- Fiscal.ai

- Posts

- 🗞 The 5 Best Earnings Reports This Week

🗞 The 5 Best Earnings Reports This Week

Five outstanding earnings reports from week 1. Plus, a look at the SuperApp dominating Southeast Asia.

Happy Sunday!

Here’s what’s on the docket for this week’s newsletter:

📈 5 Best Earnings Reports Week 1

📱 The SuperApp Dominating Southeast Asia

Let’s dive in!

Featured Story

5 Best Earnings Reports Week 1

Medpace is a full-service contract research organization (CRO) in the biotech space. In other words, they help biopharmaceutical companies develop drugs by managing their clinical trials.

For those who haven’t kept up, the biotech industry broadly has been in a cyclical downturn over the last couple of years following the spike in interest rates. This has led to sell-offs in the stock prices of most companies in the industry, including Medpace.

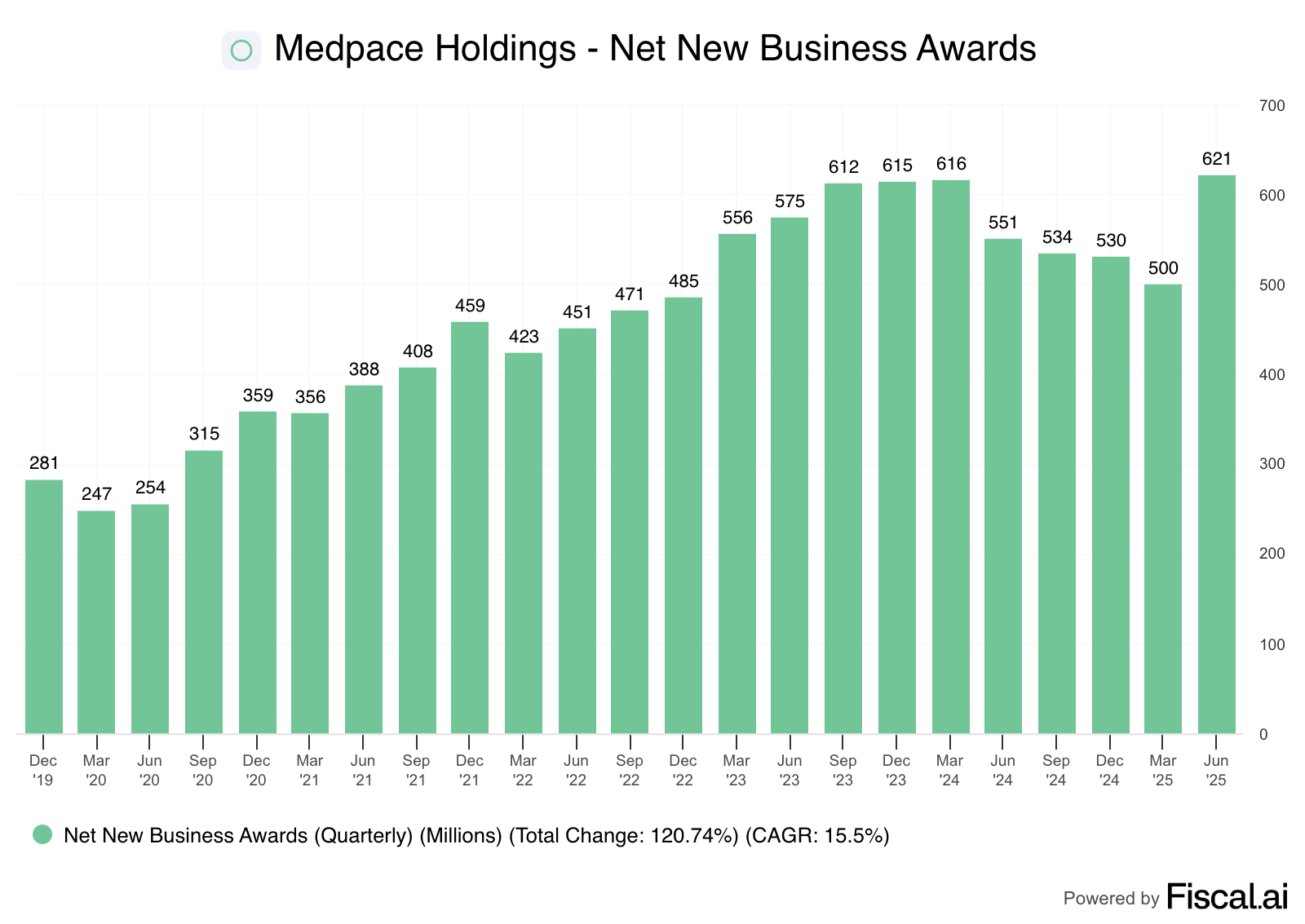

However, on Monday, Medpace surprised investors. After four quarters in a row of declines in their “Net New Business Awards” (aka Backlog), Medpace grew the figure by $121 million, up 24% compared to a quarter ago.

5-Day Return: +38.5%

While uncertainty around Alphabet’s core Search business remains, the tech giant continues to put up impressive numbers across the board. Here’s the revenue growth by segment:

Search: $54.2 billion, up 12%

YouTube Ads: $9.8 billion, up 13%

Network: $7.4 billion, down 1%

Subscriptions, Platforms, & Devices: $11.2 billion, up 20%

Google Cloud: $13.6 billion, up 32%

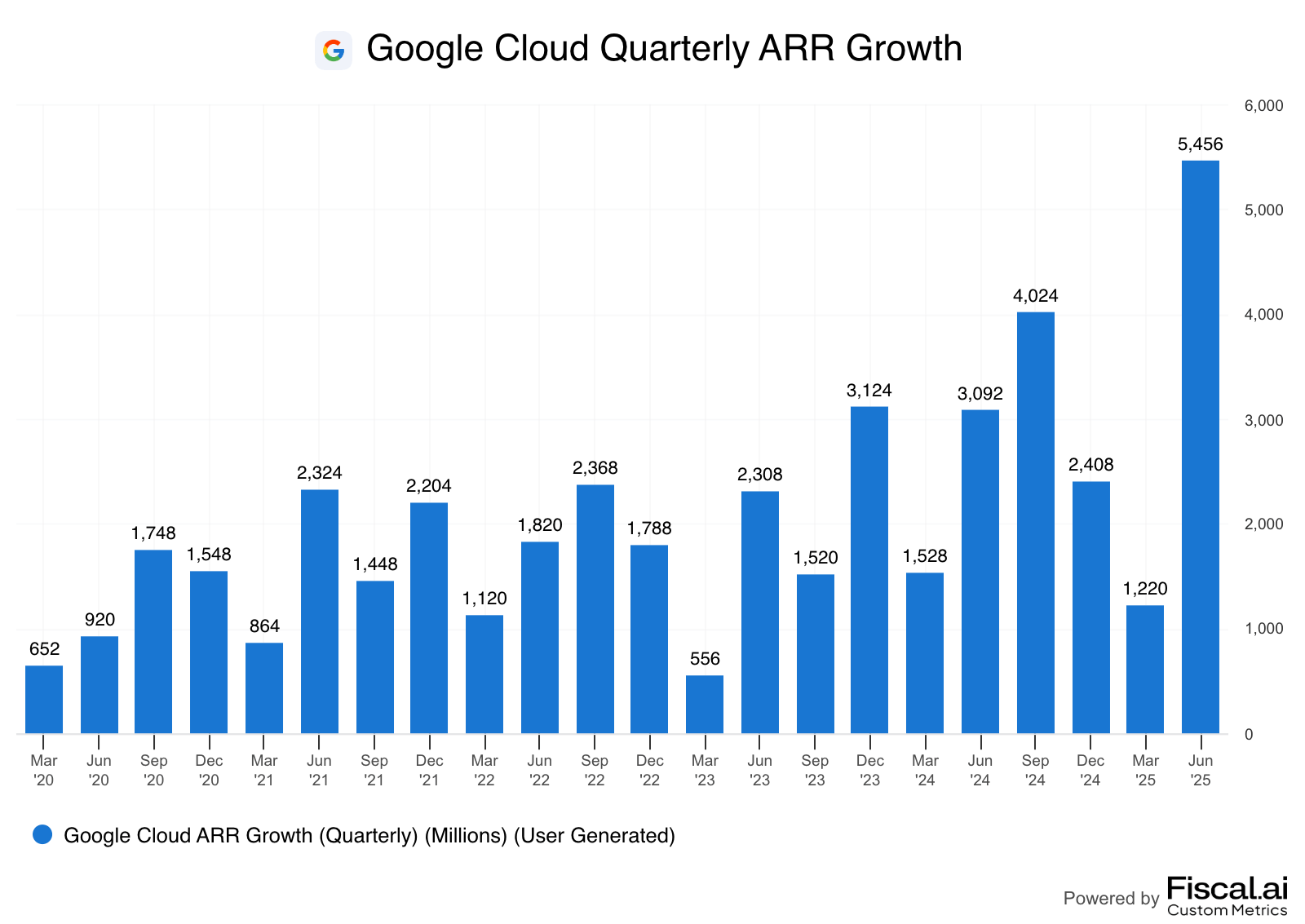

Google Cloud in particular saw strong growth during the quarter. Long considered a distant 3rd in the “Hyperscaler Race” behind Azure and AWS, Google Cloud is beginning to look far more competitive in the world of AI. This quarter, they grew their total ARR by $5.5 billion, marking their largest quarterly growth ever… and by a long shot. According to CEO Sundar Pichai “nearly all GenAI unicorns use Google Cloud.”

5-Day Return: +3.84%

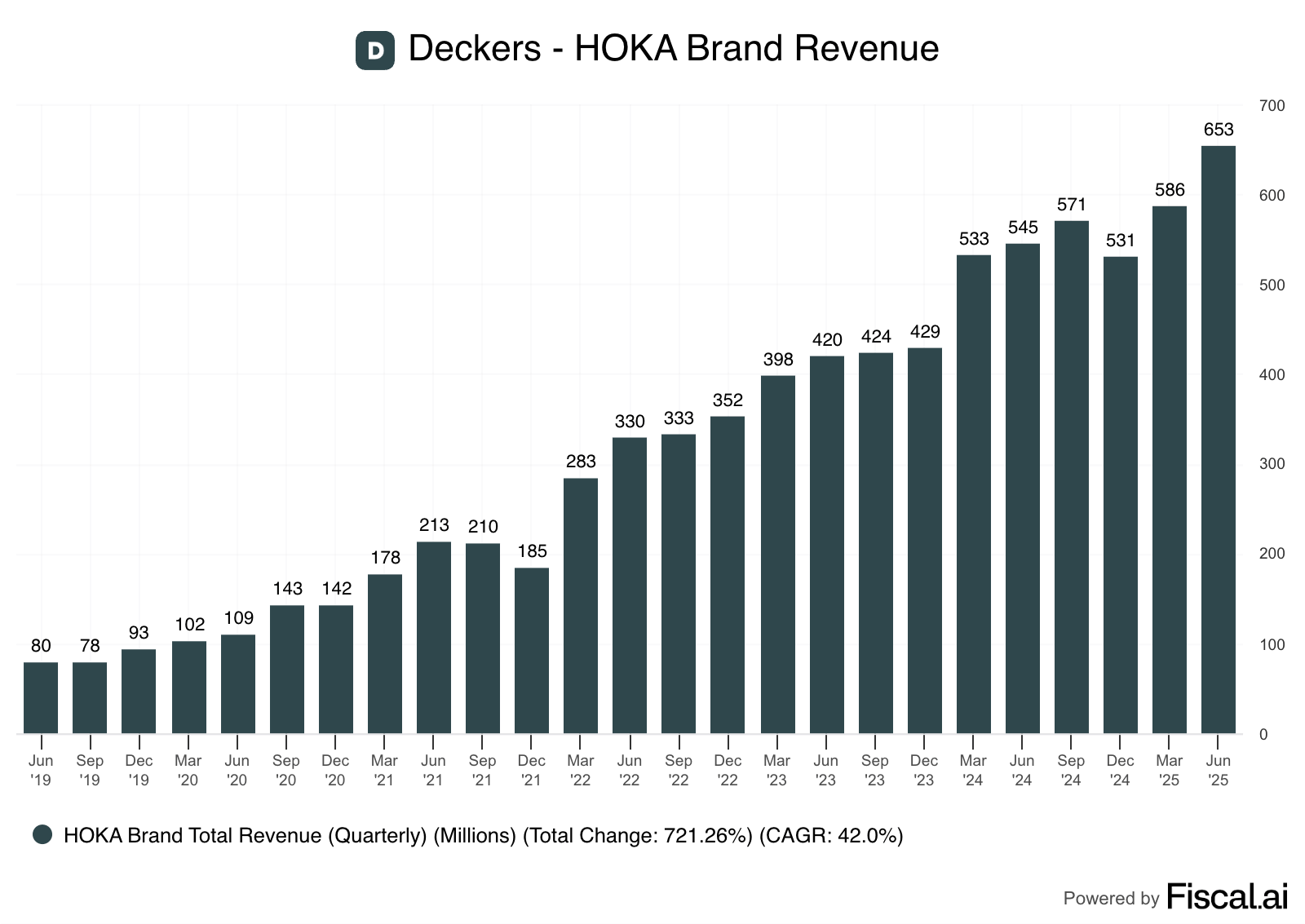

Deckers is one of the largest footwear companies in the world. Home to big-name brands like Ugg, Teva, and most notably HOKA, Deckers’ footwear portfolio now generates more than $5 billion in annual revenue, up more than 3x since 2019.

Coming into the quarter, HOKA (Deckers’ largest division) was experiencing slowing growth and witnessing choppiness from the consumer environment in the U.S. specifically. However, this quarter, Deckers saw a huge re-acceleration in HOKA revenue, jumping 20% compared to a year ago.

Here’s what management had to say: “The strength of our business continues to be driven by the remarkable growth in our international markets with HOKA and UGG both contributing to Deckers 50% increase in international revenue.”

5-Day Return: +15.2%

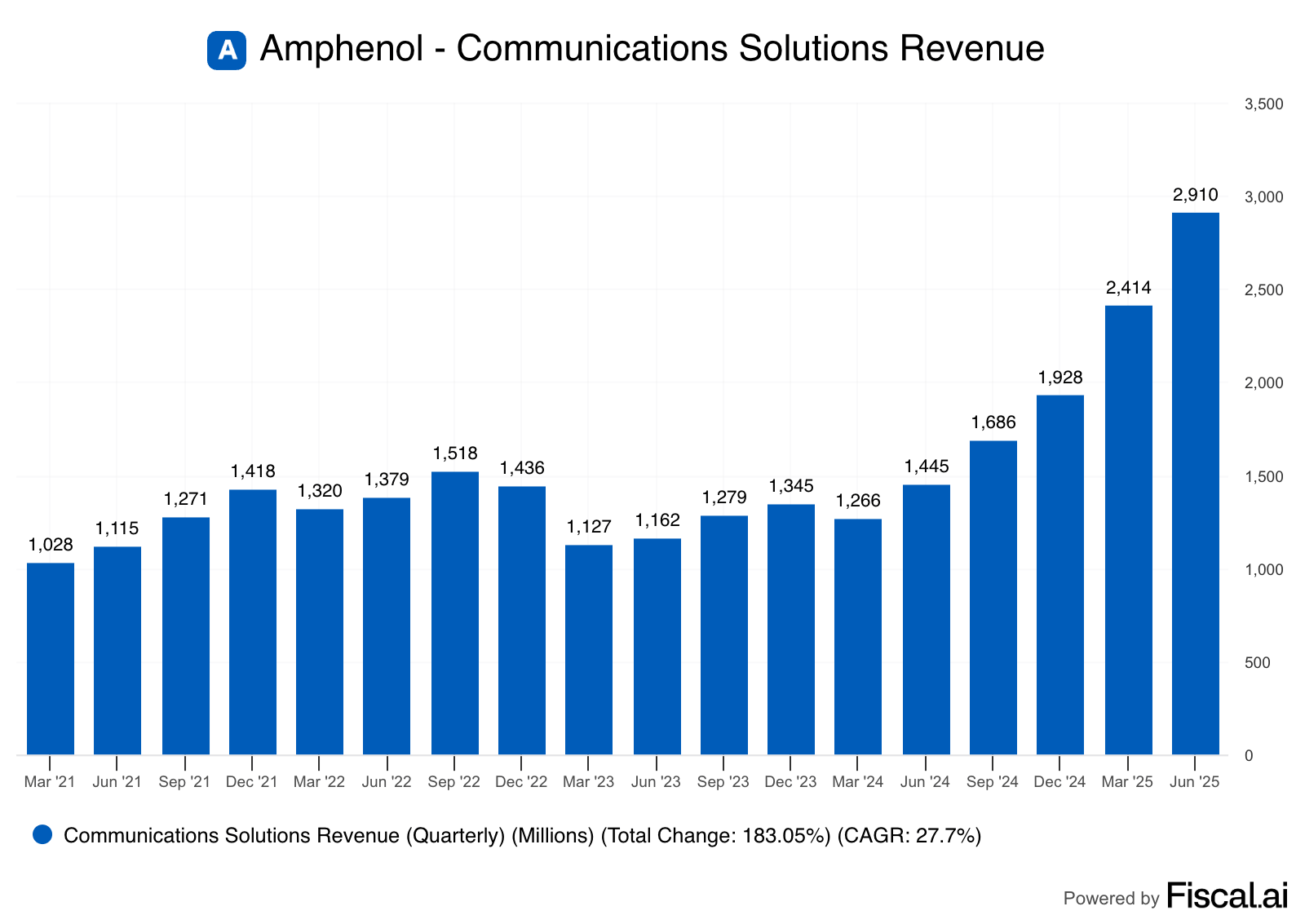

Amphenol is one of the largest hidden beneficiaries of the recent AI/Data Center spending boom. As a leading provider of products like point-to-point cables, power distributors, and sensors, Amphenol is selling hundreds of critical components to communications businesses like data centers.

This quarter specifically, Amphenol generated $2.9 billion in revenue from its Communications Solutions division, up 101% compared to a year ago. Not a bad growth rate for a company that’s almost 100 years old.

While many investors are understandably worried that AI-related spending could be elevated and this growth rate might slow in the future, Amphenol’s CEO Richard Norwitt made it clear that he doesn’t share that view: “the demand that we see across our markets appears to be strengthening.”

5-Day Return: +2.05%

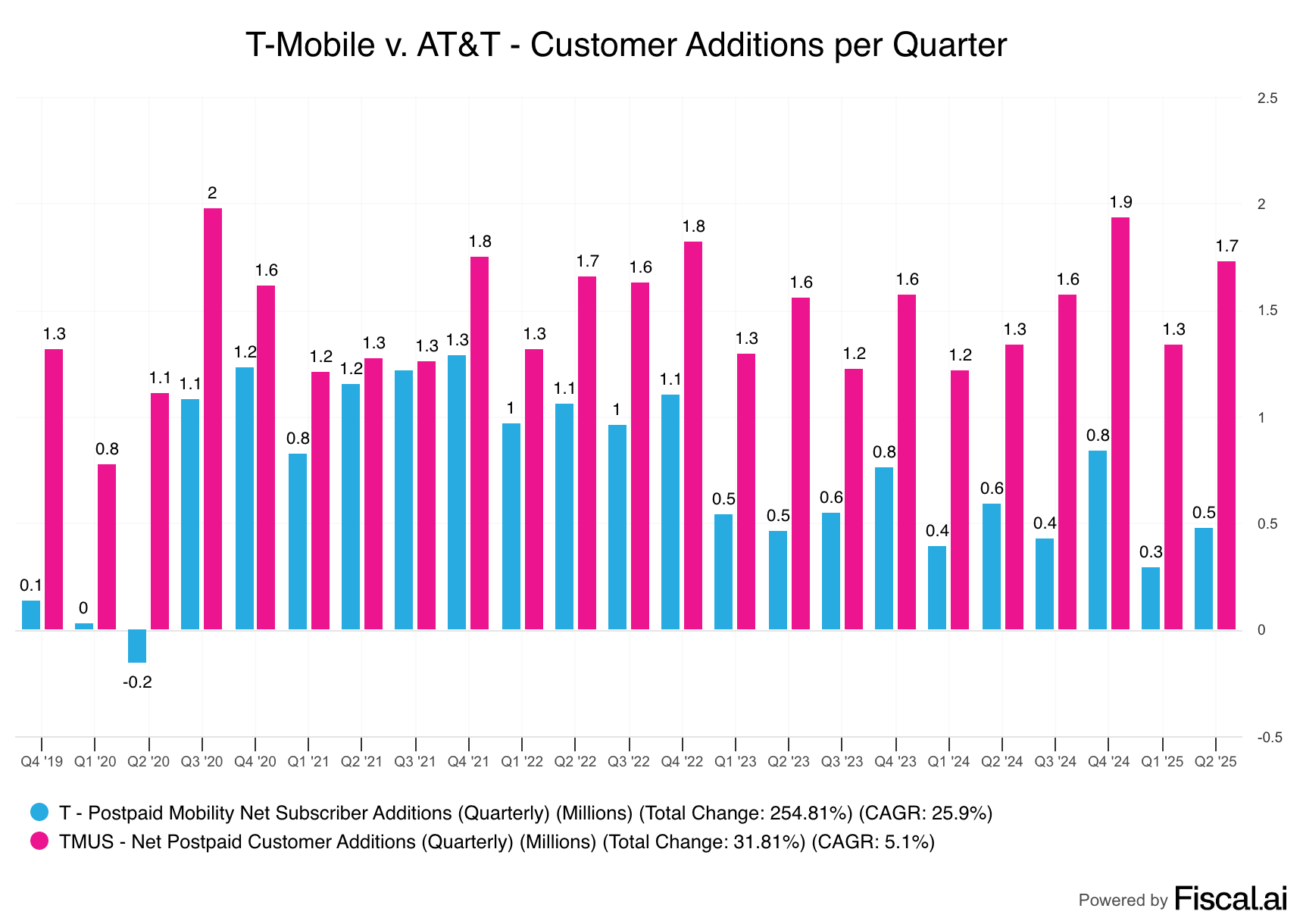

Telecom giant T-Mobile has been on an impressive run.

After finally acquiring Sprint in 2020, T-Mobile has been a major market share taker across the cellular industry. To put some specific numbers on it, T-Mobile has added more new customers than AT&T (its largest competitor) in 23 consecutive quarters.

T-Mobile’s CEO Mike Sievert expressed his optimism about the business on this quarter’s conference call: “This team right here did it again, delivering the consistent, differentiated profitable growth that we are known for. We led the industry in both customer growth and in financial growth across multiple metrics. And more importantly, we smashed our own records.”

5-Day Return: +6.8%

Partner Spotlight: Chit Chat Stocks

Grab was conceived as an idea in 2012 by Anthony Tan and Tan Hooi Ling for a startup competition at Harvard Business School. Anthony Tan — who is the youngest of three sons in one of Malaysia’s wealthiest families — and Tan Hooi Ling came up with the idea (then known as MyTeksi) to solve a core problem: Improve passenger safety of the taxi system in Southeast Asia.

MyTeksi was a mobile app with GPS enhancements that connected passengers with nearby taxis. By having the trip tracked by GPS, riders felt safer and more willing to take taxi rides. The concept won first runner up in the Harvard Business School startup competition, which provided them $25k as seed funding to help jumpstart the business.

What does the business look like today?

While MyTeksi (now Grab) started with the singular focus of improving taxi ride safety, they’ve continuously evolved the product over the years to meet more of customers’ needs.

Today, you can think of Grab as a combination of Uber, DoorDash, and even PayPal, in a single app.

Mobility:

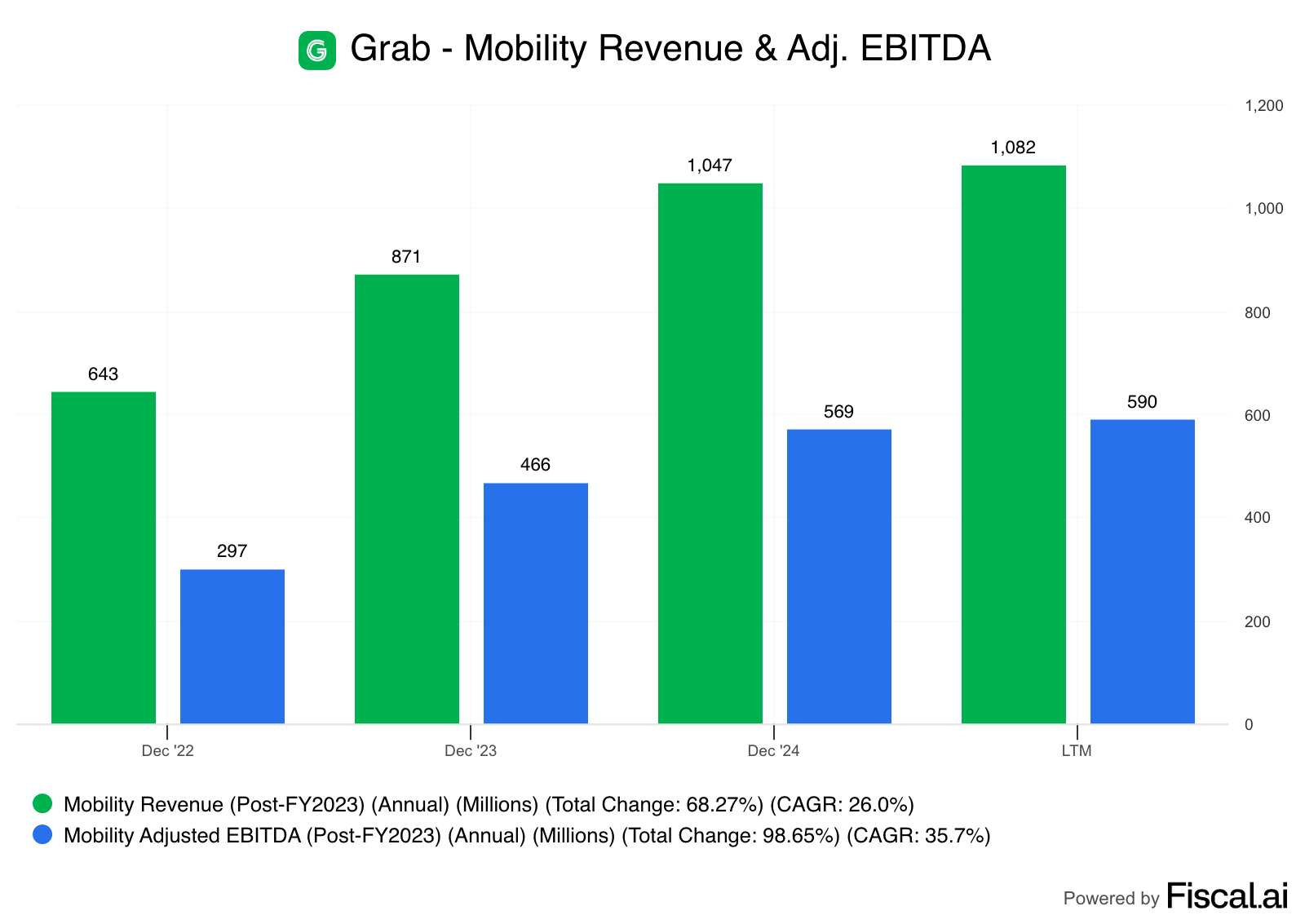

Grab’s Mobility segment is its largest contributor to earnings and is very comparable to Uber in how the app functions.

There’s a massive supply of drivers in each market (more than 5 million driver-partners in total) and users can select from a variety of on-demand ride types. There’s GrabCar, XL, Premium, GrabTaxi, and even GrabBike which is a very popular mode of transportation in Southeast Asia.

Grab is the clear leader in the mobility space in Southeast Asia. They’ve got 97% market share in Malaysia, 91% in the Philippines, 85% in Thailand, 67% in Vietnam, and the only core market for them where it’s still competitive is Indonesia.

Indonesia is the largest market in Southeast Asia (SEA), as Indonesia has a population of 275 million compared to the ~650 million in all of SEA combined. They split the Indonesian market pretty much 50/50 with Gojek, but rumors are swirling that Grab is looking to acquire them and Grab’s recent raise of $1.2 billion convertible debt does make it appear that they’re pulling together financing for a deal.

To put some numbers on Grab’s Mobility segment, over the last 12 months, Grab has generated ~$1.1B in revenue and about 55% of that revenue flows through to segment-level EBITDA.

Delivery:

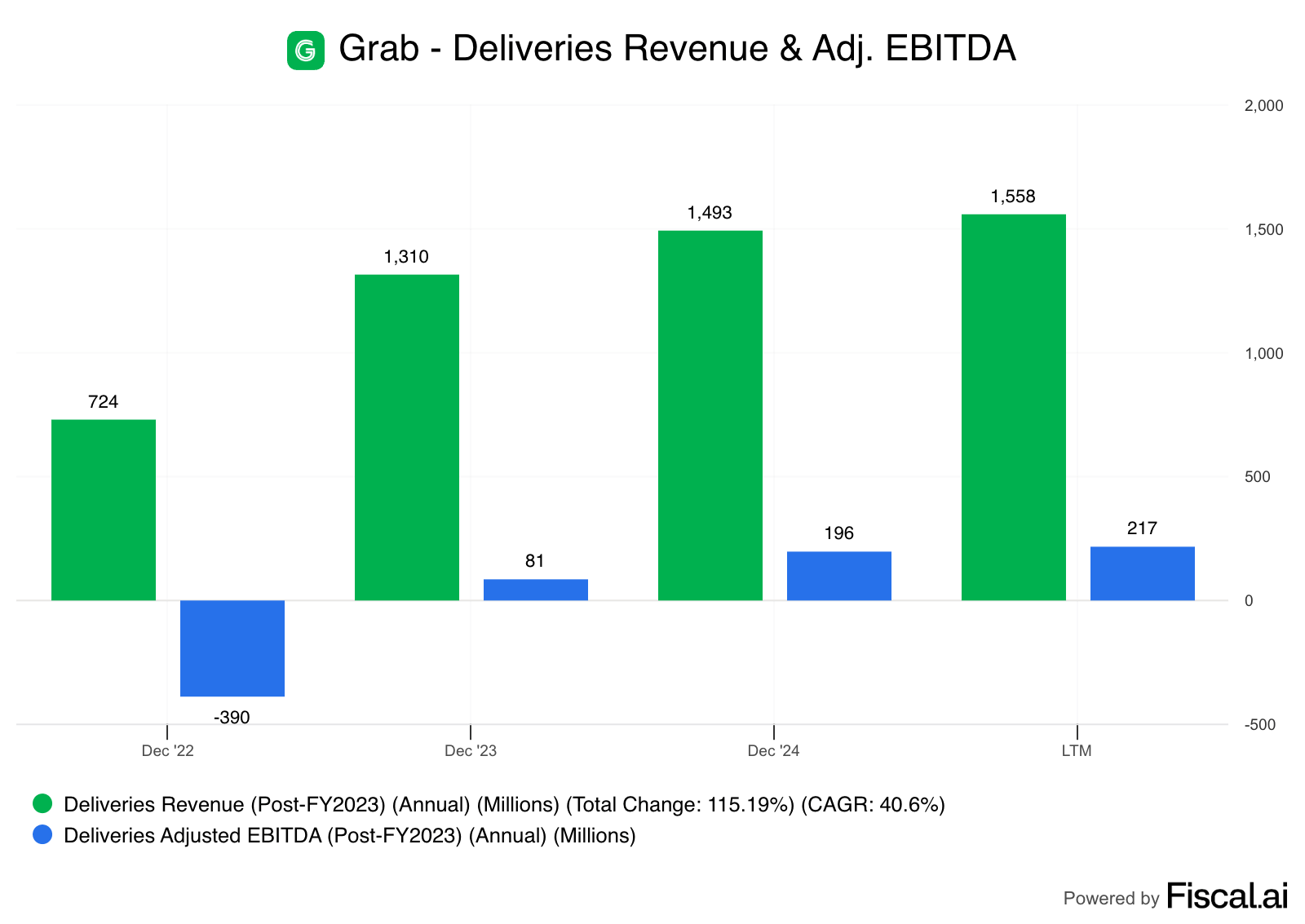

Grab Delivery is sort of a combination of Doordash and Instacart. Users can order food or items from restaurants and grocery stores, and a driver will pick those items up.

The addressable market for delivery is large (it’s bigger than mobility) and Grab is the #1 player in all of their markets, except for Vietnam where it’s a close #2.

Beyond just taking a cut for facilitating these transactions, Grab has become increasingly involved in helping grow the SKU supply for the platform. They help 3rd party merchants with financial services like working capital loans and invoice financing, but they’re also a merchant themselves.

In 2021, Grab acquired Jaya Grocery which was a large supermarket chain in Malaysia and they’ve acquired some smaller chains since to help expand Jaya’s footprint. This helped Grab drastically increase its SKU count on the platform in the early days, which kickstarted the network effect that Grab now experiences in its Delivery business.

Today, Delivery is Grab’s largest business line by revenue and they’ve also turned the corner to segment-level profitability. In 2022, they had -54% EBITDA margins and today it stands at 14%.

Long term, management expects to convert 4% of their Gross Merchandise Volume to EBITDA from this division.