and products, and email drafts around to team members for any revisions.

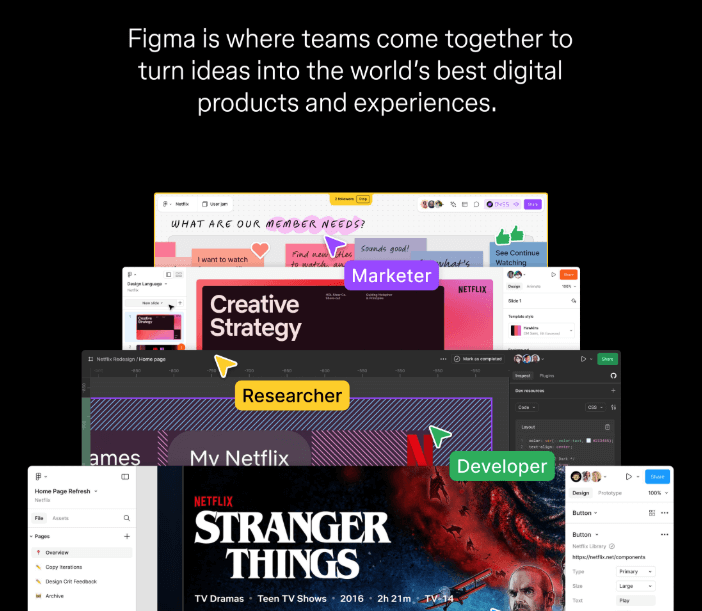

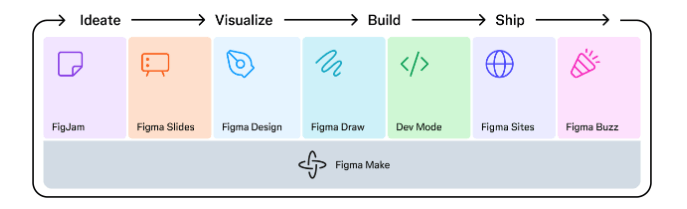

Figma was the solution to this outdated process. A collaborative, browser-based tool that would help teams go from idea to product all in one place.

Today, Figma spans that entire design to product lifecycle, and importantly makes life easier not just for the designers, but also for the developers. In fact, Figma reports that 30% of its monthly active users are developers.

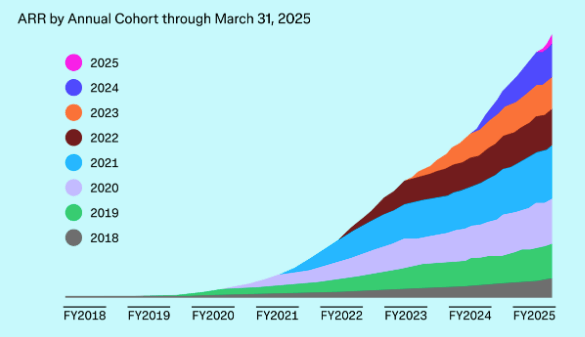

Figma’s freemium model helped spur major adoption from both individual creators as well as employees at larger enterprises. And since Figma’s ease of use and collaborative nature made the platform easy to share, the tool quickly spread within organizations.

Today, 95% of Fortune 500 companies use Figma in some capacity, and those customers continue to spend more with Figma each year. In fact, in the latest quarter, Figma reported a net-revenue-retention-rate of 132%, which means the majority of Figma’s 46% revenue growth comes from existing customers.

Should Adobe worry?

Immediately following the release of Figma’s S-1, shares of Adobe dropped 4%, which likely left many investors wondering whether or not competition from Figma is cause for concern.

The fact that Adobe bid ~40x revenue to acquire Figma in the first place would certainly lend credence to the notion that Adobe sees them as a threat. This is even more obvious now that the deal was effectively blocked over anti-competitive concerns.

However, it’s important to think about Adobe holistically. The software giant has a plethora of different products that meet the various needs of businesses, and Figma really only directly overlaps with two of those.

While Figma may continue to take market share among designers and developers, it doesn’t necessarily equate to churn for Adobe as enterprises often retain their overall creative cloud subscription since they use multiple services.

In other words, even if Figma’s success does result in declining usage for AdobeXD and InDesign, Adobe’s overall business can still grow.

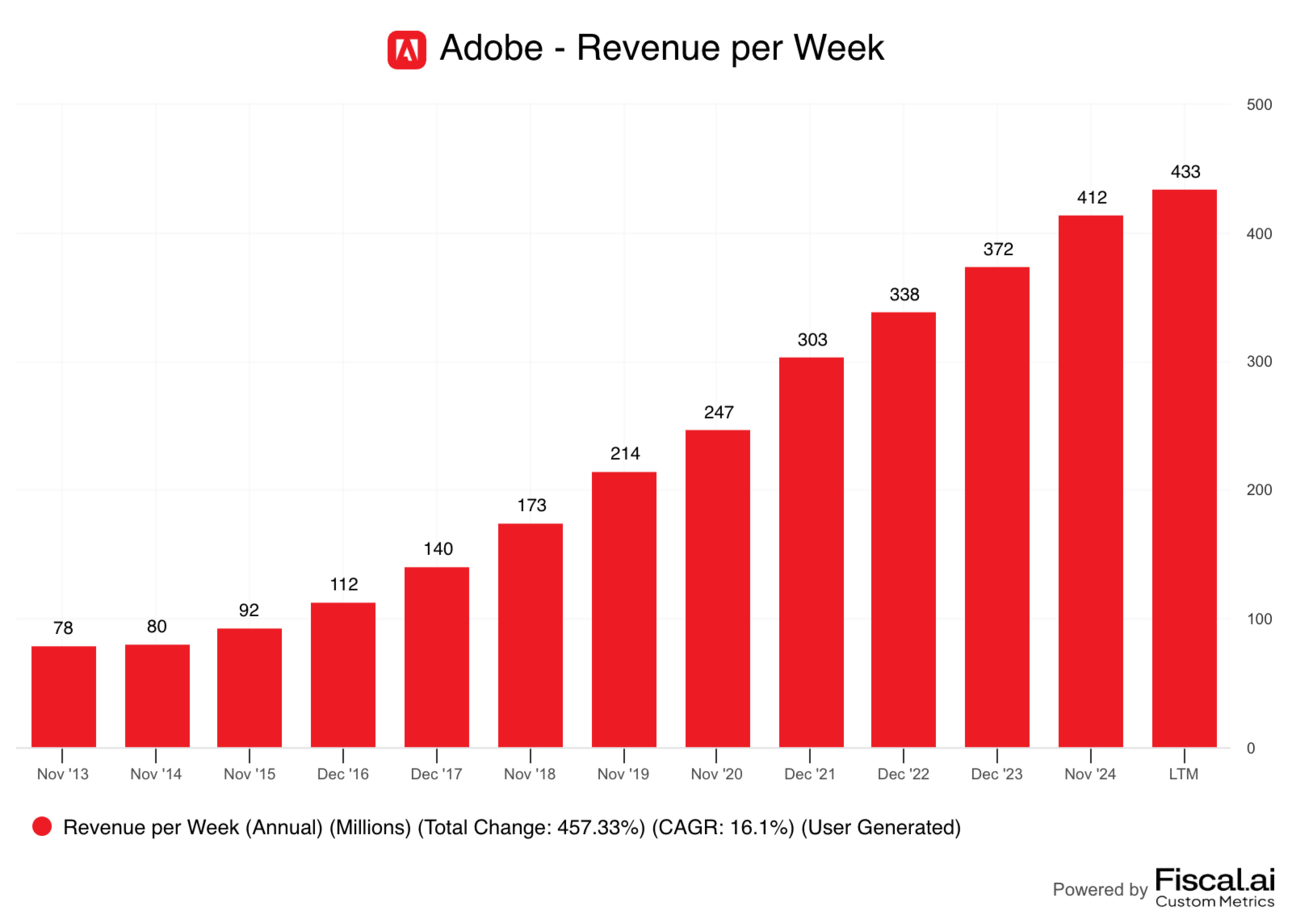

While Adobe shareholders shouldn’t entirely dismiss Figma, it’s important to put the size of the two businesses into perspective. Adobe earns Figma’s annual revenue ($821 million) roughly every 2 weeks.

Featured Story

5 Best Fiscal AI Charts From this Week

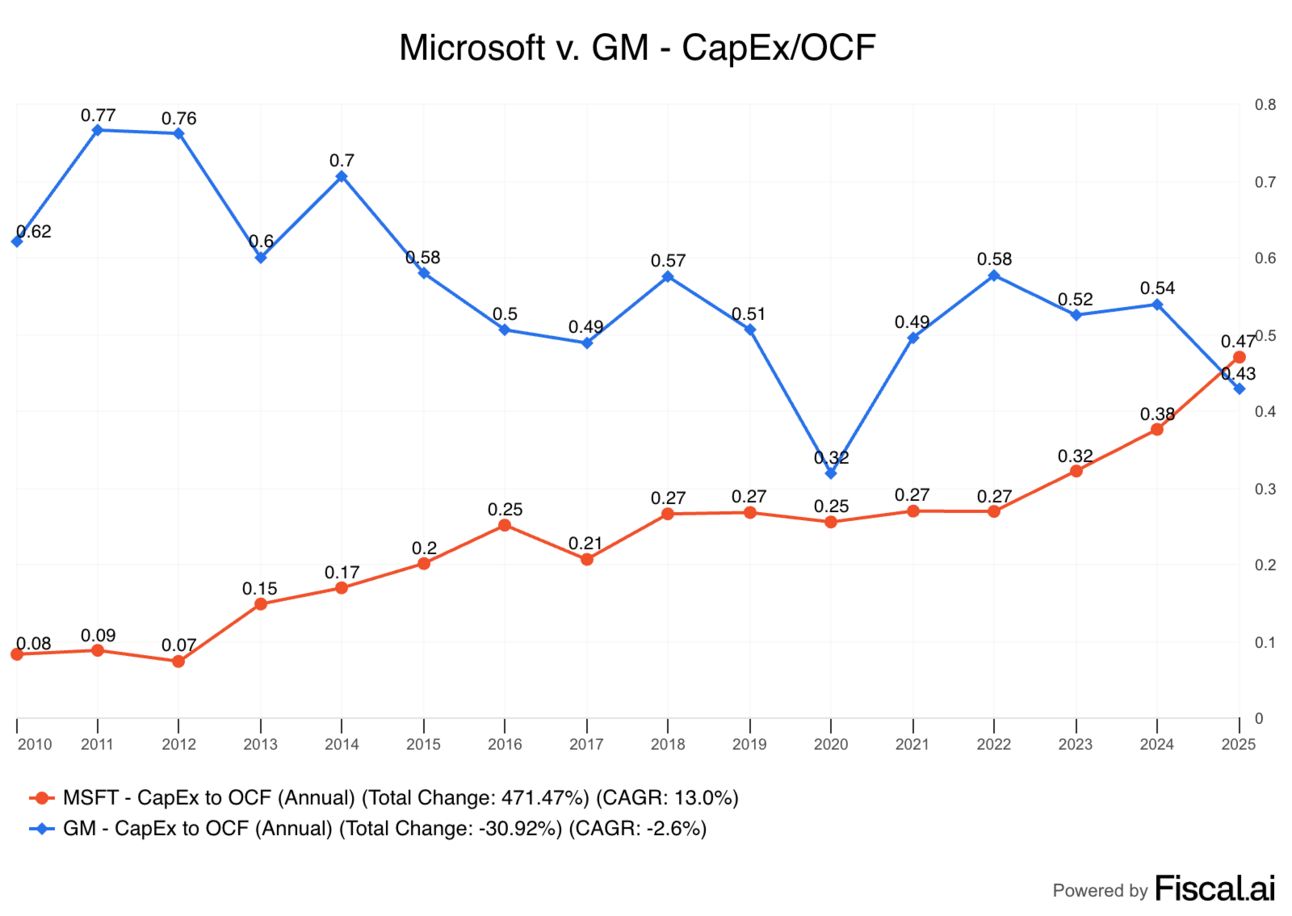

Microsoft’s Increasing Capital Intensity

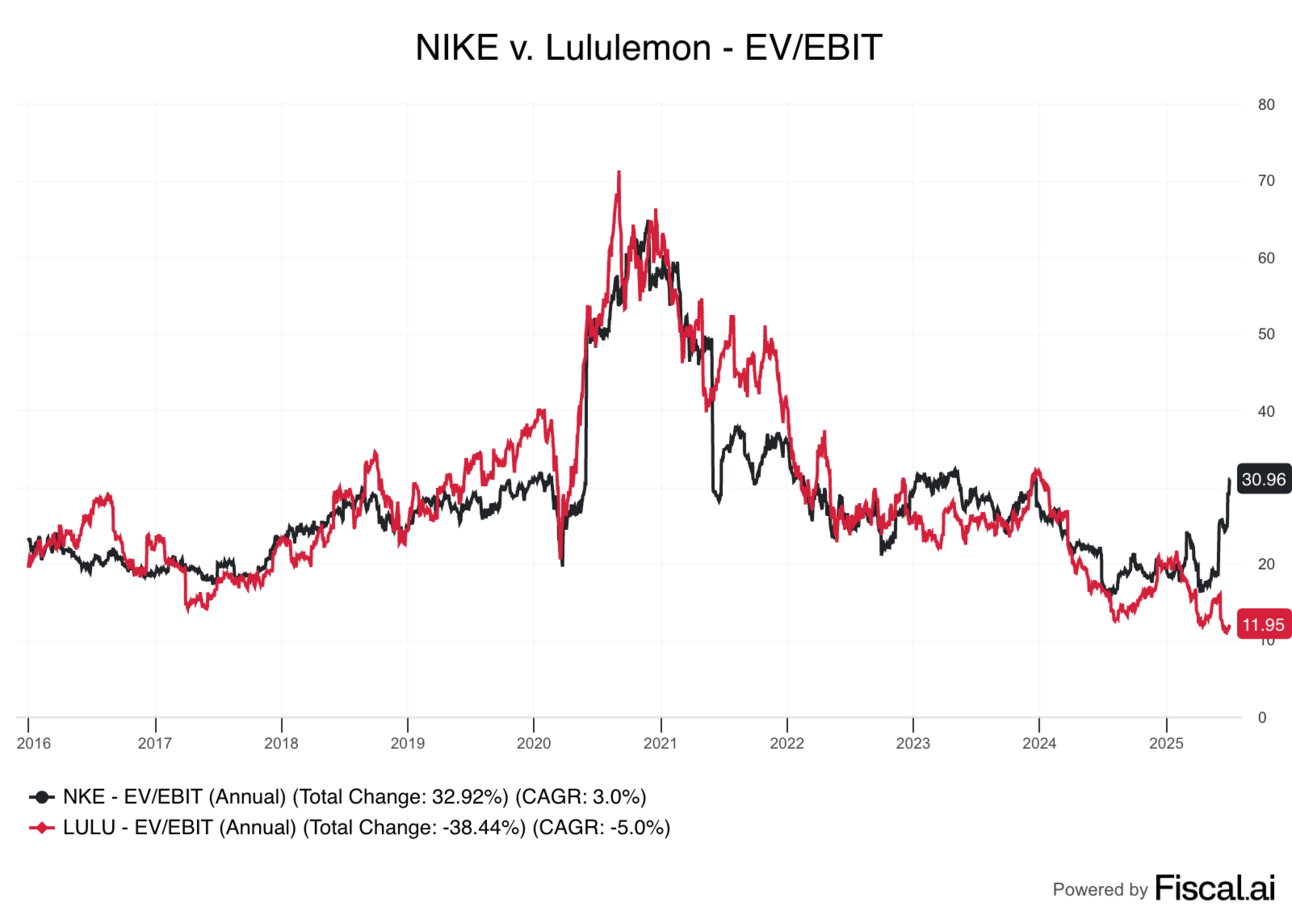

NIKE v. Lululemon: Which would you rather own?

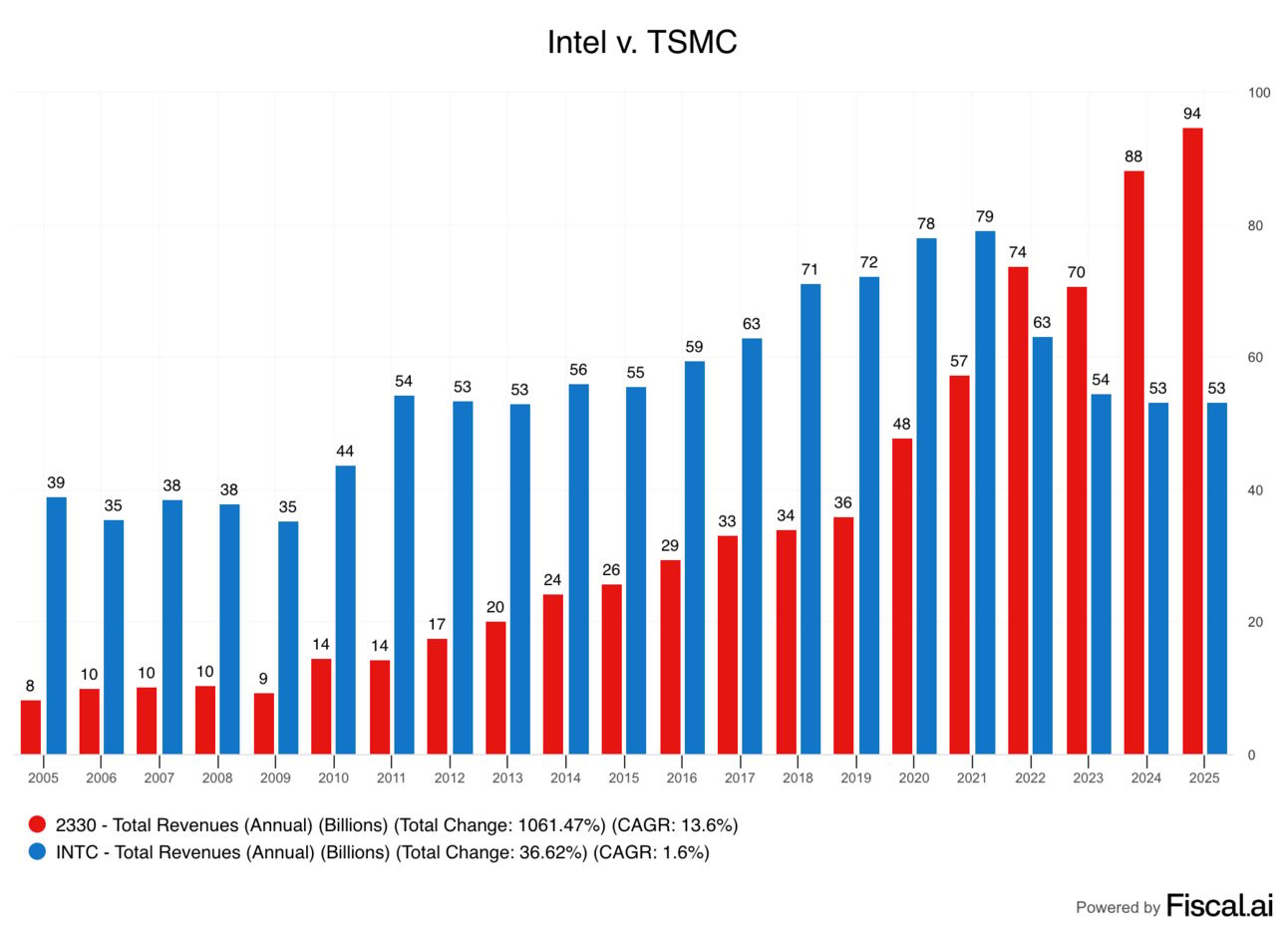

Intel v. TSMC - Focus Wins

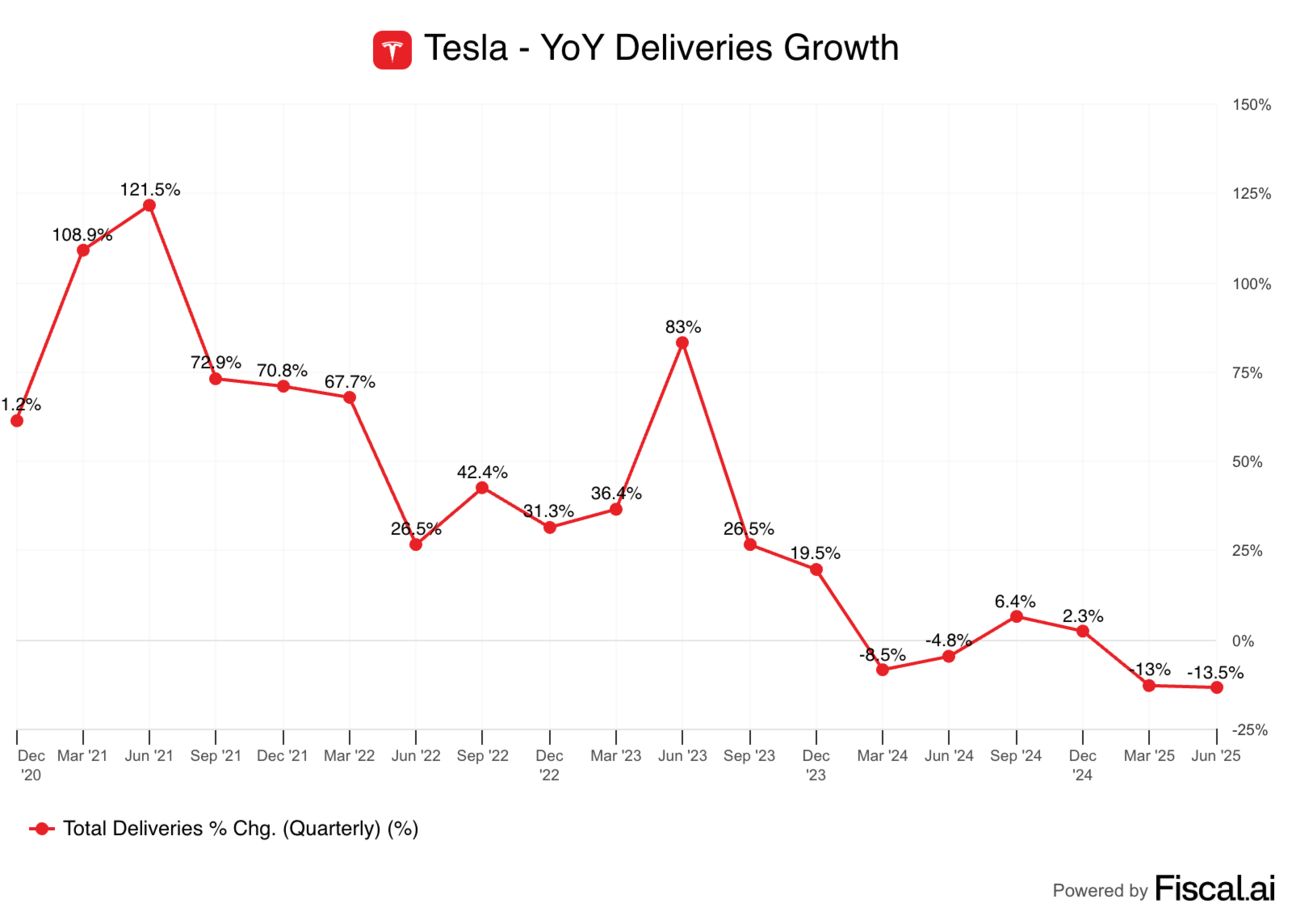

Tesla’s Deliveries Slump

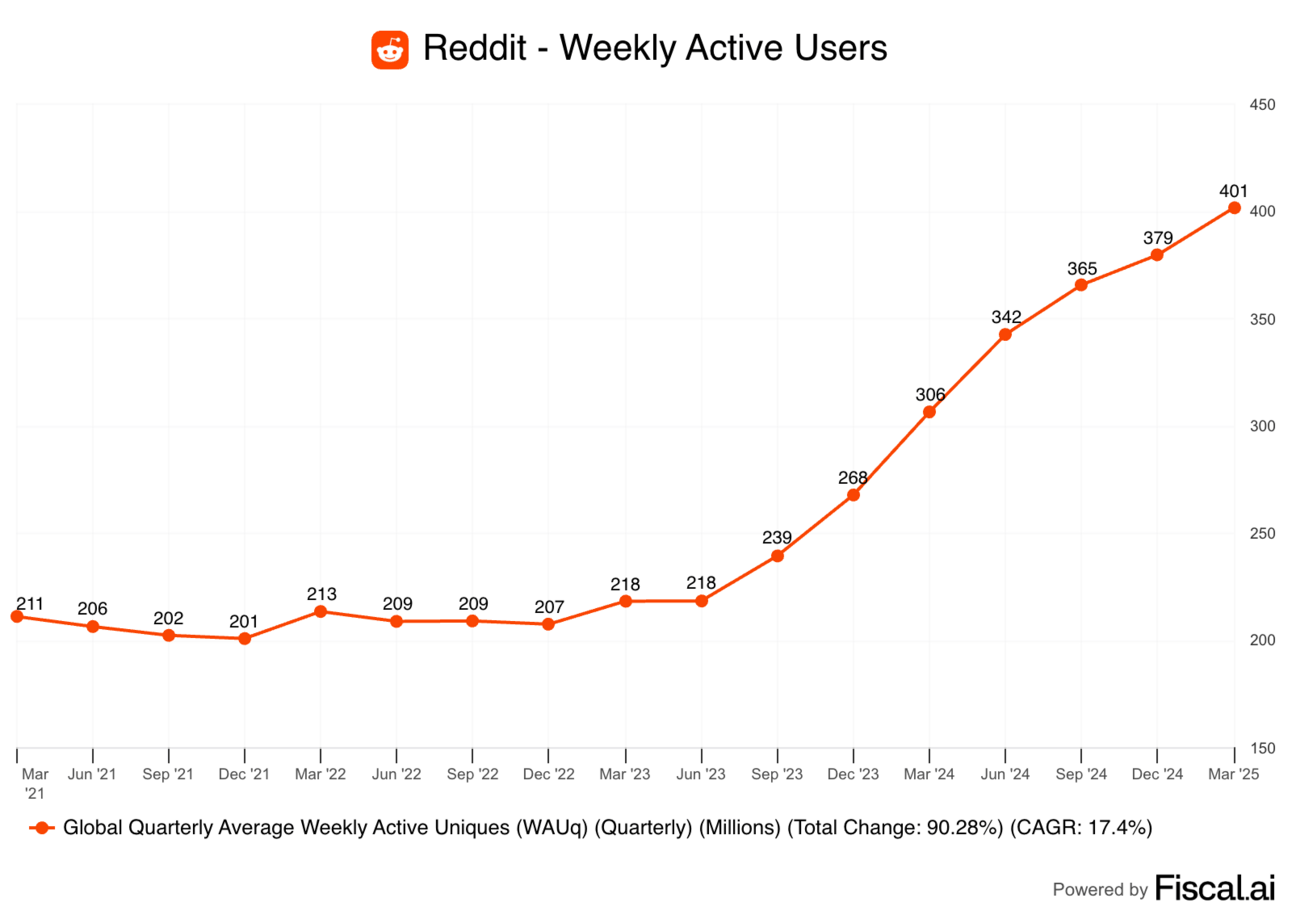

Reddit’s Rapid User Growth

Meme of the Week

Mark Zuckerberg went from Mr Steal Your Data to Mr Steal Your Girl to Mr Steal Your AI Researcher in the span of 3 years

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA)

7:21 PM • Jun 30, 2025

Over the last couple of weeks, Meta has reportedly been poaching employees from other AI companies by offering significant signing bonuses.

On a podcast this week, OpenAI CEO Sam Altman stated “They (Meta) started making giant offers to a lot of people on our team… You know, like $100 million signing bonuses, more than that (in) compensation per year."