- Fiscal.ai

- Posts

- 🗞 AI Loser to AI Leader: Google's 6-Month Transformation

🗞 AI Loser to AI Leader: Google's 6-Month Transformation

Here's how Google became know as the "AI Leader"

Happy Sunday! 👋

This week we’re taking a look at Google’s transformation from “AI Loser” to “AI Leader” 📈

Let’s dive in!

Featured Story

AI Loser to AI Leader

This week, shares of Alphabet jumped as much as 6% after the release of their latest AI model, Gemini 3.

Google DeepMind CEO Demis Hassabis had this to say:

“We’re taking another big step on the path toward AGI… It’s the best model in the world for multimodal understanding and our most powerful agentic and vibe coding model yet.”

While Google is now seen by most as a leader in artificial intelligence, that hasn’t been the narrative for long.

On April 8th, shares of Google closed at $144.70, bringing their YTD performance to -23%.

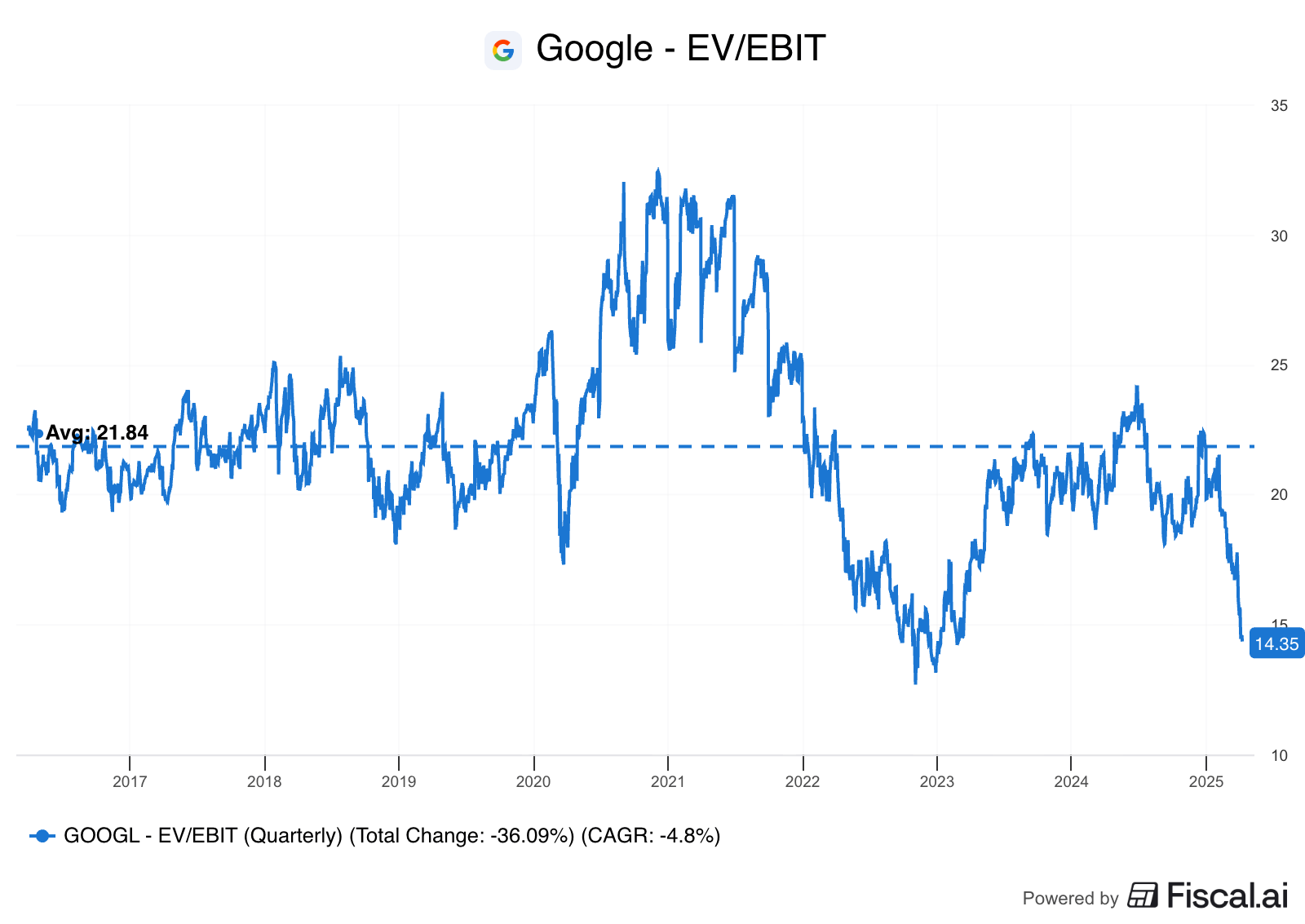

This put Google near its lowest valuation in a decade.

It’s hard to fault investors for being pessimistic.

At the time, conversational AI was calling into question Google’s core Search business.

ChatGPT was the dominant model in terms of consumer usage.

Apple’s Senior VP of Services said traditional search volume was declining on mobile for the first time ever.

Google’s Paid Clicks were growing at their slowest rate on record.

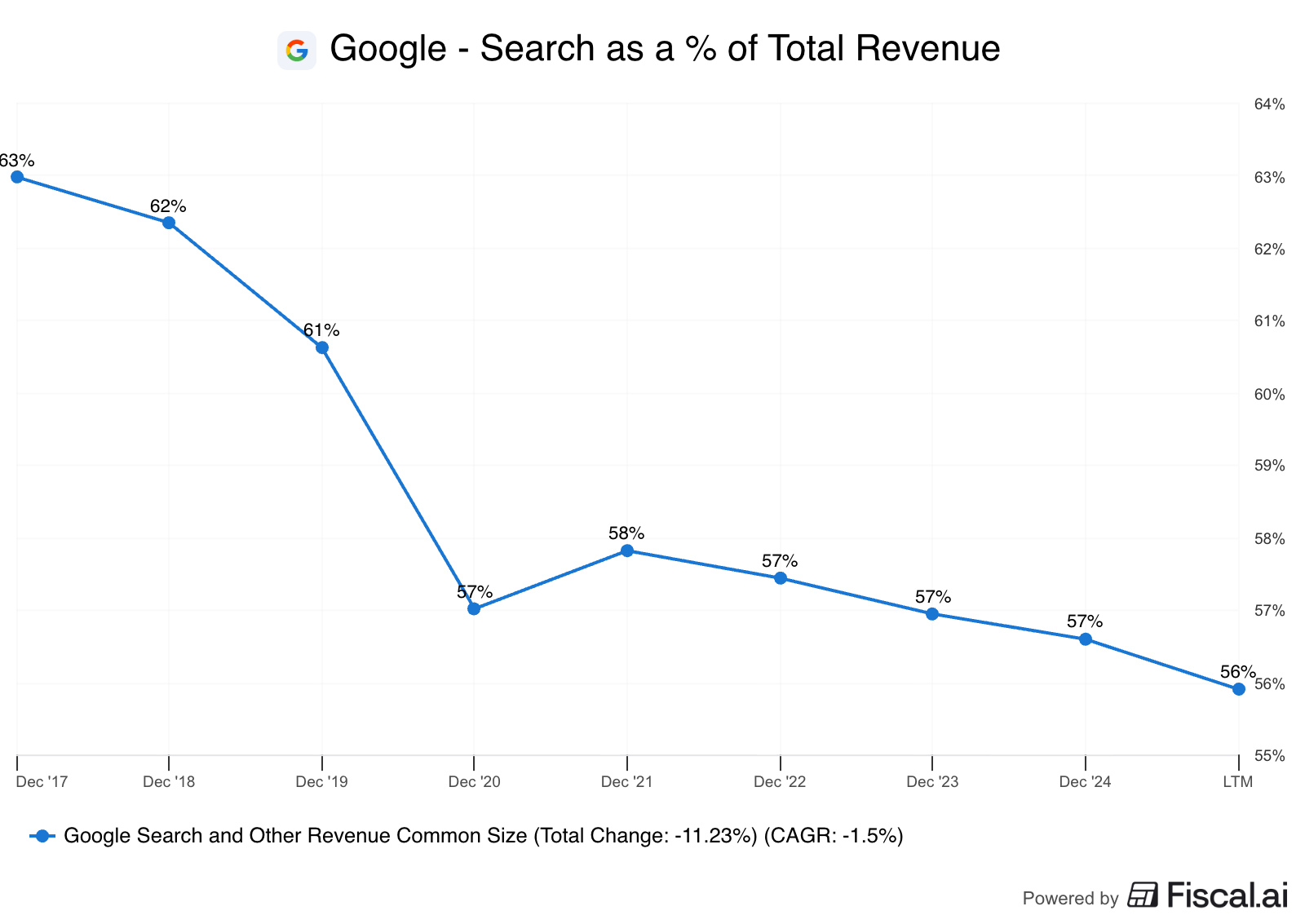

And while Alphabet had successfully scaled several other businesses under their umbrella, Search was still the company’s cash cow:

But while investors worried about their staying power, years of behind-the-scenes engineering efforts at Google were about to take center stage.

In June, Google made its Gemini 2.5 model available to the public. This model was unique in that it could reason through multiple steps and hypotheses before generating a final answer, greatly enhancing its problem-solving and coding capabilities. Quality-wise, this finally put Google on a level playing field with OpenAI.

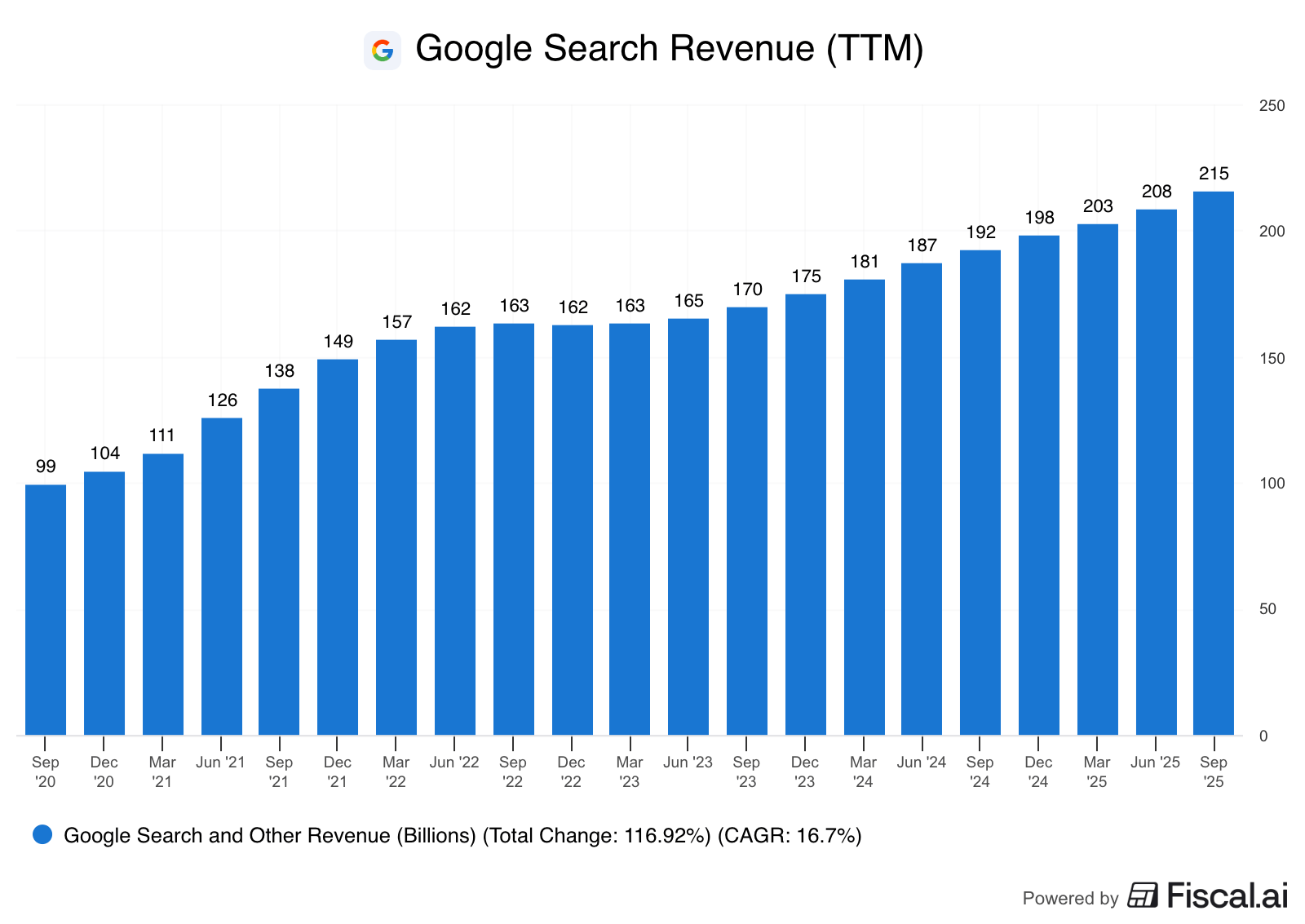

But the second (and perhaps more important part) of the Gemini 2.5 launch was the implementation and distribution. Google began answering more traditional search queries with Gemini, which not only built brand recognition and trust, but had a surprising impact on consumer Search habits as well.

Here’s what Sundar Pichai had to say on the Q2 conference call in July:

This resurgence in search volume helped reaccelerate Google’s growth in paid clicks and quell investor concerns about the resilience of its Search business.

Then suddenly, in the span of just a few months, the narrative on Google began to turn.

While it’s difficult to pin down exact dates, at some point it appears the market came to the realization that Google is essentially the only vertically integrated company in the AI space.

Aside from semiconductor fabrication (TSMC’s business), Google operates in virtually every layer of the AI value chain.

Hardware Layer: Google designs its own custom silicon known as Tensor Processing Units (TPUs) which are highly specialized for AI workloads. Not only do they use these for their own models, but they now even sell TPUs to other companies.

Infrastructure Layer: Google Cloud Platform provides the computing power, storage, and networking needed to train and run large-scale models.

Data Layer: Google consumes perhaps more consumer data than any other company in the world through its services like Search, YouTube, Android, Gmail, etc. Google can use this to train and refine their own models.

Foundational Layer: Google Research and DeepMind develop the actual foundational models like Gemini.

Distribution Layer: Google can deploy their AI capabilities into their own consumer applications like Search, Photos, Maps, Gmail, etc, which reach billions of people every day.

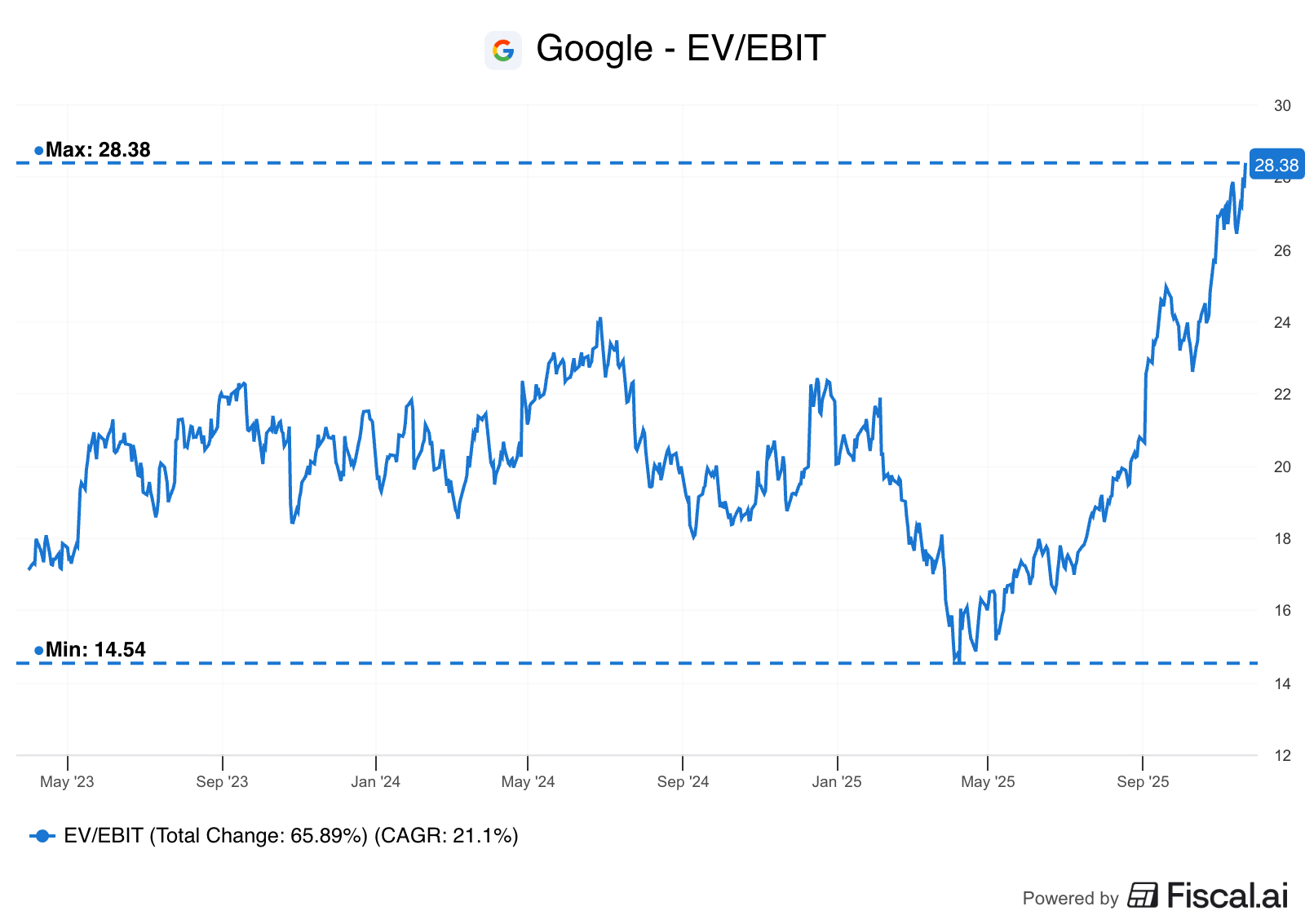

Shares of Google are now up 102% since the April 8th lows, thanks primarily to multiple expansion. Suffice to say, investors have come to realize Google’s unique position in the AI world.

Google’s Enterprise Value to EBIT multiple has nearly doubled over the last 7 months.