- Fiscal.ai

- Posts

- 🗞 "Pricing Power is the Hallmark of a Great Business"

🗞 "Pricing Power is the Hallmark of a Great Business"

These 10 companies have real pricing power. Plus, an inside look at On Running's latest quarter.

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

💰️ 10 Companies with True Pricing Power

👟 On Running - When Great Isn't Good Enough

Let’s dive in!

Featured Story

10 Companies with True Pricing Power

Legendary investor Dev Kantesaria once said “Pricing power is the hallmark of a great business. If you can raise your prices above the rate of inflation consistently, you have a phenomenal business model.”

But the pool of companies that truly fit that criteria is quite small. To be able to consistently raise prices over a long period of time, a business typically has to be either a monopoly or duopoly in its industry (there are some exceptions).

Here are 10 businesses that fit that criteria:

Financial services giant American Express has built a reputation of prestige over several decades. Because of that “prestige”, people are willing to pay increasing amounts to be an American Express cardholder.

The average fee per card now stands at ~$117 per year, and has grown at nearly 13% annually since 2019.

10-year Total Return: 392%

If a company issuing debt chose to use a rating service other than Moody's or S&P Global, they'd likely have to pay 30 or 50 basis points more in interest rates.

Thanks to this reputational advantage, Moody's can raise the price of its credit ratings above the rate of inflation each year.

10-year Total Return: 452%

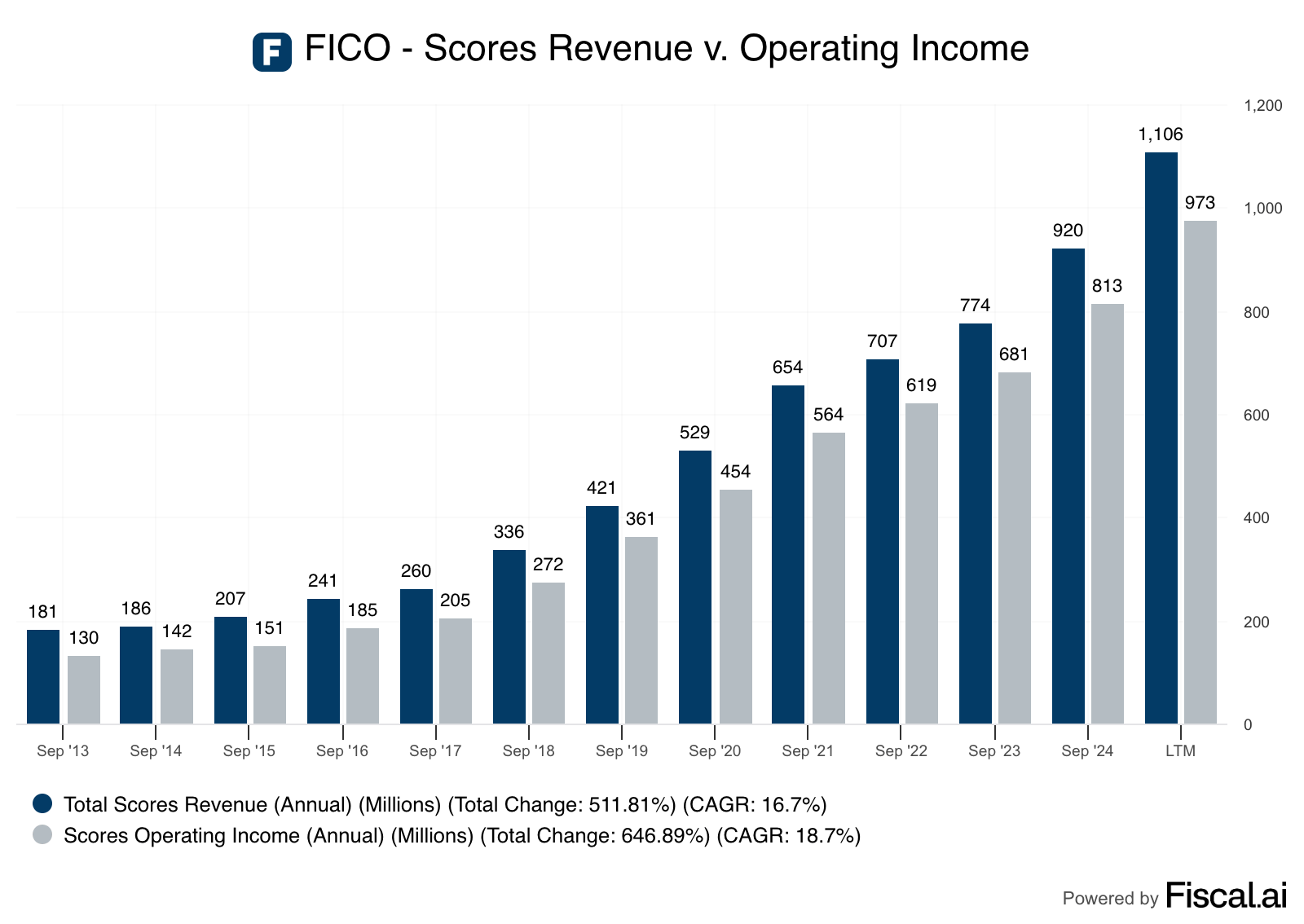

In less than 5 years, FICO has increased the price of a single Score from less than $1 to $4.95.

This new pricing system has helped FICO grow its Scores Operating Income by 21% over the last 5 years.

10-year Total Return: 1,592%

Even if you wanted to buy a new Ferrari (and had the money to do it), you likely could not. Ferrari operates more like an exclusive club than a traditional auto-maker. In order to purchase a new Ferrari, you typically have to be invited.

If you refuse to purchase the new vehicle when the company gives you the opportunity, you might not get another chance. That’s why the average price of a new Ferrari today stands at more than $400,000.

And that figure has grown at ~5% per year since 2012.

10-year Total Return: 911%

It now costs nearly $200 million to buy an EUV machine from ASML on average.

That figure has grown at 13% a year for more than a decade.

10-year Total Return: 814%

Visa has periodically raised its interchange and network fees over the years, helping to gradually improved the card network's take-rate.

For banks offering credit/debit cards to their customers, it’s nearly impossible to circumvent the Visa or Mastercard networks as they are functionally the communication layer between banks globally.

10-year Total Return: 427%

TSMC is the undisputed leader in advanced semiconductor fabrication.

For design firms seeking leading-edge chips, TSMC is the only show in town so they set their price.

Revenue per wafer shipment has grown at 15% annually since 2019.

10-year Total Return: 1,123%

Coca-Cola is pretty much the only company on this list that does not possess the monopoly or duopoly status.

However, the appeal for their product is still as strong as ever, which has allowed Coca-Cola to average just over 4% annual revenue growth from price/mix throughout the last decade.

10-year Total Return: 139%

Like many airport operators, Aeroportuario del Pacífico has a contract with civil aviation authorities that allows them to raise prices each year on flights in and out of their airport locations at a rate slightly higher than inflation.

10-year Total Return: 343%

Through its contract with the Internet Corporation for Assigned Names & Numbers, Verisign can raise prices every year on domain registrations.

In recent years, they've raised the cost of “.com” registrations by 7% annually.

10-year Total Return: 298%

Partner Spotlight: Asymmetric Investing

Most companies would love to report the kind of numbers On Running just reported for the second quarter of 2025. The company’s revenue increased by 38.2% on a constant currency basis, gross margin reached an impressive 61.5%, and operating profit nearly doubled.

For comparison, Nike’s revenue dropped 12% and Deckers Outdoor (which makes Hoka) saw a 17% increase in sales, with a 20% increase in Hoka sales.

On Running is lapping the field!

But On reported a surprise net loss for one simple reason. There was a loss of 139.9 million Swiss francs related to foreign currency changes. In other words, a weak dollar resulted in a huge loss.

I’ll explain what happened below, but this is a look at the important metrics in U.S. dollars, which is the lens through which I’ll discuss most results below. Like I said, they’re impressive.

The On Running Currency Confusion

Every once in a while, you’ll see a strange reaction to a quarter from On because the company reports earnings in Swiss francs and most of their revenue is in U.S. Dollars.

Think of it this way: The Swiss franc is the “lens” with which On reports results. And relatively little of the company’s sales and cash is generated or held in Swiss francs, so currency fluctuations can make that “lens” confusing for investors.

When the dollar is weak, as it is now, it makes sales in the U.S. “look” lower than they would be if the company reported in U.S. dollars.

On also holds U.S. dollars on the balance sheet, and if the dollar falls, it needs to take a loss on the dollars it holds because the balance sheet’s “lens” is in Swiss francs.

For example, if On sold a shoe for $100 on May 25, 2024, it would have been reported as 92 Swiss francs in revenue. The same shoe sold for $100 on May 25, 2024, would be 82 Swiss francs in revenue. It’s a drop in revenue on a reported basis, but constant sales on a constant currency basis.

The same thing would happen to dollars on the balance sheet. $100 in cash on May 2024 would be reported as 92 Swiss francs at that time. If it were held for a year, the value had dropped to 82 Swiss francs, so the balance sheet would be worse from the Swiss franc lens. Here’s the important part: That change in value would be recorded as a 10 Swiss Franc loss on the income statement!

This is technically a “real” loss. But only through the Swiss franc lens. Through a U.S. dollar lens, sales and the balance sheet would look better.

This isn’t right or wrong, it’s a matter of perspective. And sometimes investors don’t understand when a loss isn’t really a loss for On Running.

The Real On Running Story

What’s really going on at On Running?

Let’s not make this complicated. The company is growing in both wholesale and direct-to-consumer, indicating strong growth even in what some companies thought was a weak quarter for consumers.