- Fiscal.ai

- Posts

- 🗞 5 Market Share Thieves

🗞 5 Market Share Thieves

These 5 companies are stealing market share and profits from competitors!💰

Happy Sunday! 👋

This week we’re taking a look at 5 companies whose superior products/services are helping them steal market share from incumbents.

Let’s dive in!

Featured Story

5 Market Share Thieves

Capitalism is competitive.

Every day, new businesses are formed with the goal of taking profits away from incumbents. Those that succeed typically do so by finding innovative ways to serve customers better, faster, or cheaper.

These companies are known as market share thieves, and they tend to make for great investments.

Here are 5 companies stealing market share from incumbents today:

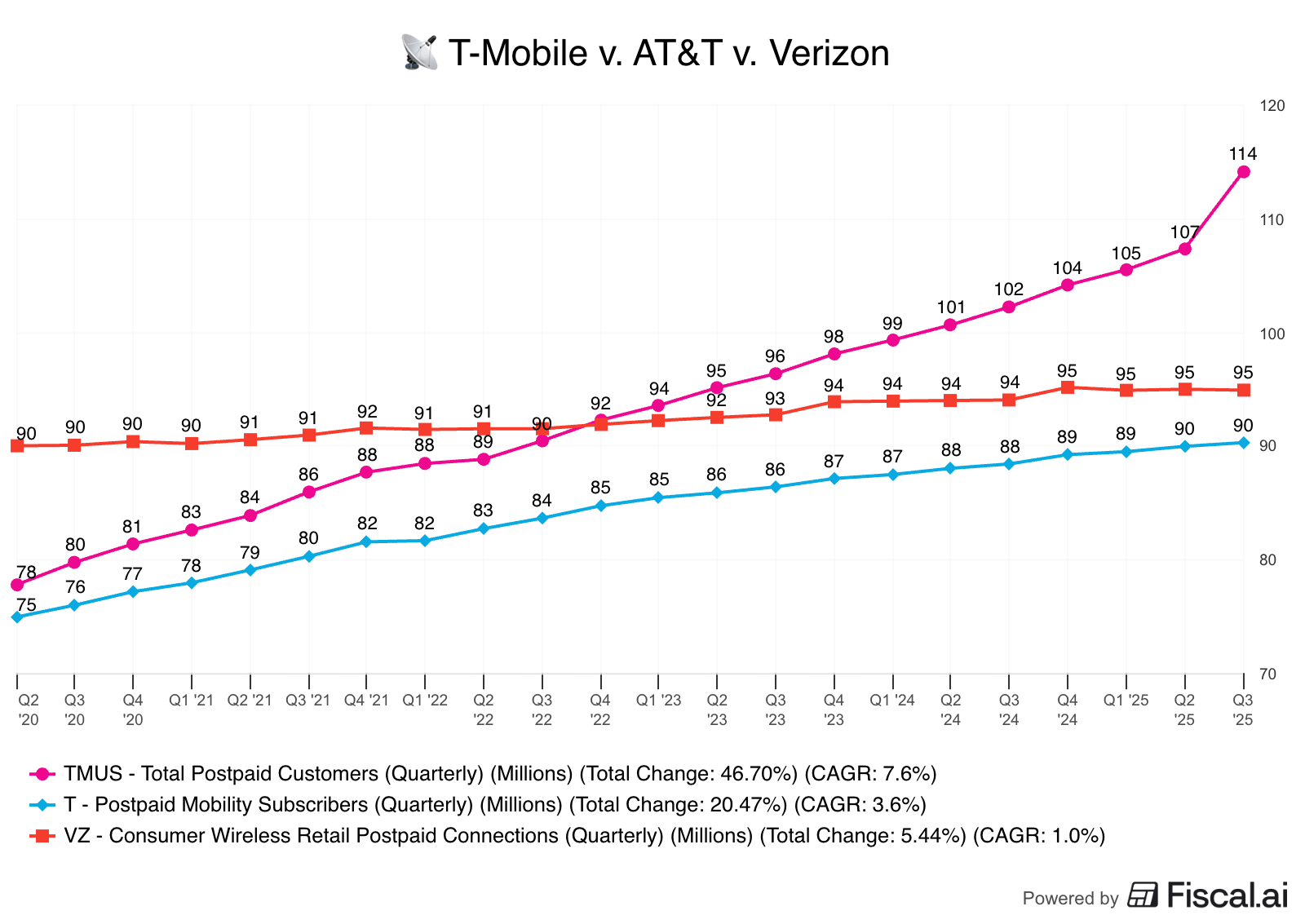

The US telecommunications industry has long been dominated by two companies, AT&T and Verizon.

However, over the last decade, T-Mobile’s counter-positioning and their acquisition of Sprint have helped them become the largest company in the industry by market cap.

In 2013, T-Mobile launched their “Un-carrier” strategy which provided customers more flexibility and transparency than they were accustomed to. This strategy eliminated long-term contracts (a major pain point for customers) and focused on straightforward plans, as opposed the complex billing of its rivals.

Then in 2020, T-Mobile paired their customer-centric approach with the largest and fastest 5G network through their $26 billion acquisition of Sprint. Sprint gave them much needed Spectrum, which enabled T-Mobile to offer the fastest 5G network.

Over the last 5 years, T-Mobile has added 36 million new postpaid subscribers, compared to AT&T’s 15 million and Verizon’s 5 million.

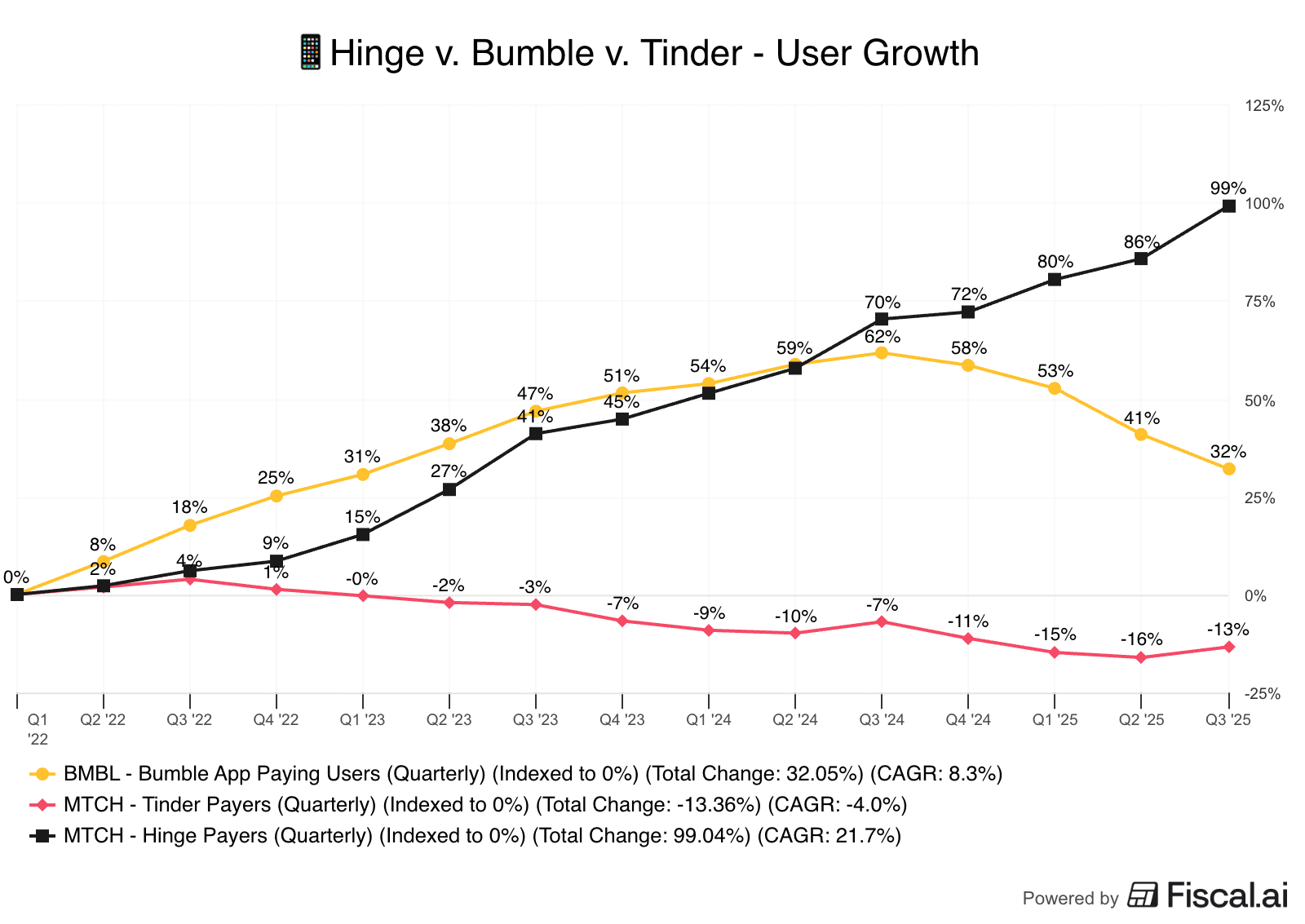

For the better part of a decade, Tinder (owned by Match Group) and Bumble have been the leading dating apps globally.

However, over the last few years, Hinge (which is also owned by Match Group) has quickly been stealing market share in the online dating space.

Hinge, which tags itself as the app that is “designed to be deleted”, counter-positioned itself well versus other dating apps by reducing the barriers to interaction with its detailed, personality-focused profiles.

Hinge found that by forcing people to put more effort into building their profiles with text-based prompts and a minimum of 6 photos, users were more likely to actually connect with other profiles and come back to the app.

Today, Hinge is the only app of the big 3 that has seen positive paying user growth over the last 4 quarters.

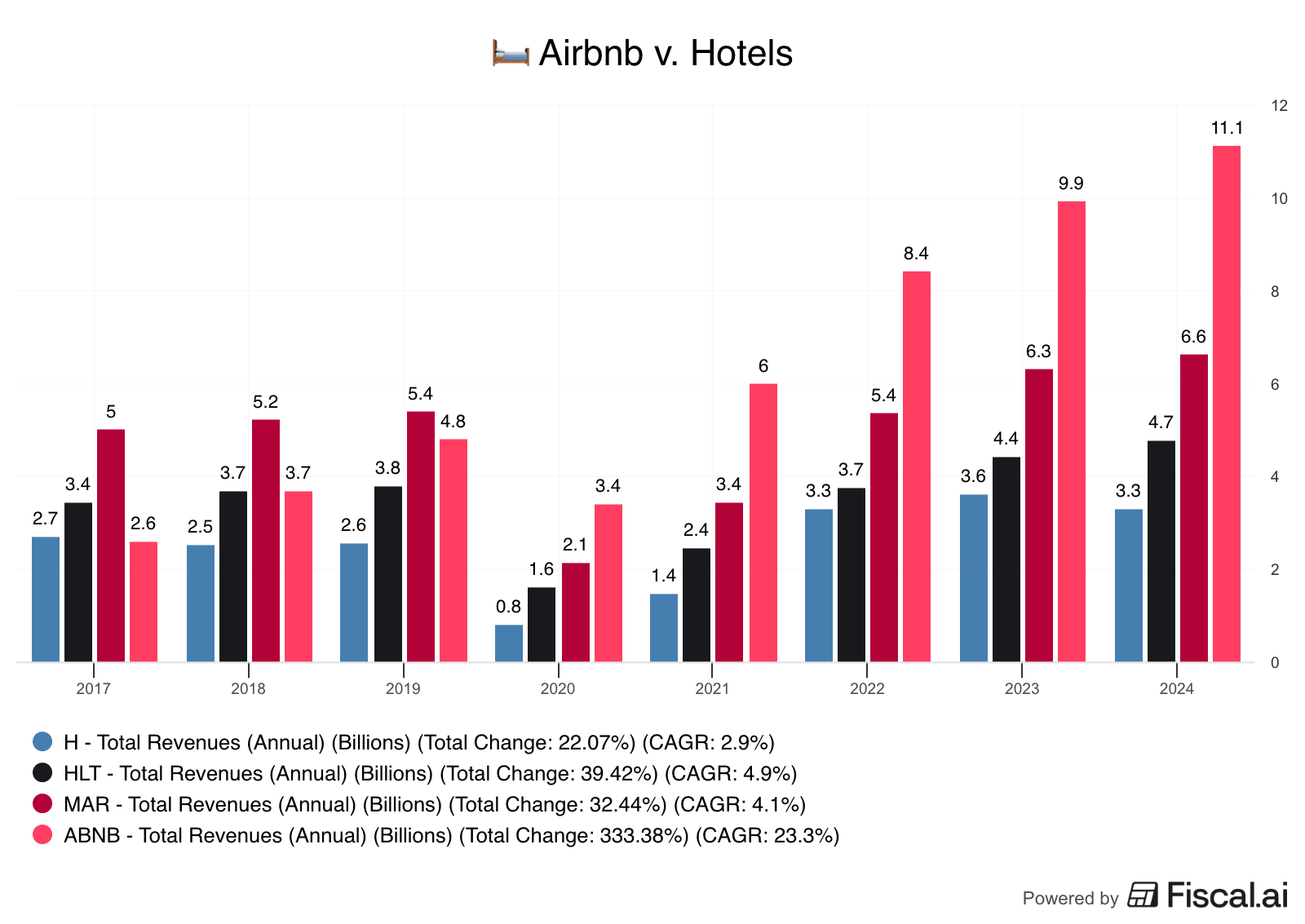

Airbnb v. Hotels

Airbnb’s asset-light marketplace model has enabled the company to grow its available accommodations much faster than their capital-intensive hotel counterparts.

While many people had doubts about the scalability of Airbnb’s business model in the early days, the company has proven that they can not only be a substitute for hotels, but even replace longer-term stays as well.

Today, Airbnb generates nearly as much revenue as the 3 largest US hotel chains (Marriott, Hilton, & Hyatt) combined!

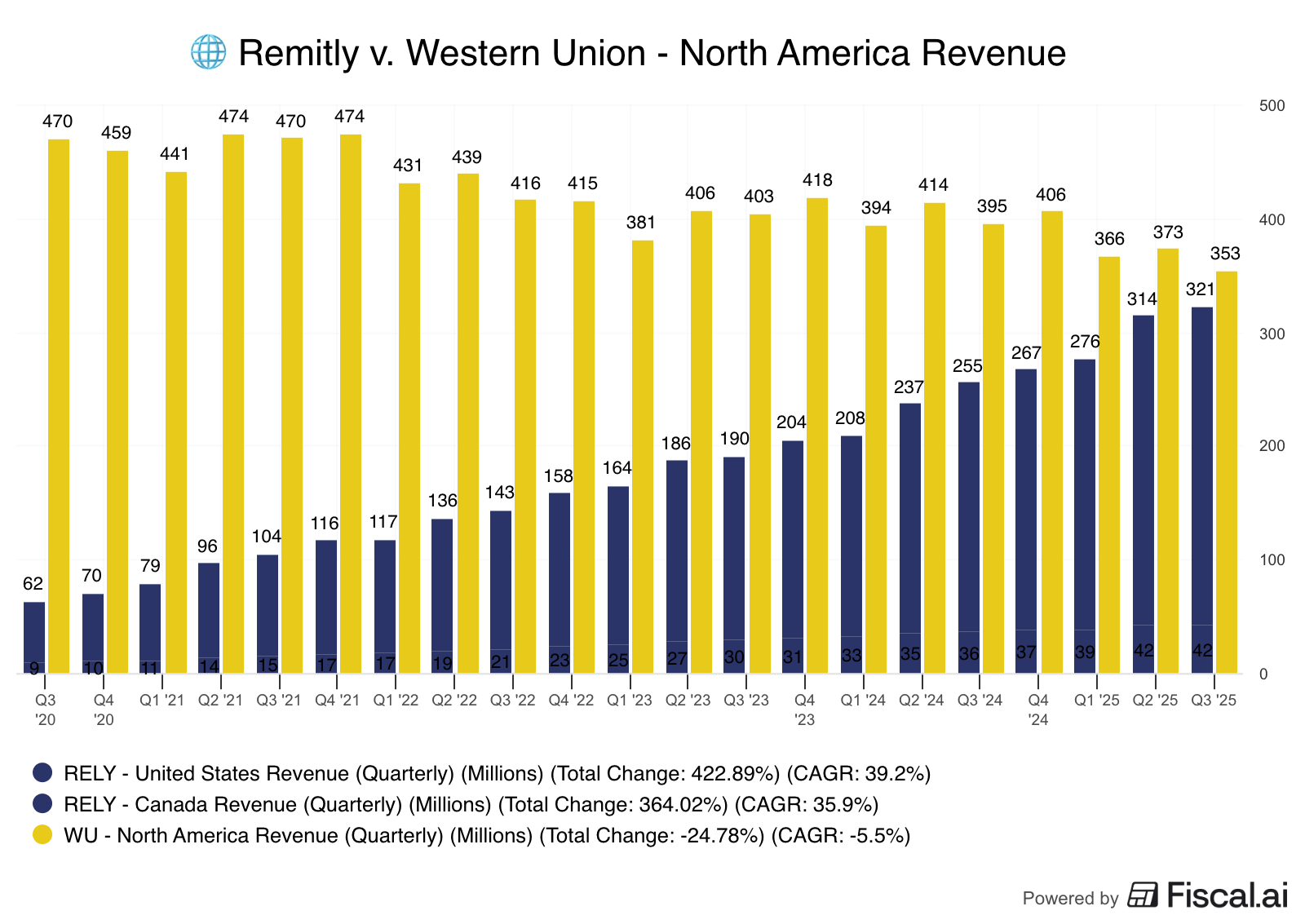

Western Union has been facilitating money transfers for more than 150 years.

However, their dominance in the remittance industry is dwindling as the world continues to migrate towards digital first solutions.

With traditional cash transfers being Western Union’s main profit driver, there wasn’t much incentive to move to a digital solution and lower their own prices.

Remitly, on the other hand, started as a mobile app and allows consumers to easily send money across borders faster and at a lower cost. This ease of use has helped Remitly grow from 948,000 active users in Q4 of 2019 to 8.9 million today!

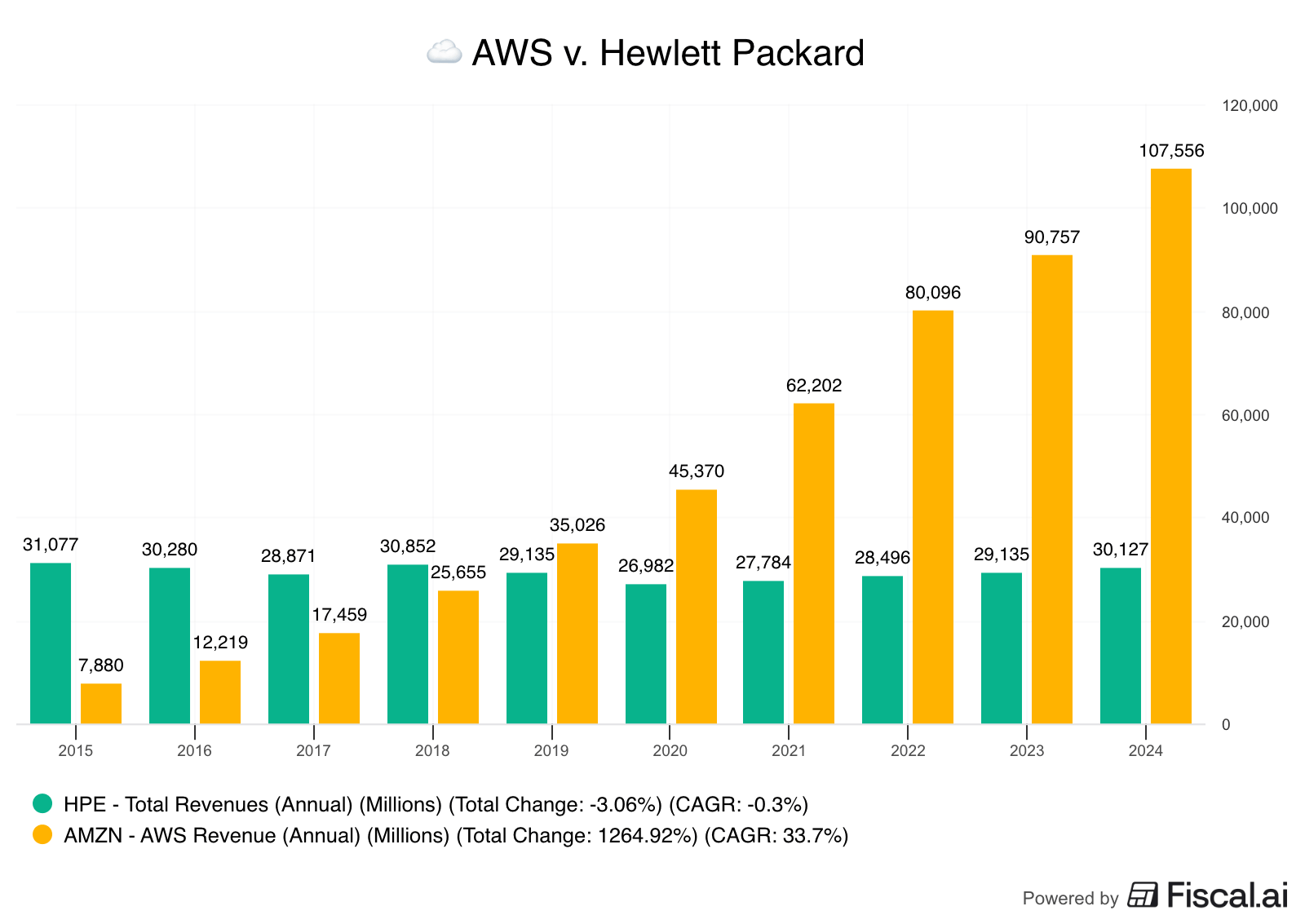

20 years ago, Hewlett Packard (HP) was one of the world’s leading vendors in the traditional server market.

In fact, HP had the most x86 server shipments (the dominant architecture of the late 90’s and early 2000’s) of any company in the world for 35 consecutive quarters.

However, in 2006, IT infrastructure fundamentally changed with the introduction of cloud computing. As companies switched from building their own data centers with HP servers to renting storage from cloud providers like Amazon Web Services, the power in the industry shifted.

Not only did this consolidation of market share hurt HP’s pricing, but many large cloud providers also began designing their own servers in-house.

10 years ago, Hewlett Packard Enterprise was generating 4x more revenue than AWS. Today, it’s almost exactly flipped as AWS earns 3.7x more revenue.

That’s all for this week!

If you want to compare some competitors of your own, you can use the Fiscal.ai Charting feature (it’s free to use) to analyze companies across thousands of different metrics.