- Fiscal.ai

- Posts

- 🗞 6 Quality Companies At Record-Low Valuations

🗞 6 Quality Companies At Record-Low Valuations

We found 6 high quality businesses trading at their lowest valuations ever.

Happy Sunday! 👋

This week we’re taking a look at 6 quality companies that just hit their lowest valuations ever.

Let’s dive in!

Platform Update

Before we get into this week’s content, just want to let y’all know that the Fiscal.ai Black Friday Sale is currently live!

The Fiscal Team has worked tirelessly this year to build the complete stock research terminal for fundamental investors, and to off 2025, we’re offering our largest discount ever: 30% off all paid plans!

Featured Story

6 Quality Companies At Record-Low Valuations

“Quality” is subjective.

Some investors define quality based on ROIC (Return on Invested Capital) hurdles, but that can fail to encapsulate companies that prioritize growth investments in lieu of near-term profits.

Some investors define quality based on revenue growth, but that can capture unsustainable growers.

There isn’t a precise definition.

Today’s list is a mix of companies with varying growth rates and profit margins, but all possess two commonalities.

They’ve grown revenue and profit margins over time.

They’re trading at or near their lowest valuations ever.

Let’s take a look at 6 of them:

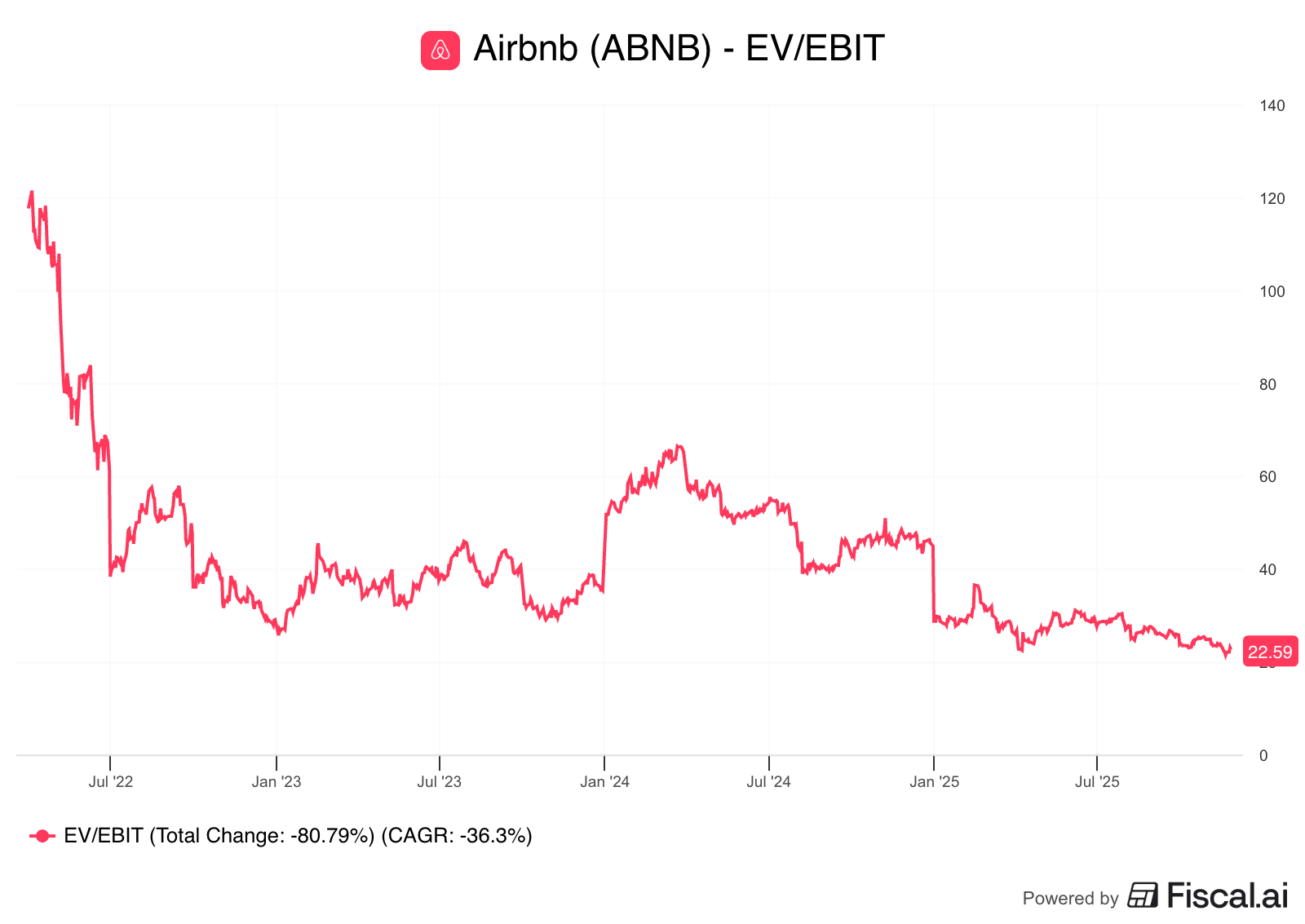

Airbnb is a leading online marketplace for alternative accommodations.

Since their founding in 2008, Airbnb has uprooted the traditional accommodations industry by empowering anyone to become a host.

Today, Airbnb delivers $89 billion in annual booking volume, which is up 997% since 2015.

EV/EBIT: 22x

Revenue CAGR since IPO: +22%

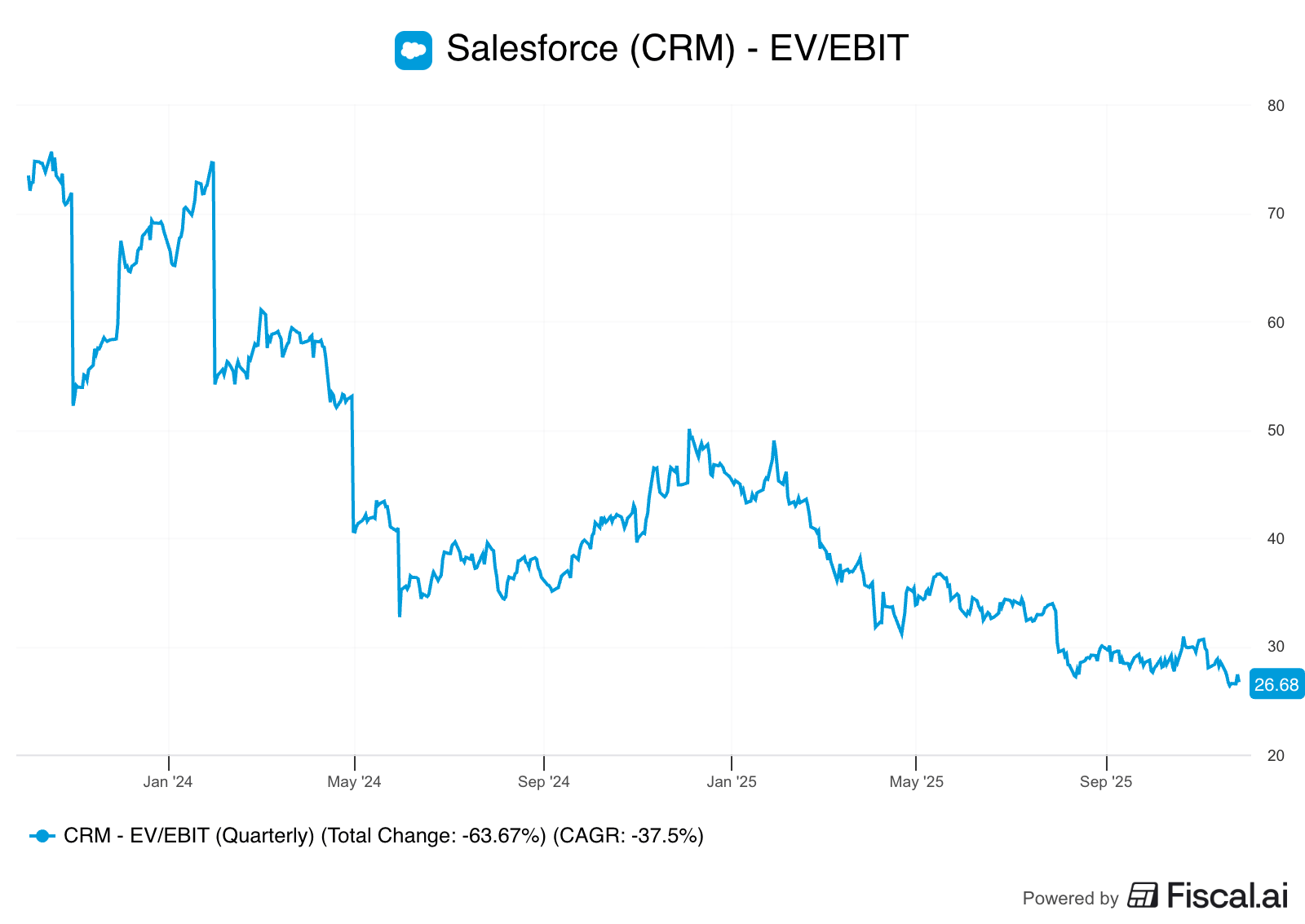

Salesforce is widely considered a pioneer of the software-as-a-service industry.

Founded in 1999, they were one of the first companies ever to deliver enterprise software entirely through the cloud via a subscription model.

This allowed them to scale quickly and reinvest heavily into their CRM (customer relationship management) platform. Today, Salesforce generates nearly $40 billion in annual revenue, which is up more than 100-fold over the last 20 years.

EV/EBIT: 26.7x

10yr Revenue CAGR: +23.1%

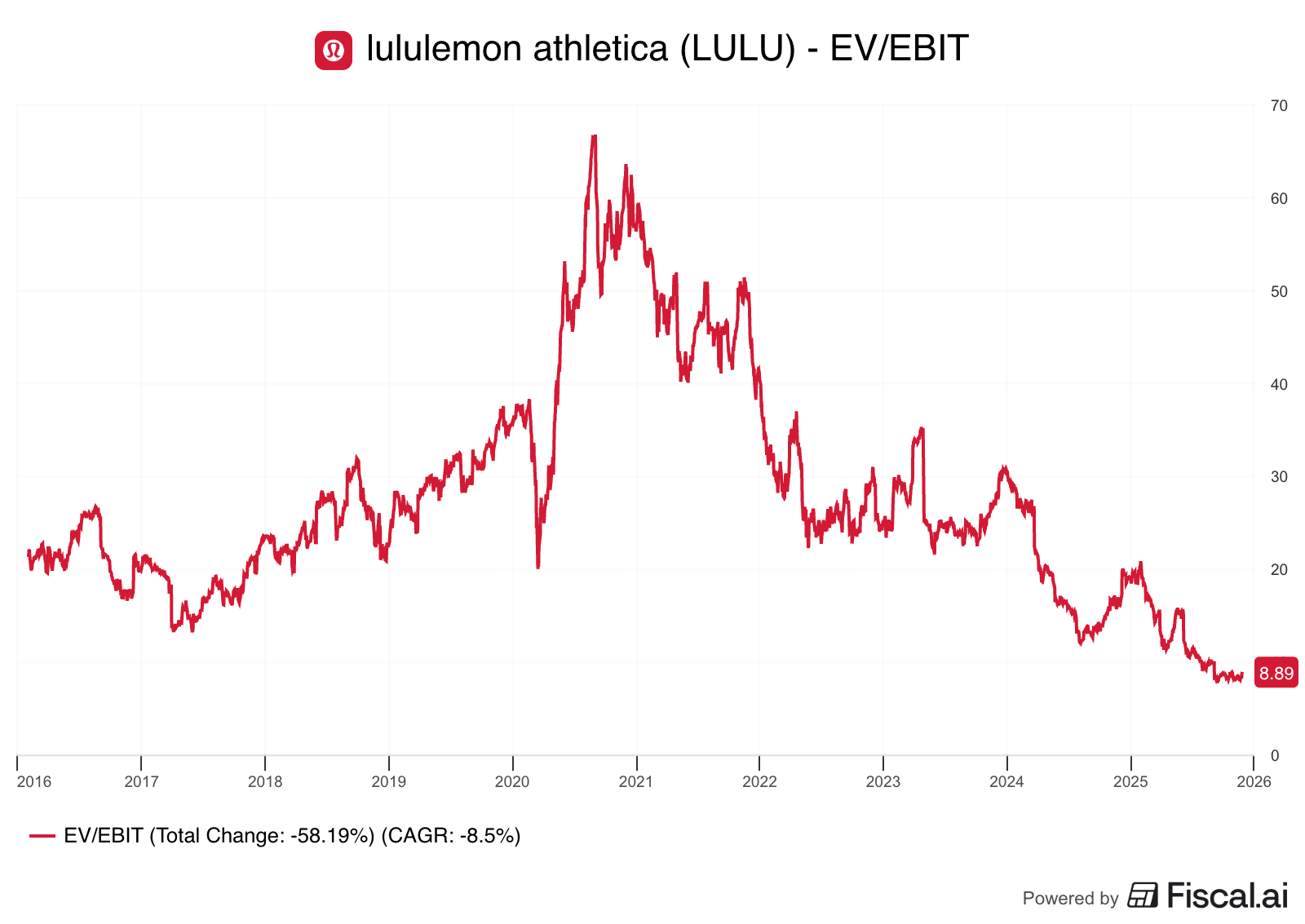

Early on, Lululemon’s merchandise was popularized by yoga goers, but quickly developed into mainstream wear as the trend of “athleisure” grew.

Over the last 2 decades, Lululemon has preserved its premium lifestyle brand by maintaining a direct-to-consumer business model. The vast majority of their sales come through either the Lululemon website or their owned stores.

Protecting their brand integrity has helped Lululemon sustain strong revenue growth in the hyper-competitive apparel industry. Since their 2007 IPO, Lululemon’s revenue has grown from $270 million to $10.9 billion.

EV/EBIT: 8.9x

10yr Revenue CAGR: +18.7%

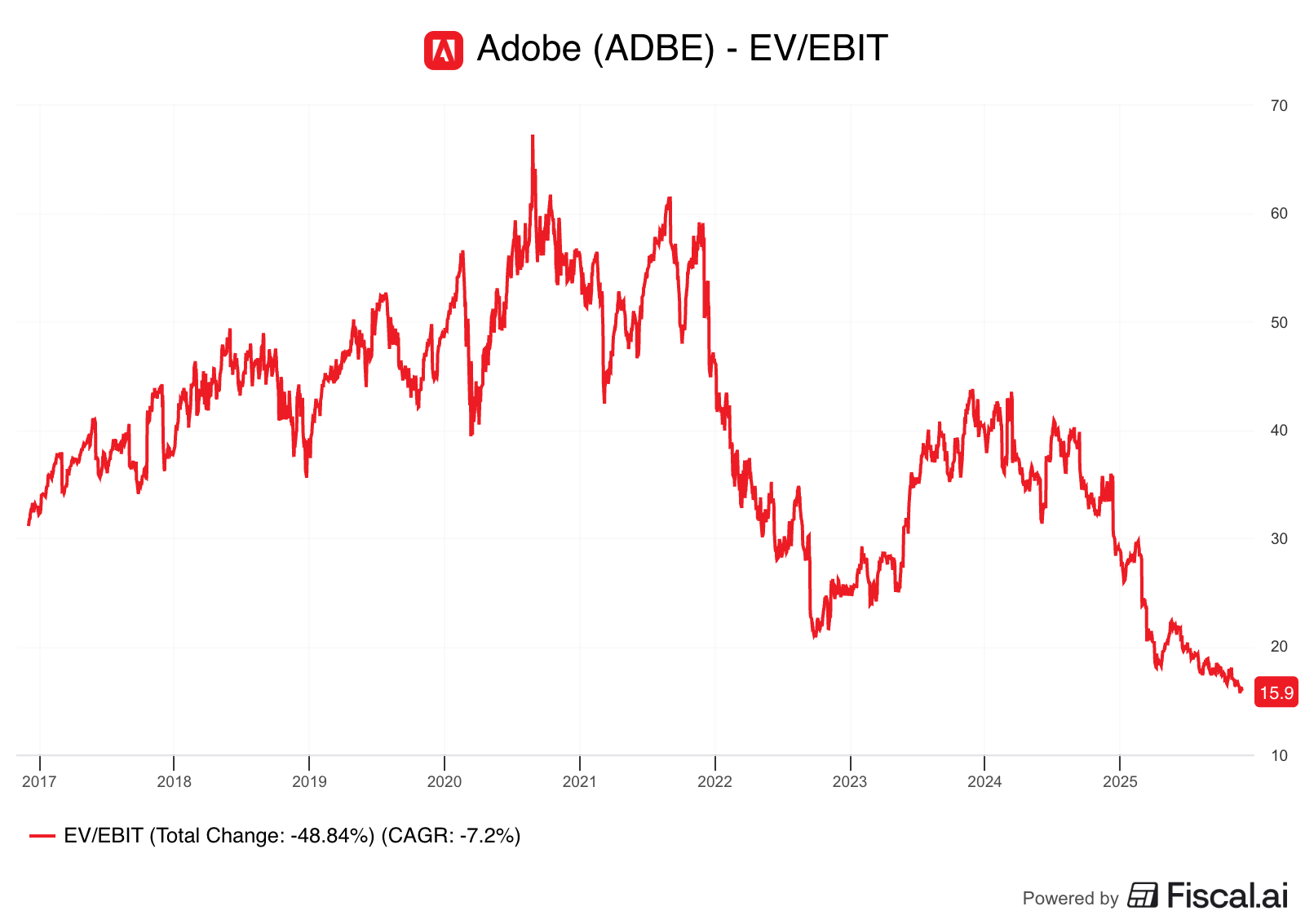

Adobe is one of the longest standing software businesses in the world today.

While they started in 1982 by creating just a single page description language known as PostScript, Adobe has evolved into a complete suite of creative and enterprise-focused software tools.

Few software companies have made the “license model” to “SaaS model” transition as successfully as Adobe. By migrating customers over to cloud-based solutions, Adobe has been able to release new features and raise prices on a more consistent basis.

That’s one of the primary reasons Adobe has been able to increase its revenue by 383% since 2015, despite already being a 4-decade old company.

EV/EBIT: 15.9x

10yr Revenue CAGR: +17.5%

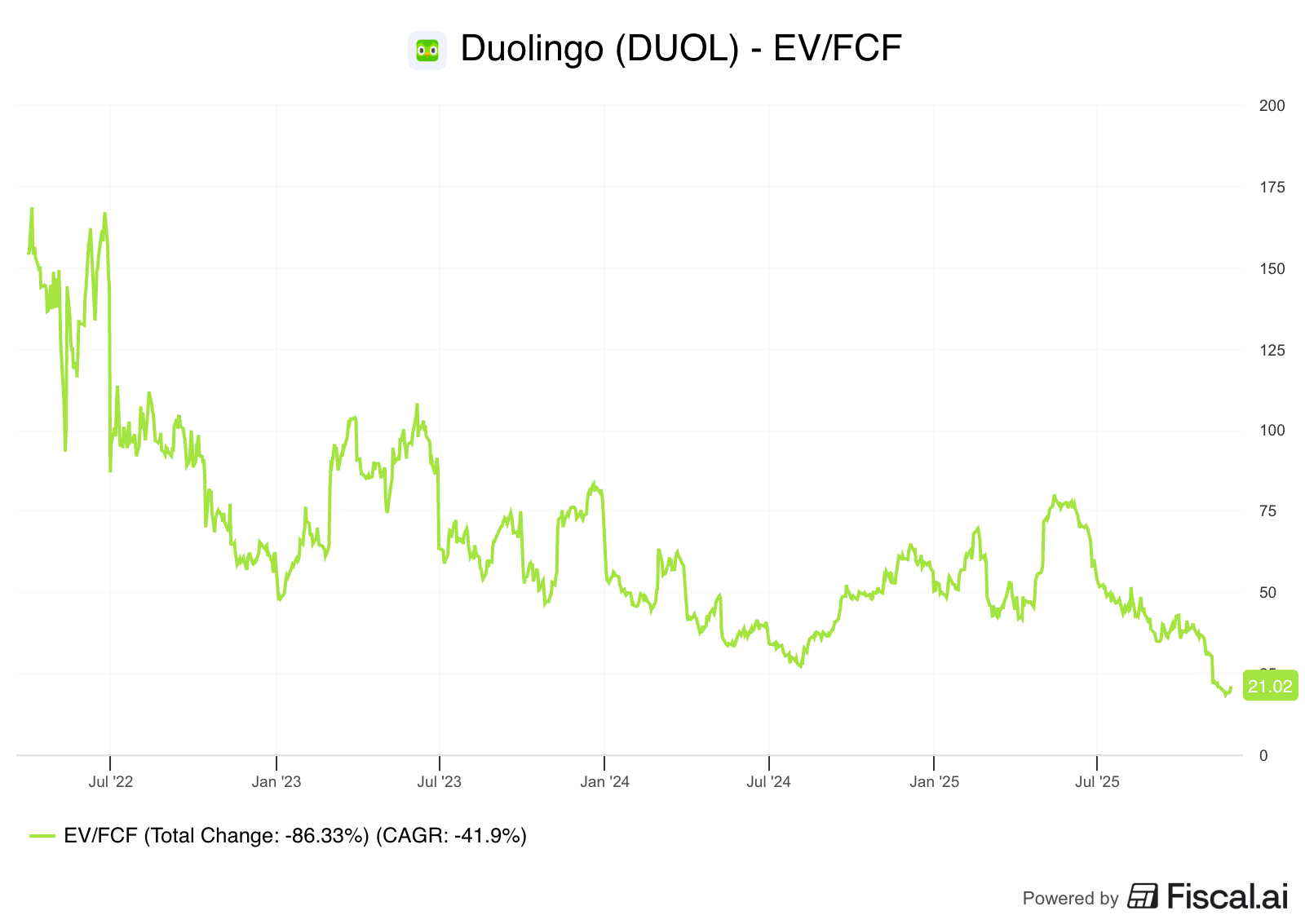

Duolingo operates a language learning app that has virtually perfected the freemium model.

By gamifying the language learning user experience, Duolingo has been able to convert millions of free users into recurring subscribers.

Duolingo has grown from 5.2 million Daily Active Users (DAUs) in 2019 to 50.5 million today. And perhaps more impressively, those DAUs are now converting into paying subscribers at a ~3x higher rate.

EV/EBIT: 21x

Revenue CAGR since IPO: +45.6%

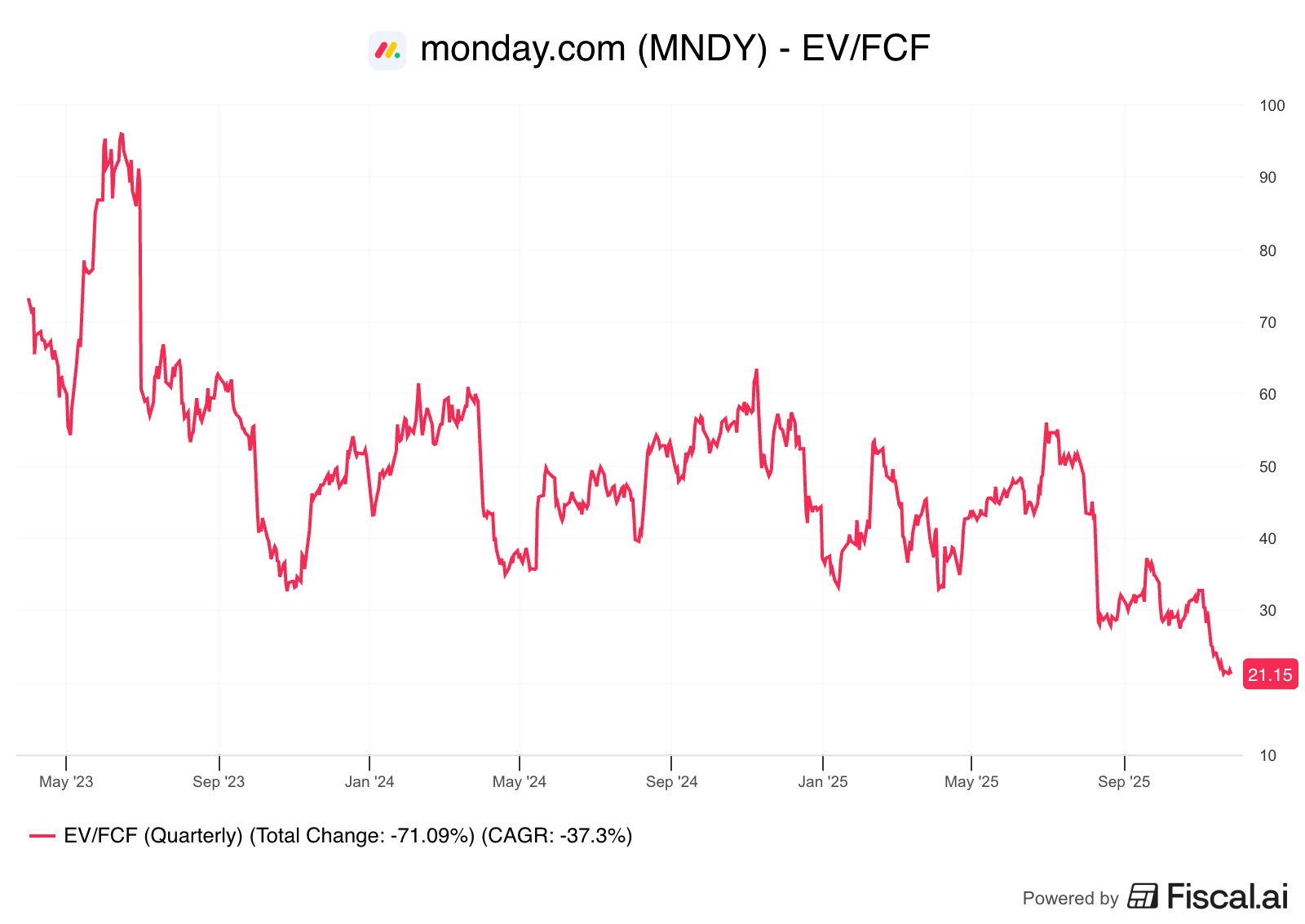

Monday.com provides task management software to businesses.

While this is certainly a crowded space — Asana, Trello, ClickUp, and Jira are just a few of the popular competitors — Monday.com has been able to not only grow its total number of customers, but also greatly expand seat count from its existing customers.

To put some numbers on this, Monday.com has averaged a net dollar retention rate of 114% over the last 5 years. In other words, they would have grown revenue by 14% annually just from their existing customers alone.

Over this time, they’ve also turned the corner to profitability as they’ve expanded operating margins from -95% to +0.5%.

EV/EBIT: 21.1x

Revenue CAGR since IPO: +60%