- Fiscal.ai

- Posts

- 🗞 Q3 Fallen Angels

🗞 Q3 Fallen Angels

These 4 quality companies are all trading at their cheapest valuations in years!

Happy Sunday! 👋

This week we’re taking a look at 4 high growth companies that are now trading at their cheapest valuations in years.

Let’s dive in!

Featured Story

Q3 Fallen Angels

Every quarter, a few great companies report disappointing earnings (or guidance), and before you know it, they’ve gone from market darling to fallen angel in the span of a few months.

This quarter was no exception.

Several high growth companies have seen their shares plummet over the last month and are now trading at their cheapest valuations in years.

Here are 4 of them:

Monday.com has been one of the most impressive SaaS companies of the last 5 years.

Their WorkOS Software has been so effective at helping teams streamline efficiency that many of their enterprise customers have begun adopting it across several different parts of their organization.

Their combination of new customer growth and increasing spend from existing customers has helped Monday.com deliver an annual revenue growth rate of ~52% over the last 5 years while gradually improving profit margins.

This quarter, Monday.com beat both revenue and EPS estimates, but came in below analyst’s expectations for guidance.

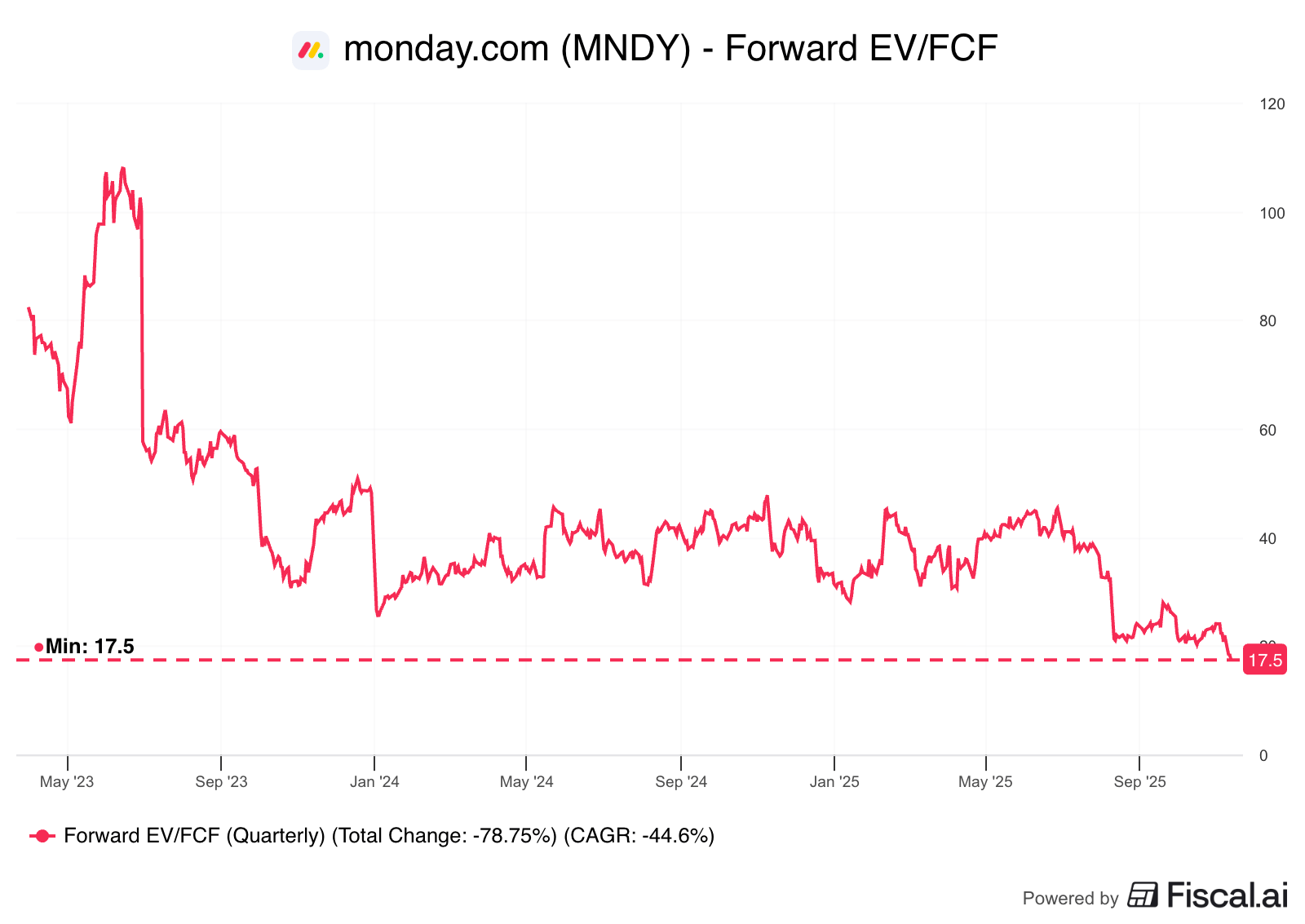

The stock dropped 15% following the report and is now down 40% over the last 12 months. With investors also worried about AI disruption, the company is now trading at its cheapest forward valuation as a public company.

Forward EV/FCF: 17.5x

It wasn’t that long ago that The Trade Desk was considered a darling among growth-focused investors. They were seen as the leading independent demand-side advertising platform, a champion of the open internet, and a compelling alternative to the “walled gardens” like Facebook, Google, and Amazon.

The numbers backed it up too. From 2014 to 2024, The Trade Desk increased its revenue from $45 million to $2.4 billion (a 49% CAGR), making them one of the fastest growing companies in the entire advertising industry.

However, this quarter, the narrative surrounding the company has changed drastically. The sudden departure of their CFO and worse than anticipated revenue guidance for the 4th quarter, has left investors questioning The Trade Desk’s competitive position.

The stock is now down 67% over the last 12 months and they are trading at their cheapest valuation in nearly a decade.

Forward EV/FCF: 19.6x

Duolingo has been the fastest growing language learning app in the world over the last 5 years.

Since 2019, they’ve increased their monthly active users from 26 million to 135 million, a nearly 5x increase. On top of the strong user growth, they’ve also more than doubled their subscriber conversion rate (Paying Subscribers/MAUs) from 3.3% to 8.5%.

This impressive growth (and improving profit margins) has earned Duolingo a premium valuation since going public.

However, amidst concerns over AI-powered competition like Apple’s AirPods automated language translation feature, and slowing user growth for Duolingo, their stock is now down 43% over the last 12 months and trading at their cheapest valuation since going public.

Forward EV/FCF: 17.3x

Constellation Software is one of the best performing stocks of the last 20 years.

To put exact numbers on it, $10,000 invested in Constellation Software’s 2006 IPO would be worth $2.5 million today!

Under the leadership of Mark Leonard, the Canadian conglomerate has built an impressive playbook for acquiring small to mid-sized vertical market software companies at compelling prices.

This playbook has enabled Constellation to grow its revenue at ~24% per year for more than 20 years, and its Free Cash Flow per Share (a more important metric for a serial acquirer) at 27% annually.

Naturally, this track record of success had earned Constellation a premium valuation. In fact, over the last 5 years, Constellation traded at an average Forward EV/FCF of ~25x.

But in September of this year, Mark Leonard announced that he would be stepping down from his role as President due to health reasons. This caused an initial drop in the stock, and mounting worries of AI disruption has created added pressure.

As of this Friday, the stock is now in its largest drawdown ever: -35.5% from highs.

While not at its cheapest valuation ever, Constellation is now trading well below its average multiple from the last decade.

Forward EV/FCF: 18.8x

That’s all for this week!

As always, if we missed any fallen angels that you think belong on this list, please respond to this email and let us know!

You can find more stocks like these by using the Fiscal.ai Screener and using the “YTD Performance” metric.